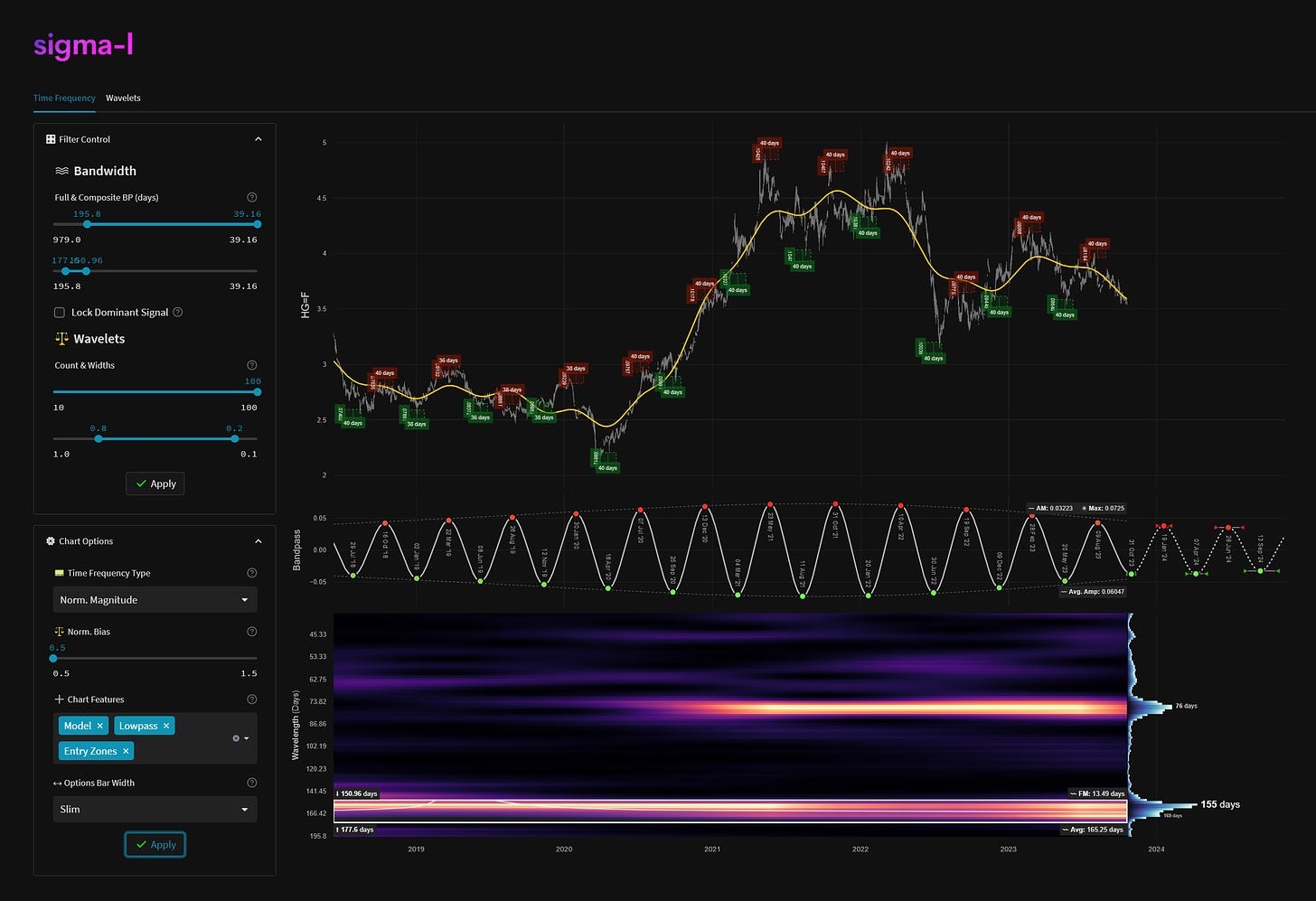

Copper (HG) - 20th October 2023 | @ 165 Days | + 4.84%

Last trade: + 4.84% | 'A' class signal detected in High Grade Copper (HG). Running at an average wavelength of 165 days over 12 iterations since June 2018. Currently troughing.

ΣL Cycle Summary

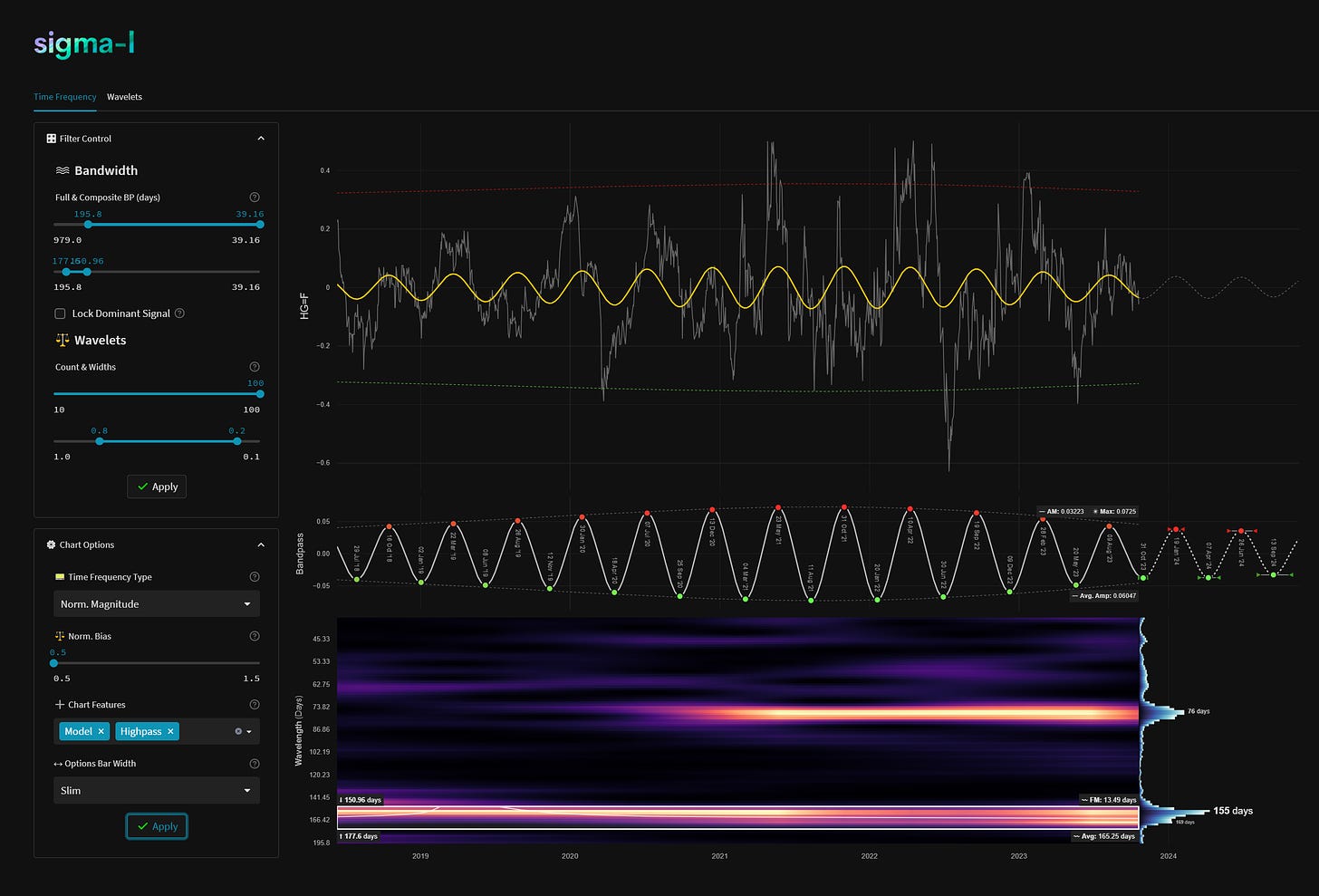

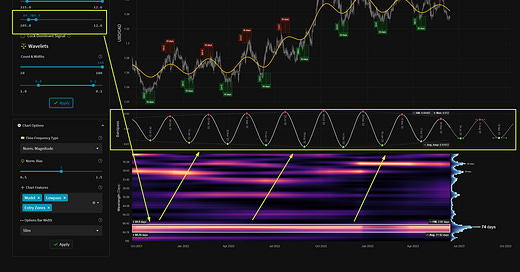

This excellent, frequency and amplitude stationary periodic wave in high grade copper has recorded a fairly neutral to bearish iteration, troughing last in May 2023 and now beginning to bottom once again. The next cycle peak is due in mid January at the current wavelength. Keen readers will also note the tremendous power of the component at 75 days average wavelength in the time frequency plot below. A Sigma-L update on that component is slated for the 30th October, 2023.

Trade Update

See also: Live ΣL Portfolio & History

Summary of the most recent trade enacted with this signal and according to the time prediction detailed in the previous post for this instrument, linked below.

Type: Late Sell - Copper (HG) 21st August 2023

Entry: 21st August 2023 @ 3.72

Exit: 20th October 2023 @ 3.54

Gain: 4.84%

Current Signal Status

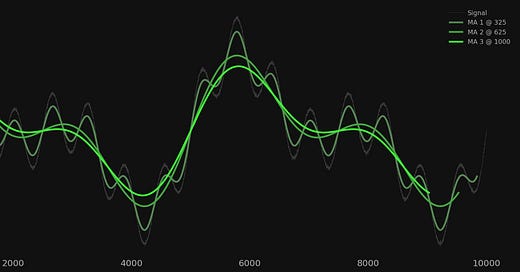

Defining characteristics of the component detected over the sample period.

Detected Signal Class: A - learn more

Average Wavelength: 160.25 Days

Completed Iterations: 12

Component Yield Over Sample: 104.11% - learn more

Time Frequency Analysis

Time frequency charts (learn more) below will typically show the cycle of interest against price, the bandpass output alone and the bandwidth of the component in the time frequency heatmap, framed in white. If a second chart is displayed it will usually show high-passed price with the extracted signal overlaid for visual clarity.

Current Signal Detail & Targets

Here we give more detail on the signal relative to speculative price, given the detected attributes of the component. In most cases the time target to hold a trade for is more important, given we focus on cycles in financial markets. Forthcoming trough and peak ranges are based upon the frequency modulation in the sample (learn more).

Phase: Troughing

FM: +- 13 Days

AM: 0.03223

Next Trough Range: 18th October - 13th November, 2023

Next Peak Range: 6th January - 1st February, 2024

Sigma-L Recommendation: Early Buy

Time Target: ~ 19th January, 2024

Current Signal Phase

This is ‘how far along’ the cycle is in it’s period at now time and is related to the predicted price action direction.

Current Signal Frequency Modulation (FM)

This is how much, on average, the signal detected varies in frequency (or wavelength) over the whole sample. A lower variance is better and implies better profitability for the component. Frequency usually modulates relatively slowly and over several iterations.

Current Signal Amplitude Modulation (AM)

This is how much the component gains or loses power (price influence) across the sample, on average. Amplitude modulation can happen quite quickly and certainly is more evident than frequency modulation in financial markets. The more stable the modulation the better.

Hi David, do yo mind an analysis for Royal Bank ( RY on NYSE; a Canadian bank), perhaps 165 days as I am wondering when a good longer term entry long may present itself for an investment, as opposed to just a shorter term pop. Thanks.