ΣL Oil Composite - 22nd December 2023 | @ 82 Days | - 1.45%

Last trade: - 1.45% | 'B' class signal detected in Sigma-L Oil Composite (WTI Crude Oil, Brent Crude Oil). Avg. wavelength of 82 days - 13 iterations since March 2021. Currently approaching a peak.

ΣL Cycle Summary

Price movement, from what was identified as the most likely position for the recent trough of this wave, has been neutral to bearish at the time of writing. Whilst very recent price action has retraced a portion of the fall since early November, this component is due a peak toward the end of December. At this point we class this signal phase as an early sell in the trading section below. Frequency modulation is fairly evident here (+- 12 days) but not enough to consign the ranking to a ‘C’ class, given the historical stability observed in the sample.

Trade Update

See also: Live ΣL Portfolio & History

Summary of the most recent trade enacted with this signal and according to the time prediction detailed in the previous post for this instrument, linked below.

Type: Buy - ΣL Oil Composite 8th November 2023

Entry: 8th November 2023

Exit: 22nd December 2023

For a composite analysis, each constituent’s respective gain over the period is displayed, in descending order. The average of the constituent gain is also shown.

Constituent Gain:

Brent Crude Oil (-0.82%)

WTI Crude Oil (-2.08%)

Composite Average Gain:

-1.45%

Current Signal Status

Defining characteristics of the component detected over the sample period.

Detected Signal Class: B - learn more

Average Wavelength: 82.15 Days

Completed Iterations: 13

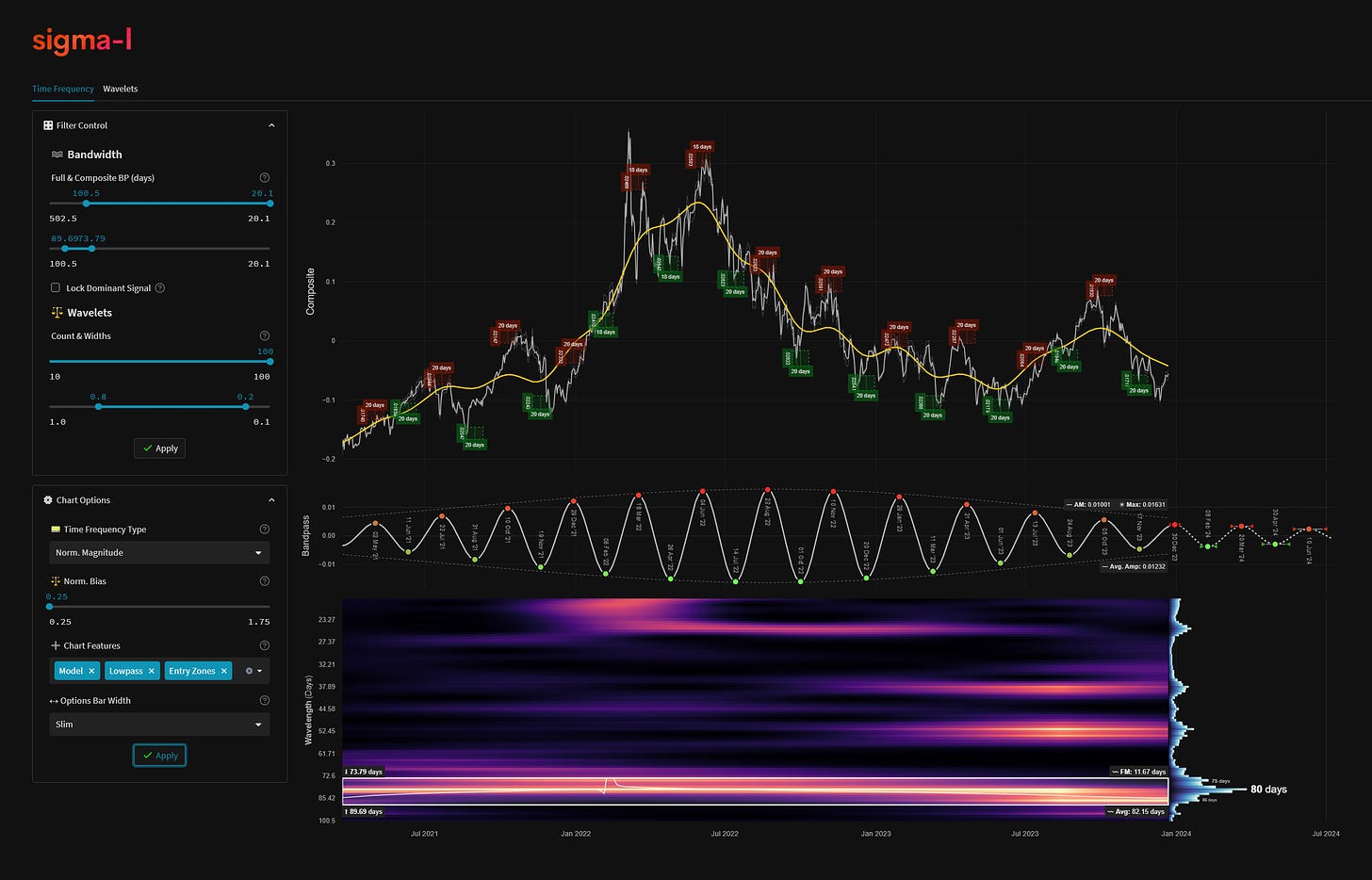

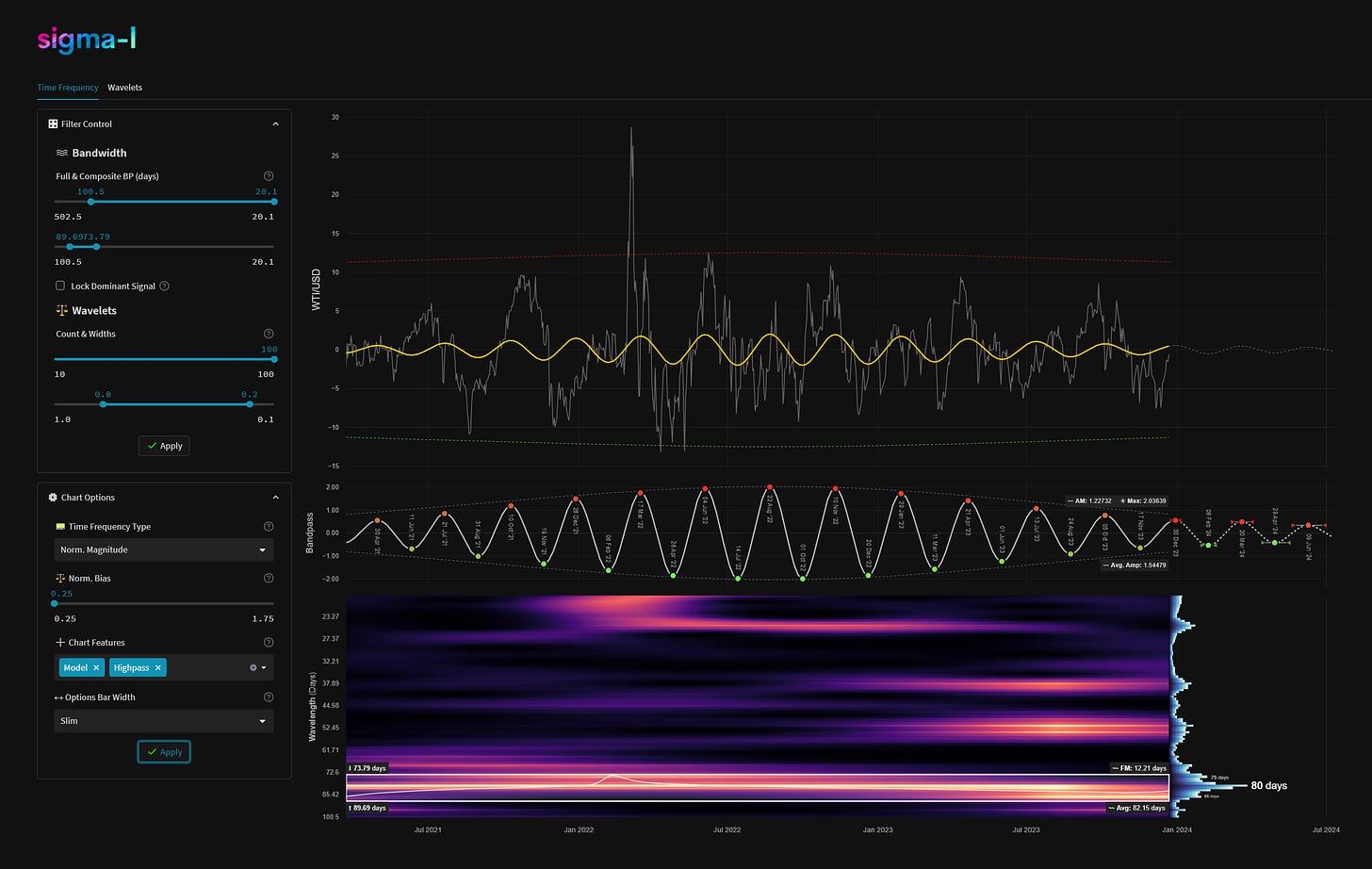

Time Frequency Analysis

Time frequency charts (learn more) below will typically show the cycle of interest against price, the bandpass output alone and the bandwidth of the component in the time frequency heatmap, framed in white. If a second chart is displayed it will usually show high-passed price with the extracted signal overlaid for visual clarity.

Current Signal Detail & Targets

Here we give more detail on the signal relative to speculative price, given the detected attributes of the component. In most cases the time target to hold a trade for is more important, given we focus on cycles in financial markets. Forthcoming trough and peak ranges are based upon the frequency modulation in the sample (learn more).

Phase: Peaking

FM: +- 12 Days

AM: N/A (Composite)

Next Trough Range: 27th January - 20th February, 2024

Next Peak Range: 8th March - 1st April, 2024

Sigma-L Recommendation: Early Sell

Time Target: ~ 8th February, 2024

Current Signal Phase

This is ‘how far along’ the cycle is in it’s period at now time and is related to the predicted price action direction.

Current Signal Frequency Modulation (FM)

This is how much, on average, the signal detected varies in frequency (or wavelength) over the whole sample. A lower variance is better and implies better profitability for the component. Frequency usually modulates relatively slowly and over several iterations.

Current Signal Amplitude Modulation (AM)

This is how much the component gains or loses power (price influence) across the sample, on average. Amplitude modulation can happen quite quickly and certainly is more evident than frequency modulation in financial markets. The more stable the modulation the better.