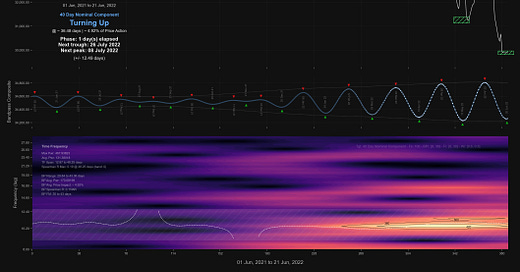

DJIA: Hurst Cycles - 21st June 2022

A collapse in price from 80 day FLD resistance sets up a further decline in July. We look at the forming 40 day nominal low in the DJIA and the crucial areas to look out for in the next few weeks.

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Analysis Summary

The equity markets in general have been slightly more bearish than anticipated. Indeed an FLD support target in the DJIA mentioned in the last report has already been met, that of 30000:

There is significant resistance at both the 20 week and 40 week FLDs, as shown on the medium term chart. Should price reach the 40 week FLD resistance once again it should be an excellent shorting opportunity, likely to hold until the proposed 18 month nominal low in October. That 18 month nominal low could very well co-incide with support at the 54 month FLD, down at 30000 and preceding a tracking move back up prior to the main bear event in mid 2023. The 54 month FLD is the orange line on the long term chart.

The fact price has already reached the level around the 54 month suggests the underlying trend is bearish. The 18 month FLD cross target was achieved prior to the last 80 day nominal low in early May, described at the last report. Further moves past this target indicate downward pressure from larger periodic components. For our purposes this is the 9 year and, more notably, 54 month nominal components.