DJIA: Hurst Cycles - 1st September 2022

The DJIA peaks from a 20 week nominal component top in mid August & hits targets to the downside around 31800. We look at the incoming 80 day nominal low and the price action to come

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Analysis Summary

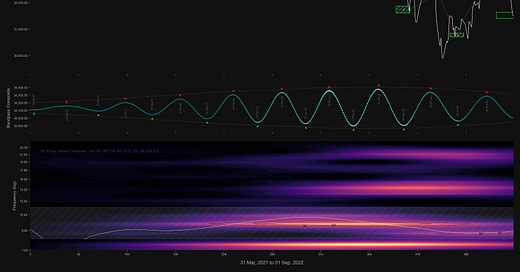

As in the S&P 500, the move from what was highly likely the 20 week nominal low in mid July was a vibrant bear market rally, forming an almost insignificant 40 day component trough on the way. This was somewhat of a surprise from the last report as the 40 day component had been fairly dominant and would usually have been expected to retain it’s amplitude. As it happens the 80 day component has come to dominate with the current move looking like it will form an almost perfect retrace from the previous 80 day nominal low on July 14th (also the 20 week low). See medium and long term charts below for a visual clarification of this.

Our original target of 31800 in early August has now been met and FLDs are lining up in a somewhat bullish cascade (short term chart below) for the 80 day component low. That component is running at around 71 days according to Sentient Trader and around 56 for the more accurate time frequency analysis. This frequency is reflected in almost all major global stockmarkets, with very minimal modulation.