Ethereum: Hurst Cycles - 5th April 2022

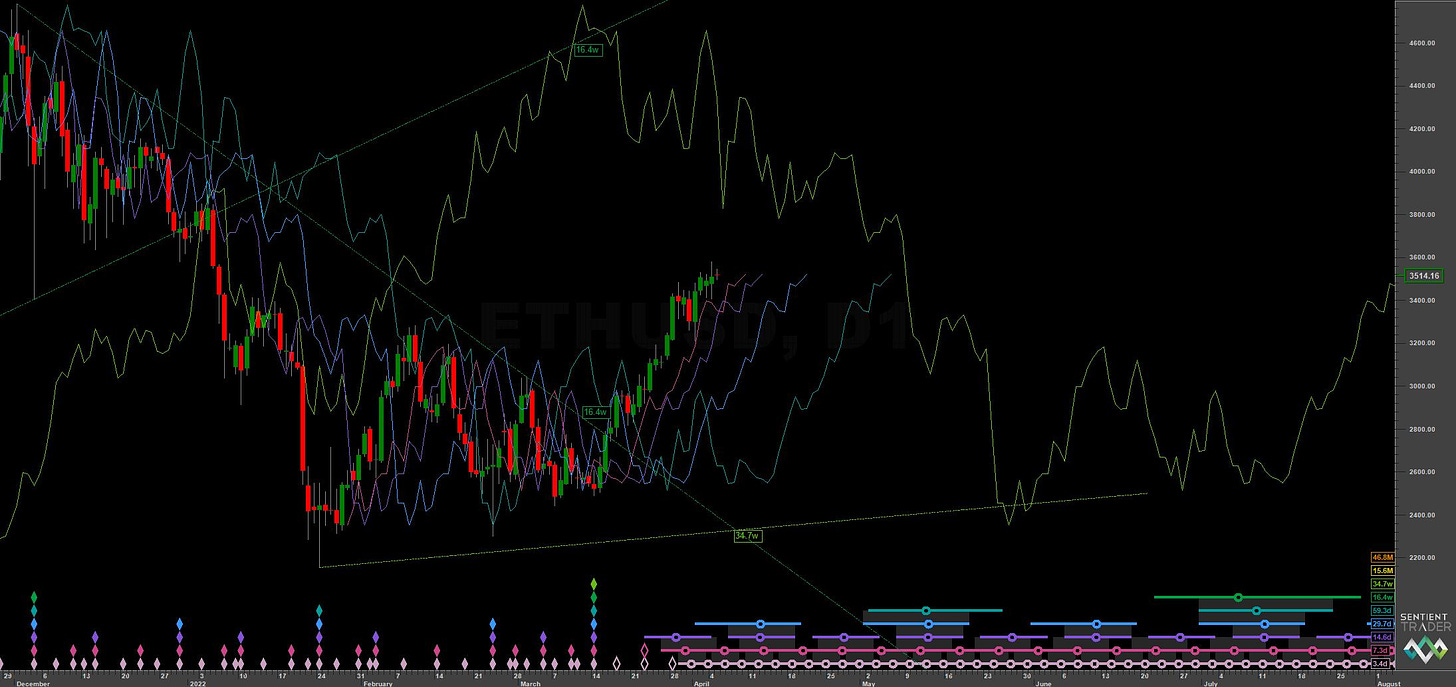

Ethereum puts in the (subtle) 40 week nominal low and we look at the slightly more bullish underlying trend evident in ETHUSD vs BTCUSD

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

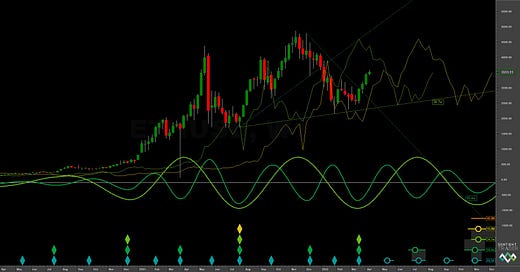

Short Term

Components around the 80 day nominal cycle

Analysis Summary

Ethereum came down to the 40 week nominal low, anticipated in the previous report to be in mid March and somewhat earlier than expected - as phased above.

From a bearish point of view and assuming the 40 week low is still to come in mid-late March there is an excellent opportunity here. Price has come up to around the 40 day FLD mark and it is here, around what should be a 20 day nominal peak, price is likely to start moving down, in the final move, to the anticipated larger low. The 5, 10 and 20 day FLDs have formed a bearish FLD cascade - in this instance to the 2600 area.