DAX - 26th February 2024 | @ 76 Days | + 6.26%

Last trade: + 6.26% | 'B' class signal detected in the German DAX. Running at an average wavelength of 76 days over 13 iterations since July 2021. Currently peaking

ΣL Cycle Summary

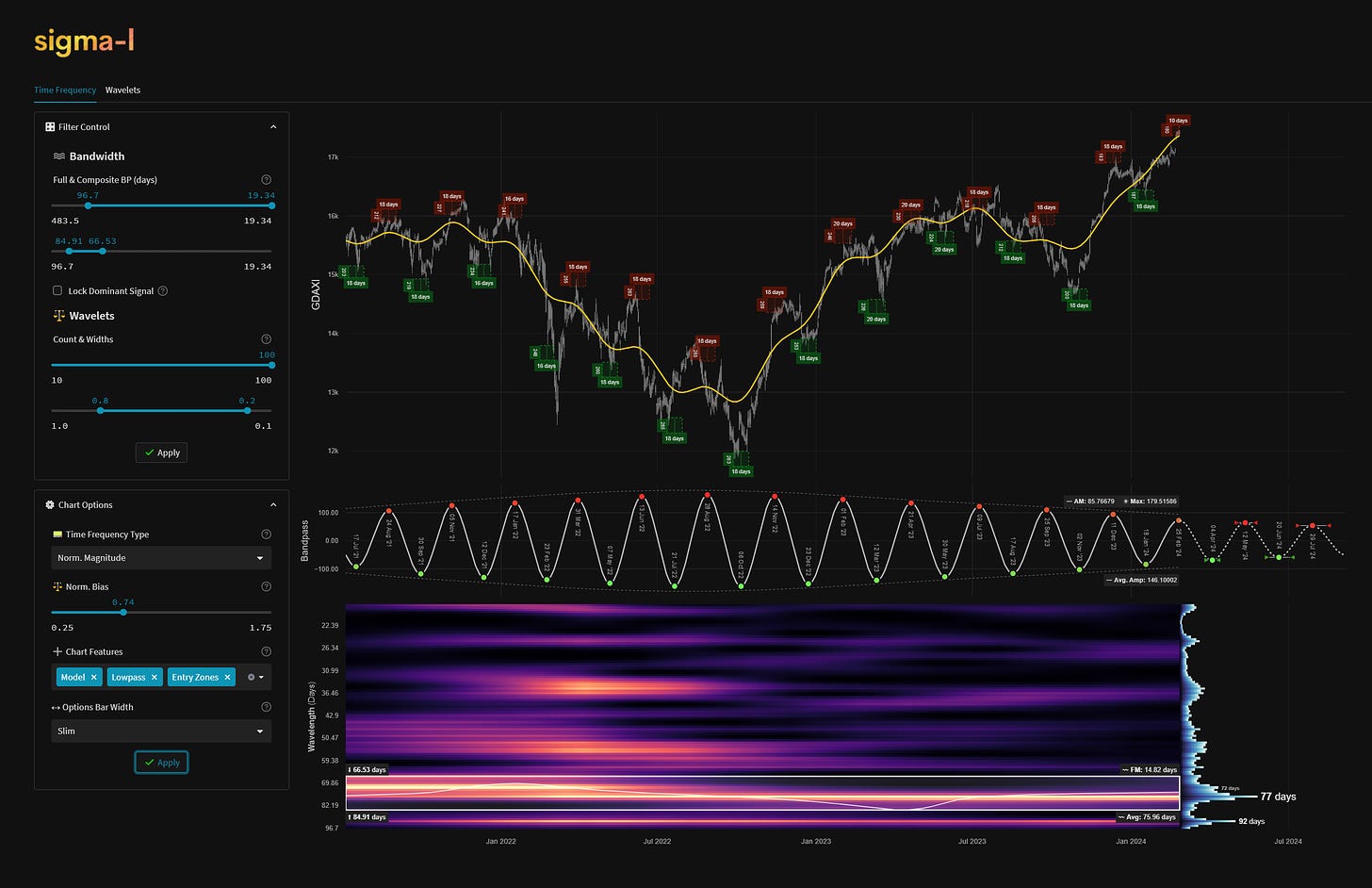

Not as crisply defined as the 80 day nominal wave in US stock markets, the wave here in the DAX is certainly amongst the clearest in Europe and is, of course, analogous to the aforementioned cycle in the US. Once again, as we have noted on several previous reports, the low in October 2023 was a trough of at least 40 week magnitude, which is now also peaking. Equity indices in Europe will follow the frequency components identified in global markets, varying more widely with amplitude (volatility) only. The next trough of this wave is due late March to early April, detailed below in the time frequency analysis.

Trade Update

See also: Live ΣL Portfolio & History

Summary of the most recent trade enacted with this signal and according to the time prediction detailed in the previous report for this instrument, linked below.

Type: Buy - DAX 17th January 2024

Entry: 17th January 2024 @ 16431.69

Exit: 26th February 2024 @ 17460.52

Gain: 6.26%

Before and After

Signal comparison between our last report and the current time, in chart format.

Time Frequency Analysis

Time frequency charts (learn more) below will typically show the cycle of interest against price, the bandpass output alone and the bandwidth of the component in the time frequency heatmap, framed in white. If a second chart is displayed it will usually show high-passed price with the extracted signal overlaid for visual clarity.