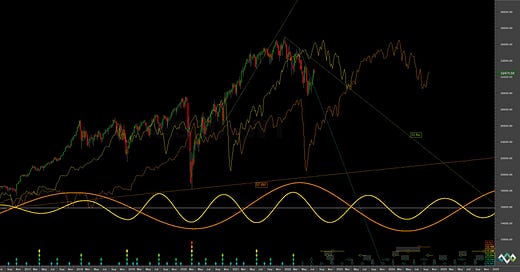

DJIA: Hurst Cycles - 3rd August 2022

The DJIA, in common with other equity indices, makes a low of at least 40 day magnitude on 14th July. Price is now peaking from that 40 day component, in this report we look at the next moves

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Analysis Summary

The 80 day downward VTL, mentioned in the last report as a confirmation for the 20 week nominal component trough, was breached on 18th July:

From 29th June Report

Medium term we can draw a helpful 80 day component downward VTL (medium term chart, blue) now to confirm when a 20 week nominal low has occurred, for future reference. Given the assumed phasing we can expect this to be breached subsequent to the 20 week nominal low in mid July.

The fact that the most recent 40 day component low was a higher low has muddied the waters somewhat in US indices. However, commonality with European indices, most notably the EUROSTOXX suggests this low was infact the 20 week nominal low anticipated and shown on the short term chart below.