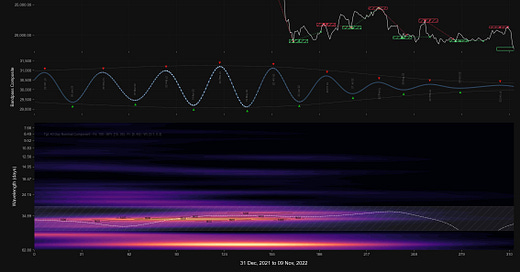

Bitcoin: Hurst Cycles - 9th November 2022

Bitcoin collapses to our target of around 17500 and beyond on macro news. Typical of late stage bear market price action, panic capitulation is a signal to be ready for a large component low

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Analysis Summary

Bitcoin finally threw off the grinding shackles over the last few days with a capitulation move down, mirrored in other related instruments and typical of a late stage bear market. Our target from the last report of around 17500 and lower to 17000 (54 month FLD) was met and approached.

Having established what looks to be the final 40 day component on the 13th of October, price moved up into the same range that has typified Bitcoin (and related) over the months since June. This turned out to be the archetypal bull trap with the larger move down to the area of the 54 month FLD accompanied and accelerated by some bearishly perceived macro news. Interestingly, this kind of macro accelerated price action was also evident in GBPUSD recently, forming a low of at least 40 week magnitude back in late September. This was rationalised by the UK and world media as the ‘mini budget’ effect.

As market cycle enthusiasts it seems we are being spoiled recently!