Gold Market Cycles - 19th January 2023

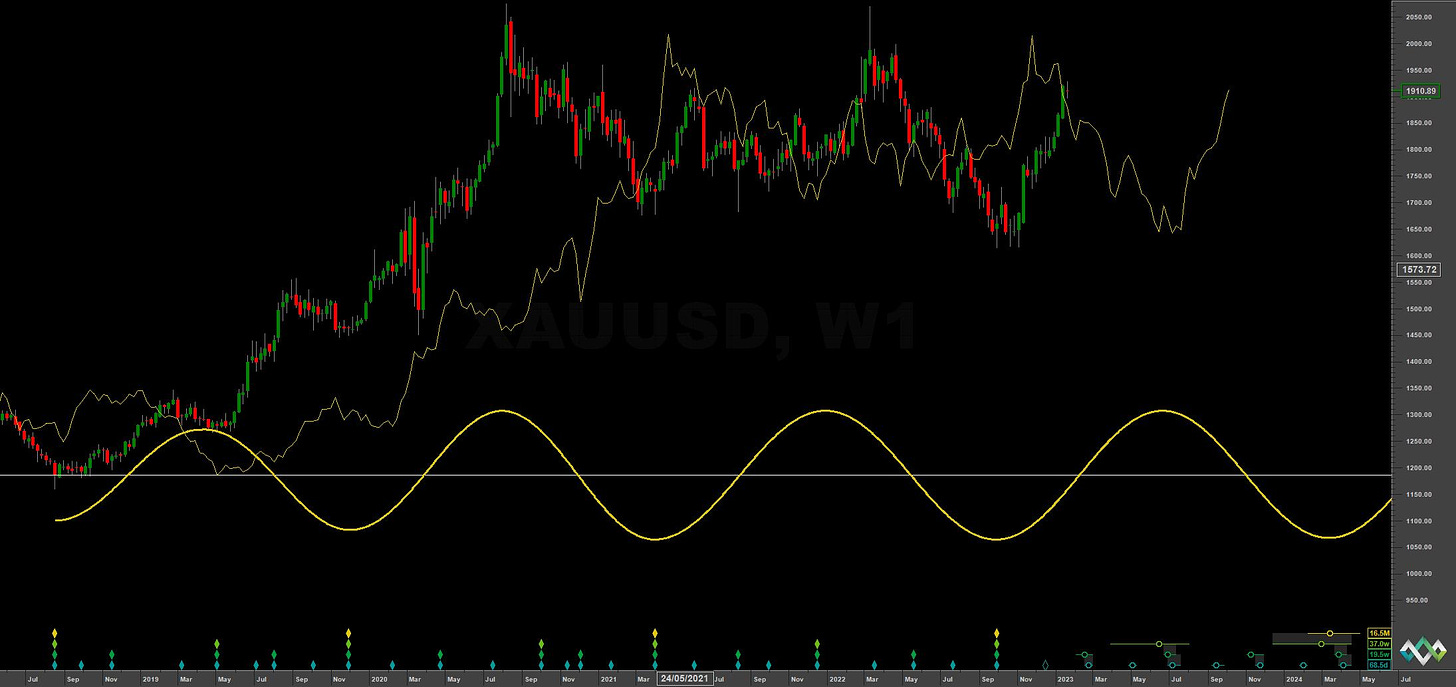

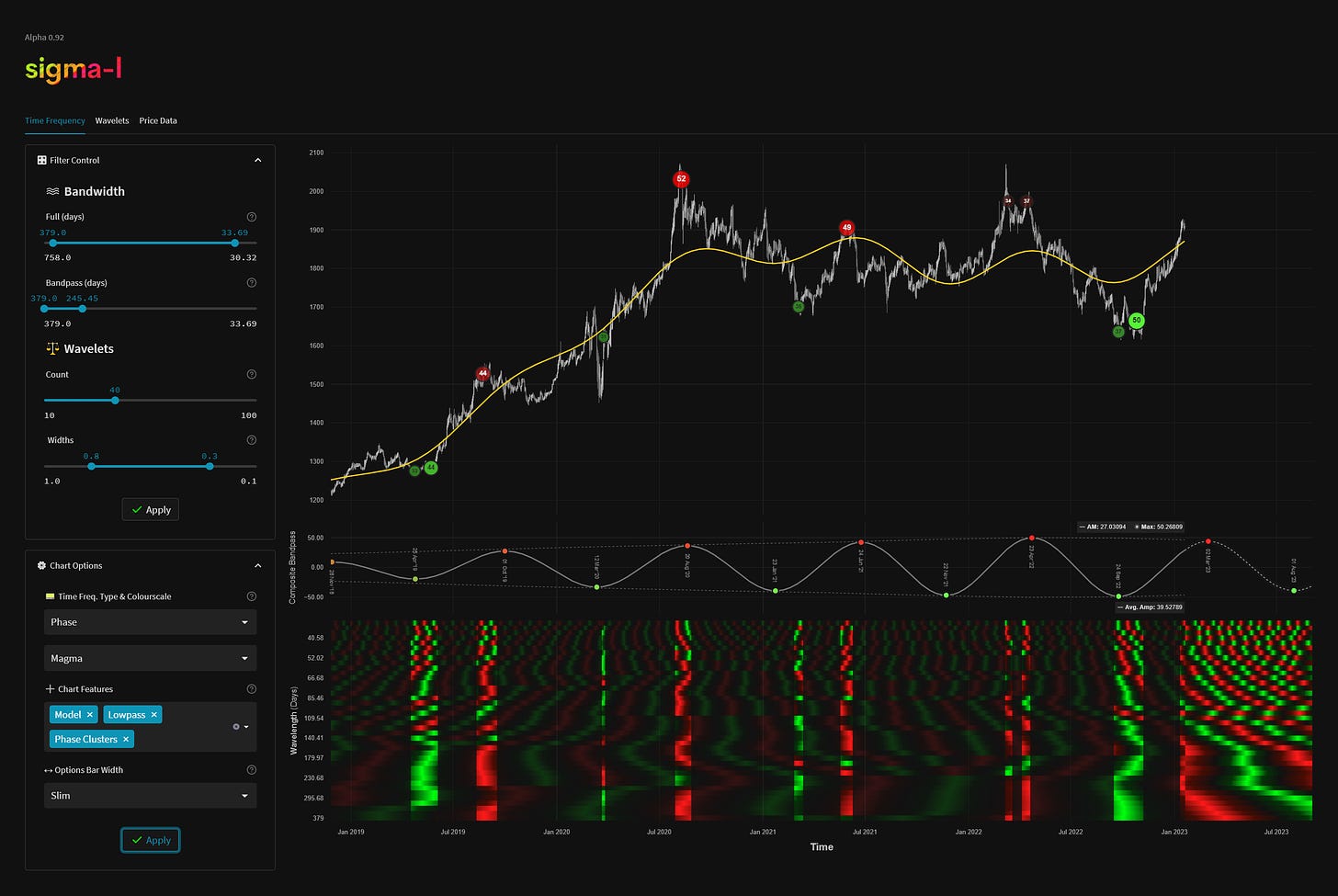

Gold moves bullishly from the 18 month nominal low around October 2022, putting in a higher low for the first 80 day component. Now, price is due a peak of the 20 and perhaps 40 week component

Essentials: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend | Time Frequency Analysis

Analysis Summary

Gold has been bullish from the last 80 day component low, thought to have occured around mid-late December 2022 and now in the process of peaking, along with the 20 week component. Price is currently at the 18 month FLD resistance according to Sentient Trader and therefore this area is a prime position for a crest of at least 20 week magnitude.

Whether the 18 month nominal low in October was of larger magnitude is now under question, a higher low to come for the 20 week component being a strong sign it was. Certainly the cross target of the 18 month FLD, which will likely occur around this area, depending on the pullback incoming, will point to a test of the peaks. The 18 month component itself is due to peak in May-June this year. A peak later than that will imply a larger component low has occurred with more certainty.

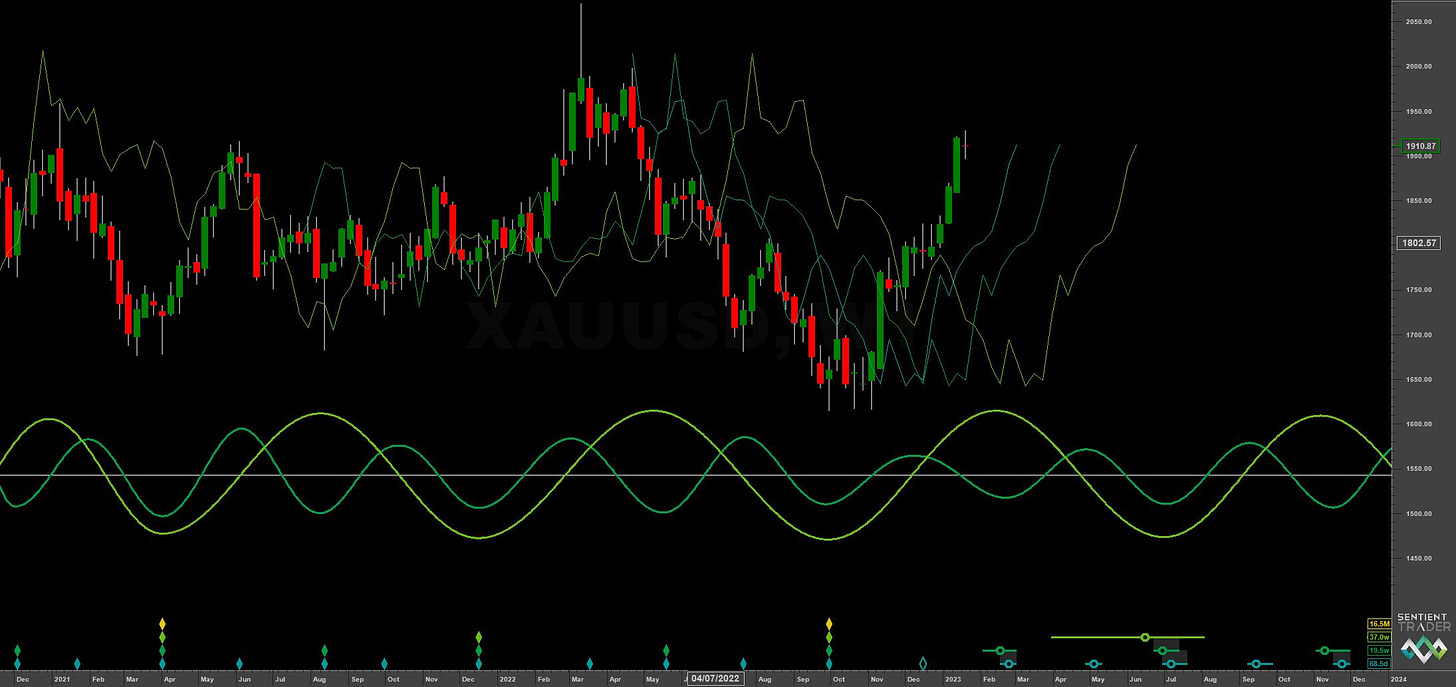

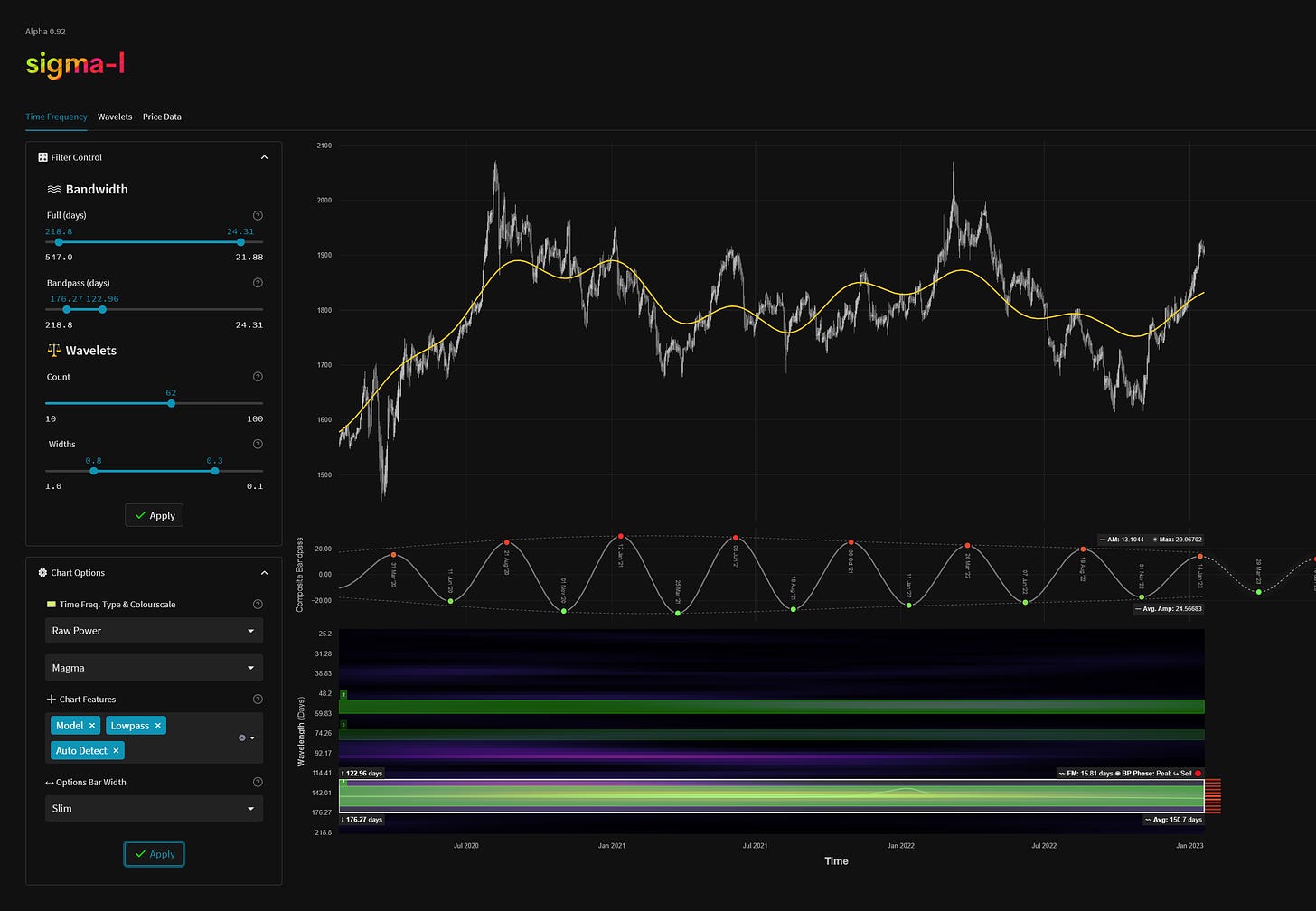

The 40 and 20 week components are inside the sell zone, the 20 week component more so according to the time frequency analysis below, at the medium term. The 40 week FLD cross target at 1925 has just been met.

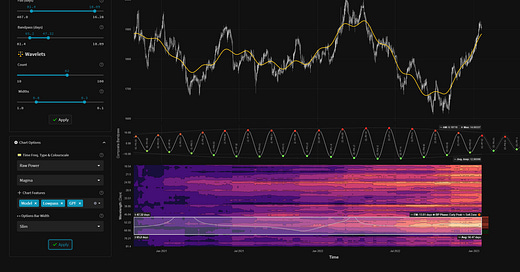

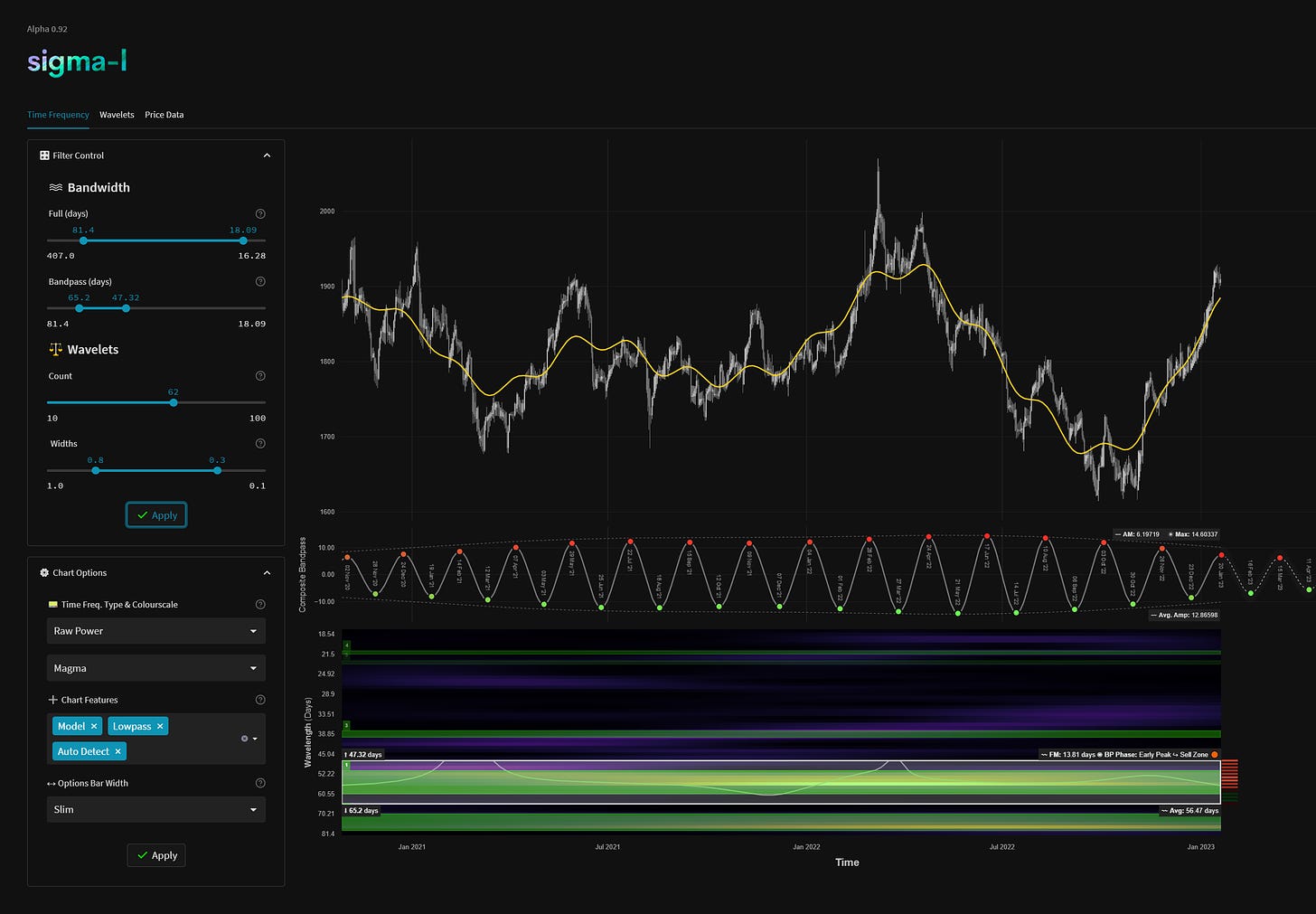

The short term presents a very interesting picture as we have two strong signals, one around 56 days (previously crowned ‘the beacon’) and one around 74 days, both moving in and out of phase with each other. When it comes to actually trading and not speculating in an academic manner, the 56 day component is highly dominant. This is shown below in the ‘gain per frequency’ plot, where a simulation of buying and selling is calculated. In this case buy and sell ‘trades’ are held for half the wavelength of the component.

Phasing Analysis

Long Term

Components including and longer than the 18 month nominal wave

Medium Term

Components between the 20 week to 18 month nominal wave

Short Term

Components shorter than the 20 week nominal wave

Trading Strategy

Interaction Status

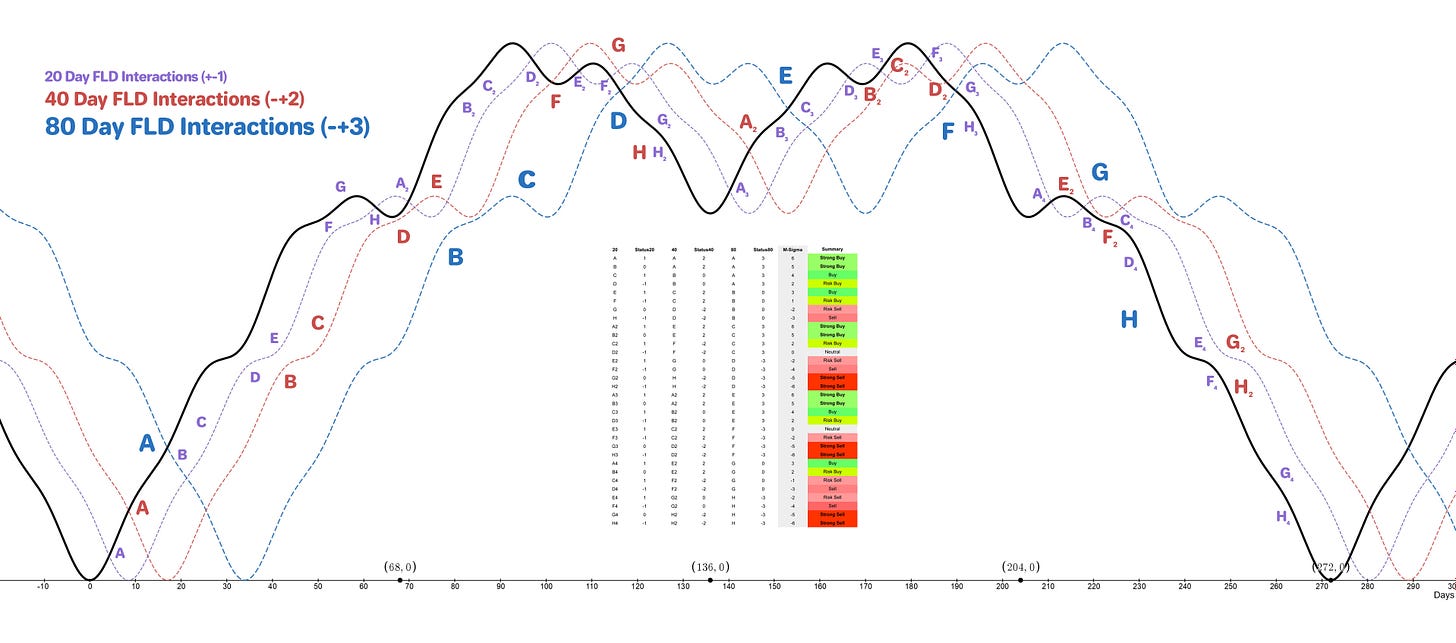

Interactions and price in the FLD Trading Strategy (Advanced). This looks at an idealised 40 week cycle and an array of 3 FLD signal cycles. We apply the instrument’s phasing to the model and arrive at an overall summary for the interactions with the 20 day FLD, current and forthcoming.

Sigma-L recommendation: Sell

Entry: 10 Day FLD / 20 Day FLD

Stop: Above forming 20 week nominal peak

Target: ~1850 (80 day FLD support) 1800 (20 week FLD support)

Reference 20 Day FLD Interaction: F2

Underlying 40 Day FLD Status: G-H

Underlying 80 Day FLD Status: D

A modest pullback to the 80 day FLD support is highly likely. Further to the 20 week FLD support around 1800 is possible. From there price will likely make the monthly cross point of the 18 month FLD and provide a target to the upside.

FLD Settings

If you do not have the use of Sentient Trader use these settings to plot common FLDs in your trading software (daily scale) to more easily follow trading signals and strategy from Sigma-L.

Make sure to account for non-trading days if your broker omits them in the data feed (weekends, for example). The below offsets are given with no added calculation for non-trading days.

80 day nominal: 63 days | 32 day FLD offset

40 day nominal: 32.8 days | 16 day FLD offset

20 day nominal: 16.4 days | 8 day FLD offset

10 day nominal: 8.3 days | 4 day FLD offset

Correlated Exposure

A non exhaustive list of correlated instruments for consideration

SPDR Gold Shares iShares Gold Trust IAU 0.00%↑

SPDR Gold MiniShares Trust GLDM 0.00%↑

Aberdeen Physical Gold Shares ETF SGOL 0.00%↑

Granite Shares Gold Shares BAR 0.00%↑

VanEck Merk Gold Trust OUNZ 0.00%↑

Goldman Sachs Physical Gold ETF AAAU 0.00%↑

ProShares Ultra Gold UGL 0.00%↑

Invesco DB Precious Metals Fund DBP 0.00%↑

Invesco DB Gold Fund DGL 0.00%↑

wShares Enhanced Gold ETF WGLD 0.00%↑

Barrick Gold Corporation GOLD 0.00%↑

Newmont Goldcorp NEM 0.00%↑

Wheaton Precious Metals WPM 0.00%↑

VanEck Junior Gold Miners ETF GDXJ 0.00%↑

VanEck Gold Miners ETF GDX 0.00%↑

Franklin Responsibly Sourced Gold ETF FGLD 0.00%↑

Amplify Pure Junior Gold Miners ETF JGLD 0.00%↑