Something a Little Different..

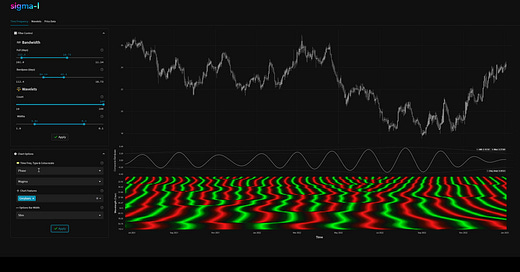

This short video, presented with no commentary, shows some of the techniques that we use to identify periodic components in financial markets with our new (heavily alpha!) app. Most notably a time frequency analysis and the useful microscope it provides for insight into the world of financial market price motion.

In this example we look at the ‘nominal’ 40 week, 20 week and 80 day components in popular precious metals, at the daily timeframe. The start of the video explores the longest component, using a composite (time domain average) of gold, silver, platinum and palladium. Note the commonality of components between these at the longer timeframe. We examine phase clustering, detailing which components that are troughing or peaking have the most power (magnitude) across the bandwidth of frequencies specified - useful for nailing down the magnitude of wave features.

We then go on to look at the 20 week component, which has been quite coherent in all the precious metals here for the last year or two.

Finally we examine the ‘beacon’ signal of the past 6-8 months. The ‘nominal’ 80 day component, which runs at around 55 days. We show how it’s lack of amplitude in early September was tricky to phase if using just one instrument and normal techniques. Note how both silver and platinum show distinct troughs around this period.

Throughout the video we adjust the full frequency bandwidth for the wavelet convolution, the bandpass area (which provides the BP composite on the plot) and examine phase clusters in all timeframes. Adjusting the ‘widths’ parameter of the wavelets briefly allows the fundamental time/frequency tradeoff to be explored. We also switch to the wavelet tab in order to build a simulated bandpass filter, which we can then use as a guide for filter cutoffs in the main analysis.

If you like these kind of videos, please add a like and let us know what you think in the comments below. Perhaps we will do more in future if the format is conducive, with commentary and so forth.

Share this post