The Periodical: 12th August 2022

Stock markets push higher, gold and silver climb from 80 day nominal lows and the dollar starts to establish it's latest trough. Oil continues bearish chop and crypto apes the equity markets

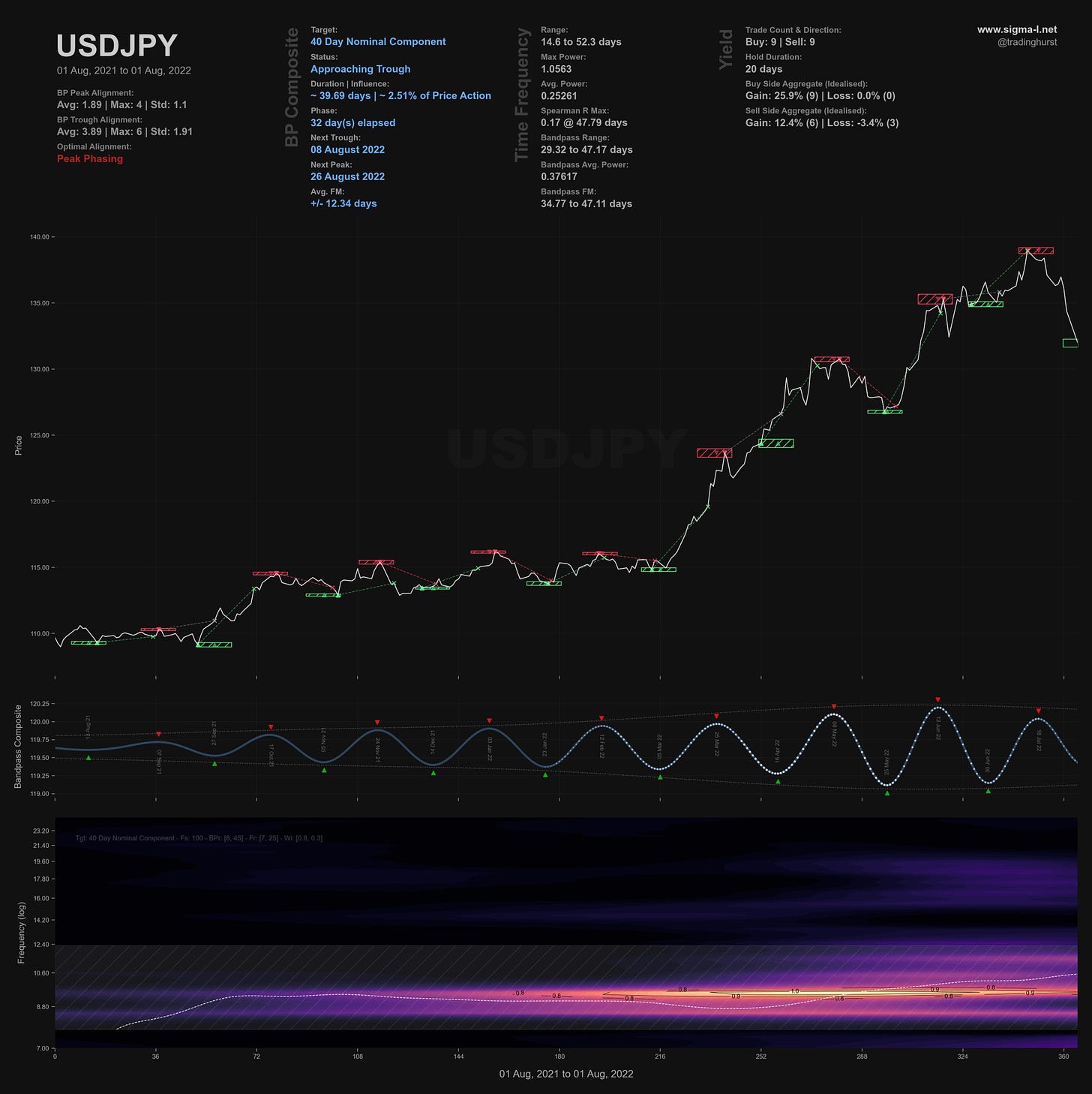

Chart Highlight: USDJPY

Round Up

For precious metals investors and speculators the last couple of weeks have been a sweet relief from the ongoing bearish slide, featured prominently in the gold and silver markets. Gold achieved a target of 1800 and, alongside silver, is likely beginning the process of peaking from the 40 day component. This peak may well also be a peak of 80 day magnitude, evidence will gather on the strength of the incoming move down.

Stock markets have risen strongly from troughs of at least 20 week magnitude in mid July and have possibly just made a very shallow 40 day nominal low. Commonality between US and EURO markets is compelling, with the EU markets somewhat more hesitant to move higher. The period late August into early September will be crucial in establishing longer components and our positions going into the end of the year.

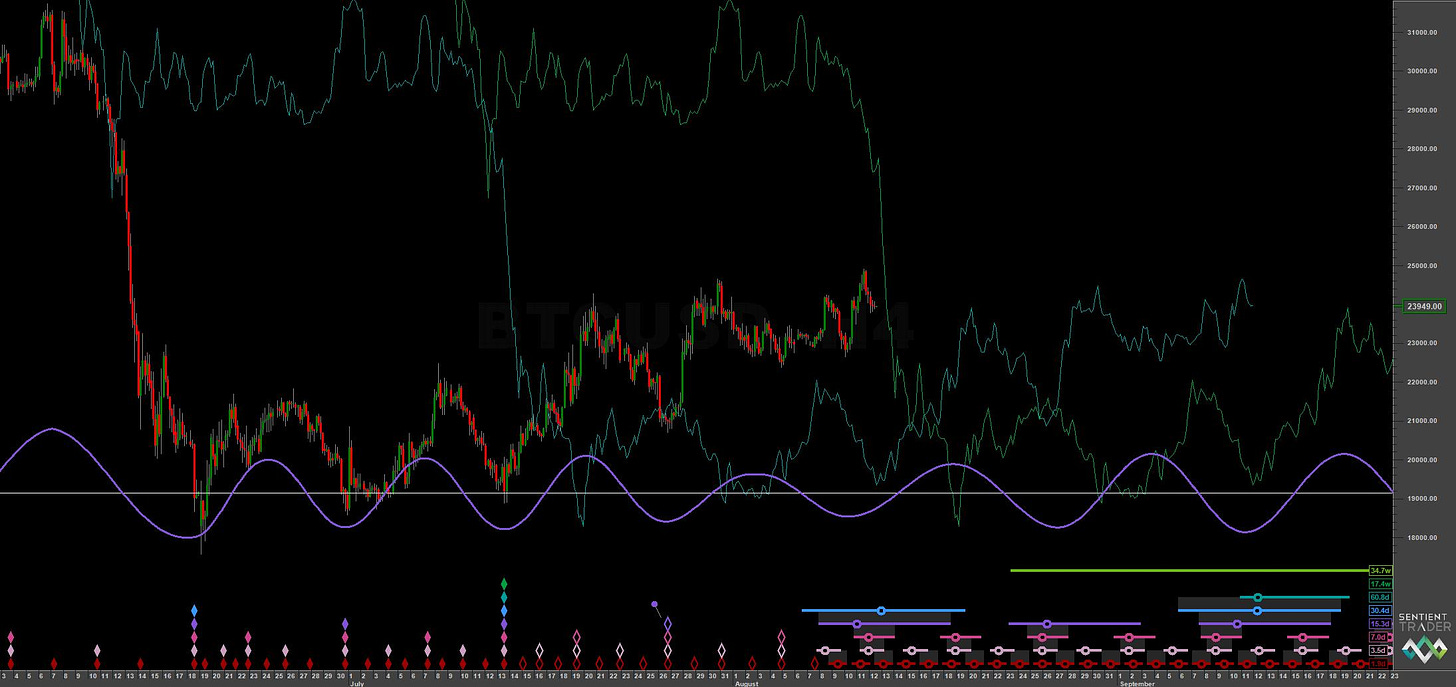

Cryptocurrency is, as usual, in much the same position as the equity markets, with amplitude modulation differentiating the multitude of coins. Bitcoin is relatively sideways from the 20 week nominal low but has reached upside targets recently, as has Ethereum. Again, the 40 day nominal low formation is under scrutiny here from a Hurstonian perspective and should provide clarity over the next few weeks.

The oil market has continued to chop lower, the most recent short rally likely a trough of 20 or 40 day magnitude. Downside targets of 82 from the 20 week FLD cross are still very much valid and the 18 month FLD support awaits at that level later this month. US natural gas has established a tracking move around the 20 week FLD and has most recently formed it’s 40 day nominal low around the 3rd of August. A continuation of the 20 week FLD tracking calls for a bearish move into the next 80 day nominal low, due early September around 5.5.

In the currency markets the dollar has come under pressure recently but both USDJPY and the DXY are likely establishing 80 day nominal lows, with the former slightly ahead in phase. USDCAD continues to display a most excellent 80 day component, explored in today’s report and starting it’s next bottoming process. Both EURUSD and GBPUSD are due 80 day component peaks over the next week or so. EURGBP came down to target of 0.835 recently and has bounced strongly, possibly forming a trough of 40 day magnitude.

Twitter Highlight

The 18 month component in AUDNZD has been really outstanding over many years. Indeed it was featured in one of the first reports to launch on Sigma-L back in late 2021. That component is likely now peaking and we can look forward to some excellent trades over the coming months as the longer components start to lose influence.