Gold: Hurst Cycles - 16th September 2022

Price moves sharply down to the 40 day nominal low late August before a telling and weak bounce. A subsequent collapse sees Gold approach an imminent 20 week nominal low, at least.

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Analysis Summary

Gold continued it’s weak display in late August, clarifying the position of the 40 week component low in May and removing the outlier scenario discussed in the last report. Price now approaches a low of at least 20 week magnitude:

From 18th August Report:

At the medium term the 20 week component is still outstanding, running at around 19 weeks average wavelength from the sample of over 20 iterations and synchronised well trough to trough. The next low of this component is expected in line with the 80 day nominal low mid-late September.

The collapse from a weak 40 day nominal component low, proposed to have occurred August 22nd and shown in the short term chart below, has set the stage for quite a contrast to Silver. Silver is known to be more volatile than Gold, offering greater yields for the skilled Hurstonian. In this case the difference between amplitudes at the 20 day component has been notable. They will converge once again and we suspect it will be Silver that will retrace a good deal of the enthusiasm prior to this incoming 20 week nominal low.

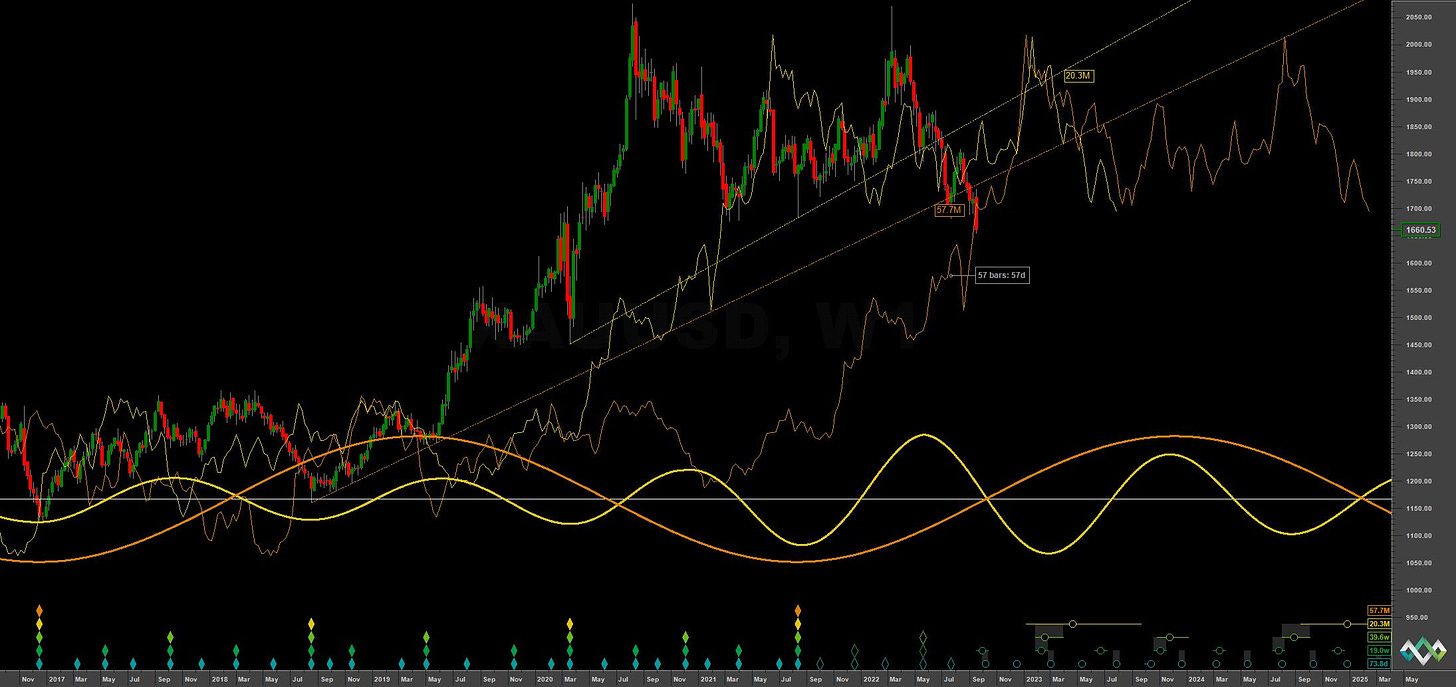

At the longer term phasing it is quite possible that the 18 month component low is going to occur here, in addition to what is at least a 20 week nominal component. This is the beauty of Hurst Cycles of course, one can be uncertain about a magnitude of a trough but aligned on direction. Only amplitude will differ. It really rests on the phasing of previous 18 month component lows, notably that of November 2019 and March 2021. Whilst this is not our primary phasing, readers should be aware of this possibility, which is more likely than a far outlier, given the difference in phasing is a margin of error at 20 week duration. The fact price is at the 54 month FLD (orange, long term chart) should alert us to this possibility. A strong weekly tracking up of this FLD will increase probabilities as we trade price action over the coming months.

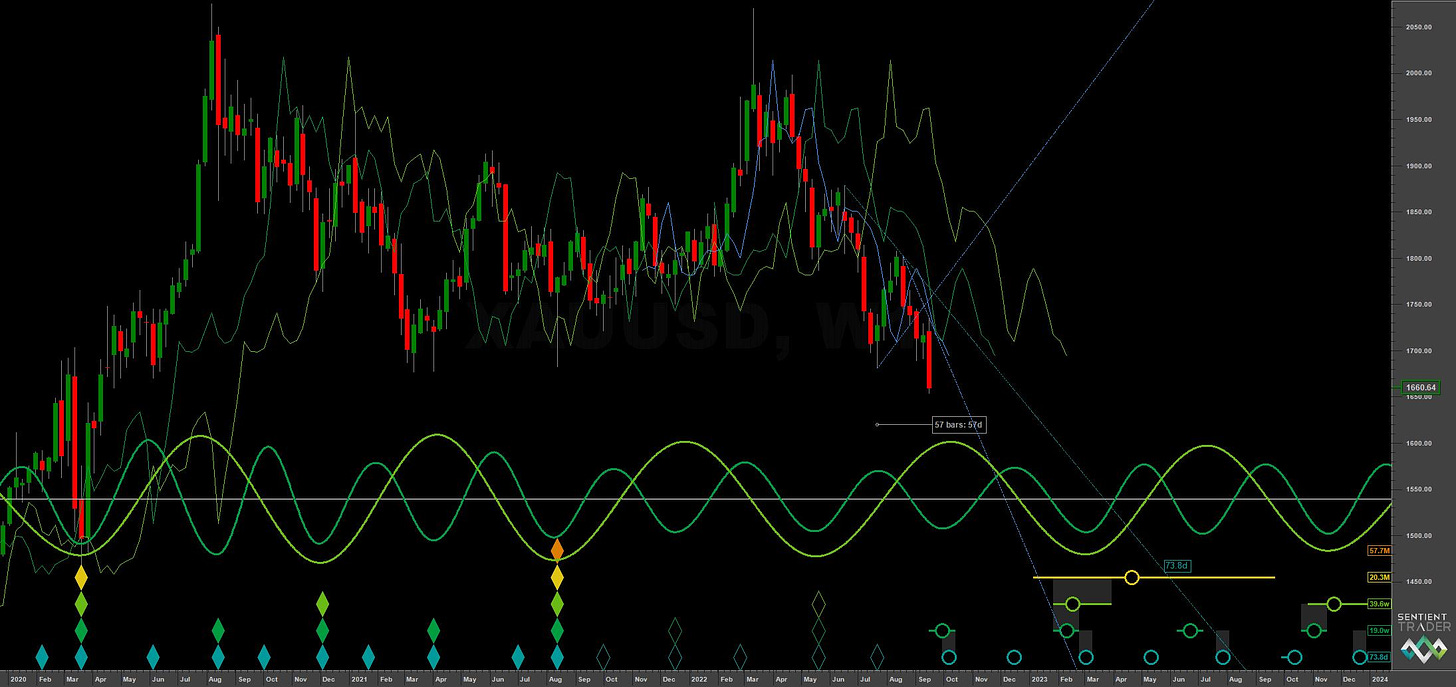

At the medium term and the 20 week component specifically, an imminent low of this component is due. 17.6 weeks have elapsed since the last trough iteration against a sample average of around 19 weeks from Sentient Trader’s pattern algorithm.

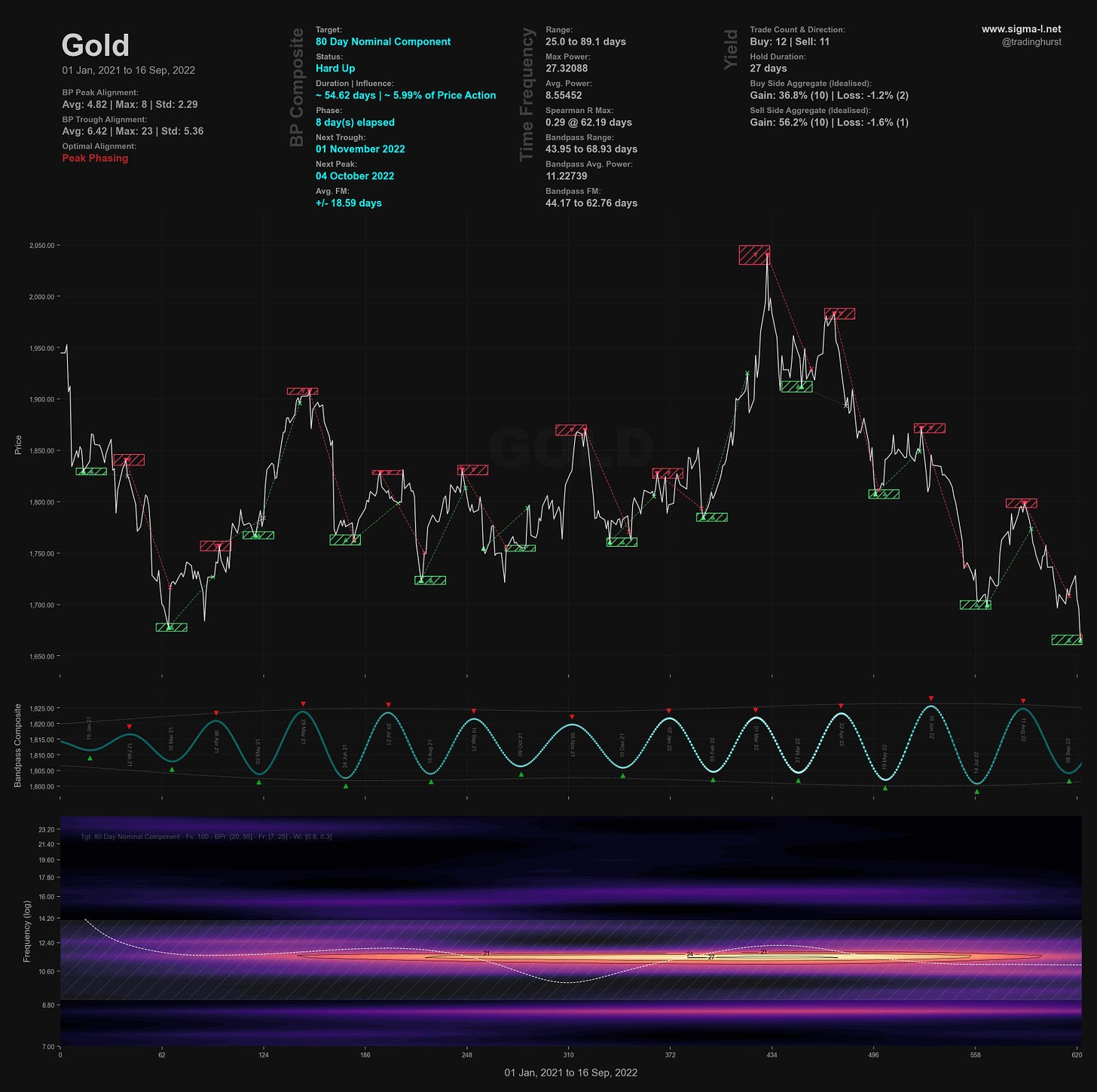

Shorter term the outstanding signal from the time-frequency analysis is suggesting the trough of the 80 day component (@ ~ 55 days) is overdue. Frequency modulation over the sample period is around +-18 days so the ‘nest of lows’ should be considered with this in mind. A cross of the 40 day downward VTL by median daily price is confirmation that the 80 day component low has formed. This is shown in dark blue on the short term chart. In addition, a cross of the downward 80 day VTL (light blue) confirms the 20 week nominal low has occurred.

A rapid move beyond the 80 day FLD and to test the 1780-1800 area within this first 80 day iteration of the 20 week component would strongly suggest the forming of an 18 month component low. A more turgid move up which finds resistance around the 80 day FLD (light blue, short term chart) and reverses sharply early October suggests more downside is to come and the current long / medium term phasing is accurate.

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

Short Term

Components around the 80 day nominal cycle

Time Frequency

Wavelet convolution output targeting 80 day nominal component

Trading Strategy

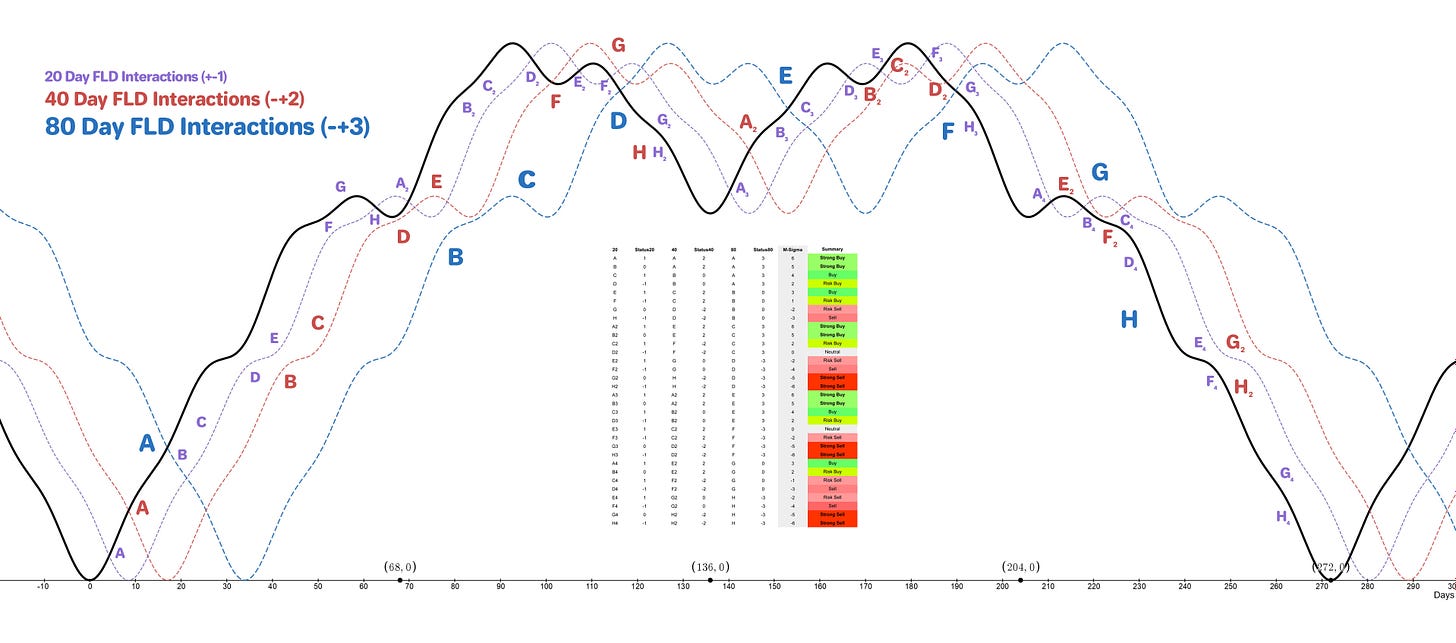

Interaction Status

Interactions and price in the FLD Trading Strategy (Advanced). This looks at an idealised 40 week cycle and an array of 3 FLD signal cycles. We apply the instrument’s phasing to the model and arrive at an overall summary for the interactions with the 20 day FLD, current and forthcoming.

Sigma-L recommendation: Buy

Entry: 10 Day FLD (risk on) / 20 Day FLD

Stop: Below formed 80 day nominal low

Target: 1720 initially, 80 day FLD resistance

Reference 20 Day FLD Interaction: A3

Underlying 40 Day FLD Status: E2

Underlying 80 Day FLD Status: G

Interactions noted above are given assuming the 18 month component low is still to come early next year.

Given the phasing and the excellent peak phasing from the time frequency analysis we must expect some resistance at the 80 day FLD initially. This is around 1720.

A sharp and sustained move to the 18 month FLD resistance around 1780-1800 would suggest the 18 month nominal low has formed around this area (see main analysis above).

FLD Settings

If you do not have the use of Sentient Trader use these settings to plot FLDs in your trading software (daily scale) to more easily follow trading signals and strategy from Sigma-L.

Make sure to account for non-trading days if your broker omits them in the data feed (weekends, for example). The below offsets are given with no added calculation for non-trading days.

80 day nominal: 73.8 days | 37 day FLD offset

40 day nominal: 34.3 days | 17 day FLD offset

20 day nominal: 17.5 days | 9 day FLD offset

10 day nominal: 9.1 days | 5 day FLD offset

Correlated Exposure Options

A non exhaustive list of correlated instruments for consideration

SPDR Gold Shares iShares Gold Trust IAU 0.00%↑

SPDR Gold MiniShares Trust GLDM 0.00%↑

Aberdeen Physical Gold Shares ETF SGOL 0.00%↑

Granite Shares Gold Shares BAR 0.00%↑

VanEck Merk Gold Trust OUNZ 0.00%↑

Goldman Sachs Physical Gold ETF AAAU 0.00%↑

ProShares Ultra Gold UGL 0.00%↑

Invesco DB Precious Metals Fund DBP 0.00%↑

Invesco DB Gold Fund DGL 0.00%↑

wShares Enhanced Gold ETF WGLD 0.00%↑

Barrick Gold Corporation GOLD 0.00%↑

Newmont Goldcorp NEM 0.00%↑

Wheaton Precious Metals WPM 0.00%↑

VanEck Junior Gold Miners ETF GDXJ 0.00%↑

VanEck Gold Miners ETF GDX 0.00%↑

Franklin Responsibly Sourced Gold ETF FGLD 0.00%↑

Amplify Pure Junior Gold Miners ETF JGLD 0.00%↑