FTSE 100: Hurst Cycles - 17th Feb 2022

FT Stock Exchange 100 | Phasing Analysis Update, Outlook & Trading Strategy

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality

Phasing Analysis

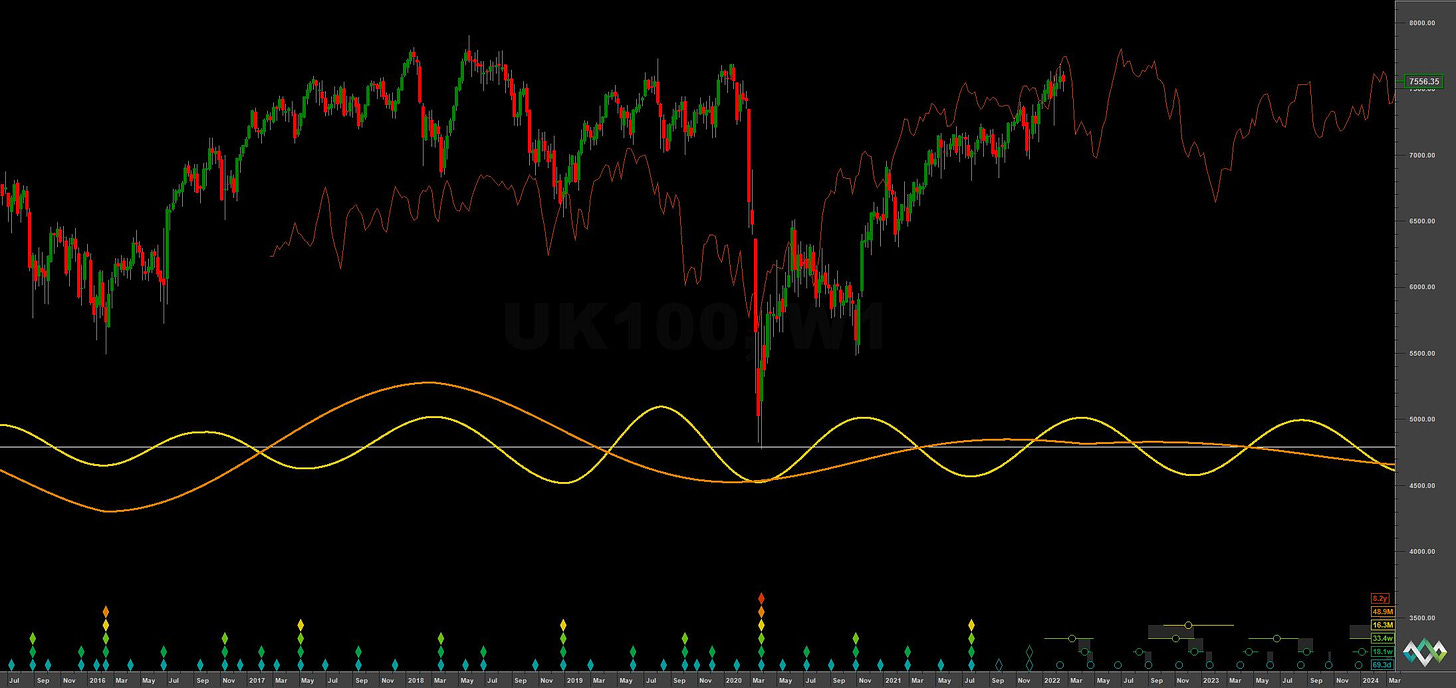

Long Term

Components greater than and including the 18 month nominal cycle

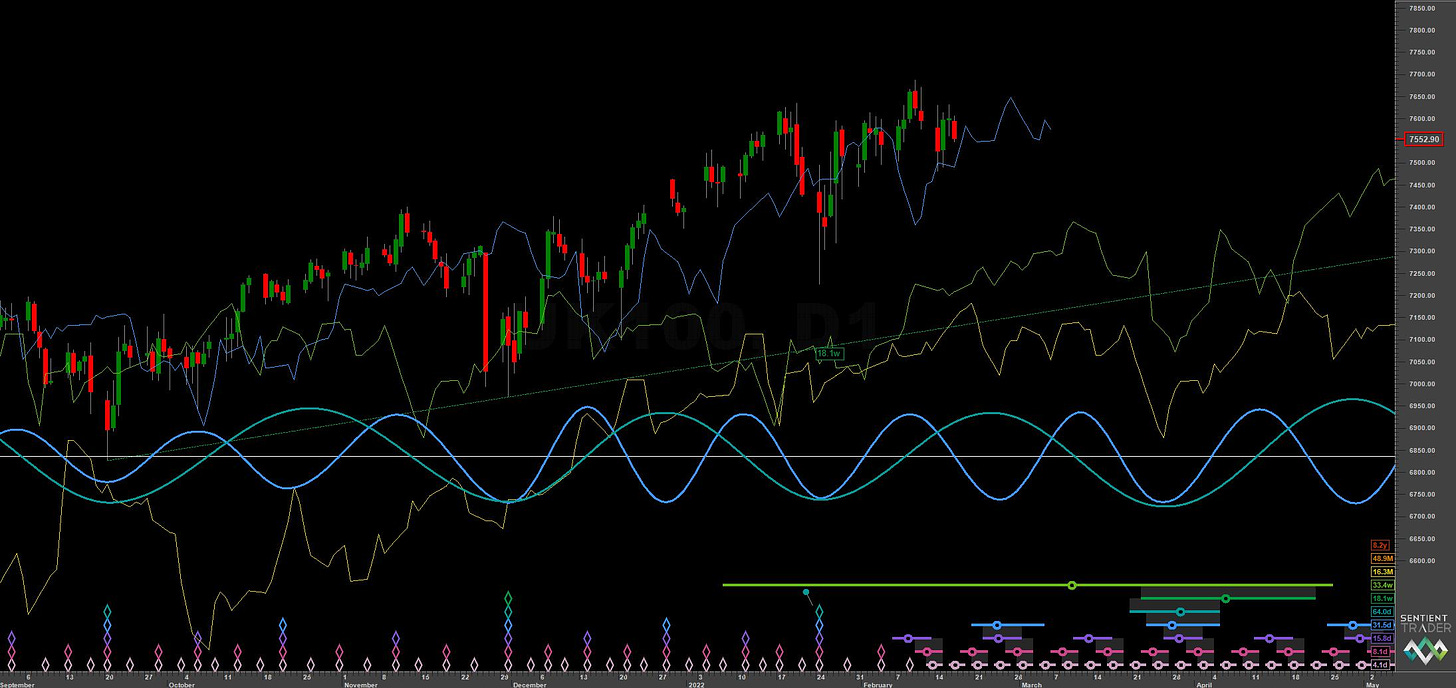

Medium Term

Components less than and including the 18 month nominal cycle

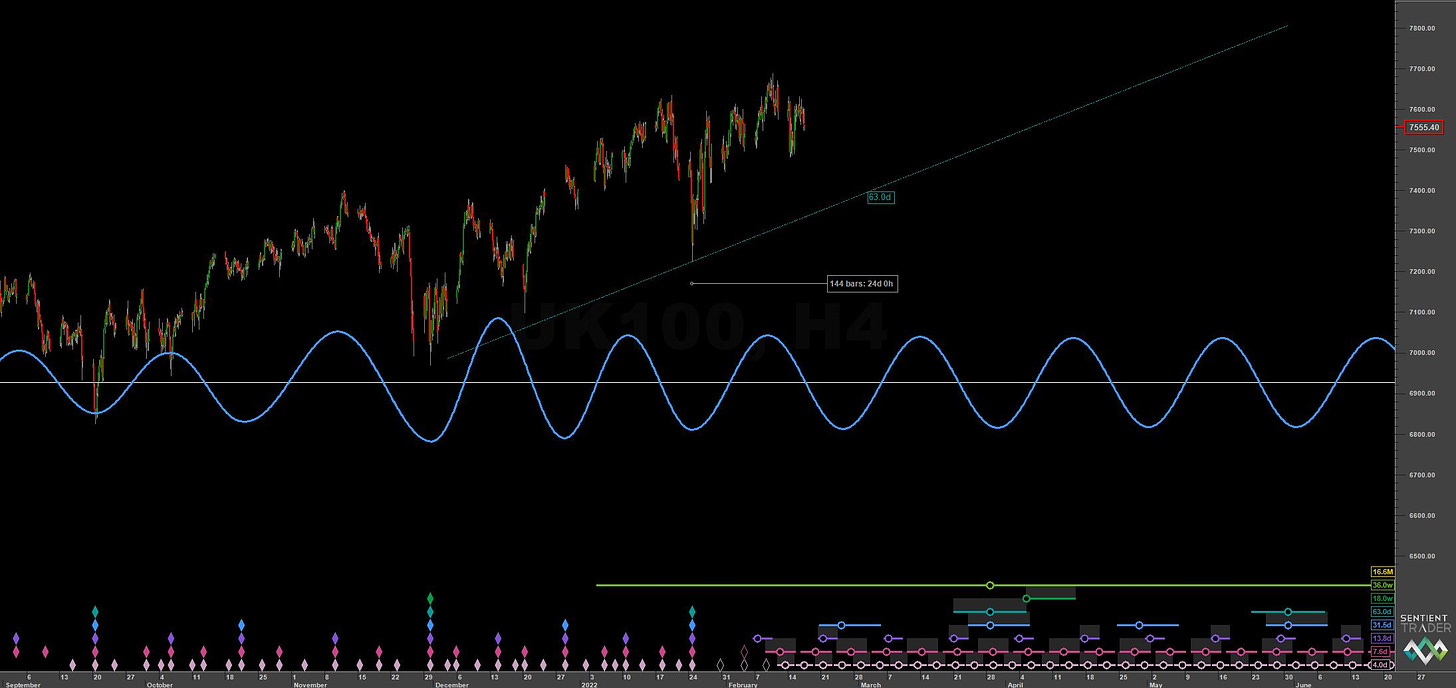

Short Term

Components around the 80 day nominal cycle

Summary

The FTSE has presented a fascinating phasing for us to examine here. In our last report we anticipated a move to around 7050 for the expected 40 week nominal low. This never materialised and price moved sideways to up for the next few weeks prior to a sharp move down into the 80 day nominal low 24th January. This has prompted a shift in the phasing (as shown above) to place the 20 week nominal low in late November and the 18 month low in July 2021. The phasing now looks very good indeed and is infact in commonality with the Russell 2000, shown below.

Traders paying attention to the DJIA and S&P 500 should also take note - the phasing in the FTSE and the RUT below may well be correct, meaning the 40 week nominal low is due to come in late March. It certainly looks compelling.