The Periodical: 1st April 2022

The 40 week nominal low is established in stockmarkets and cryptocurrency, oil slumps and USDCAD is primed for a big move

Chart of the Week: USDCAD

Round Up

Stockmarkets over the last two weeks have established a low of at least 20 week magnitude and most likely, according to our current phasing analysis, a low of 40 week magnitude. While the European markets have shown extraordinary amplitude at the 40 day component (see FTSE) out of the low, US markets have been slower (although still putting in a remarkable string of bullish days) - no doubt less affected by geopolitics this side of the ‘pond’. In all major equity indices price is now approaching the first 40 day nominal peak. The move down from this first significant crest of the 40 week component will reveal a glimpse of price action to come late April.

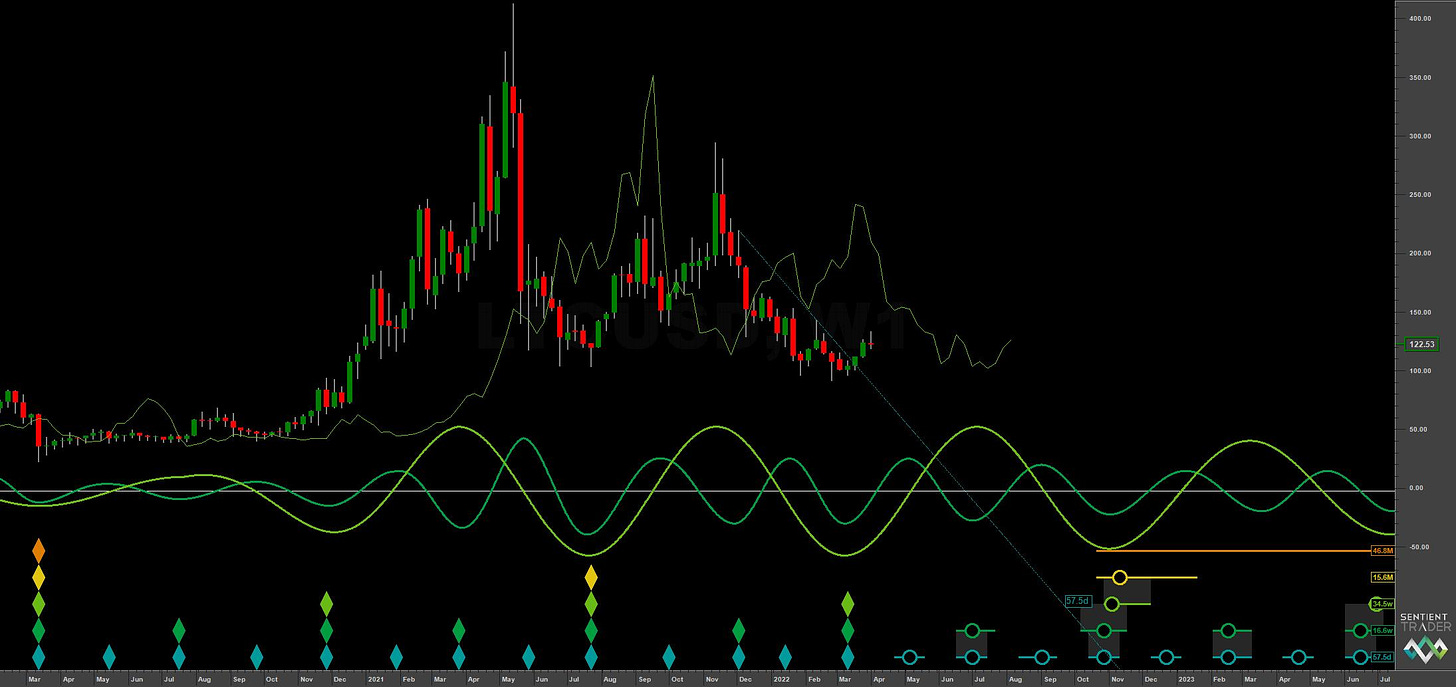

Cryptocurrency has also most likely made the 40 week nominal low. Many of the major coins, certainly Bitcoin and Ethereum, have seen amplitude modulation at the most recent 80 day nominal low, resulting in a higher low for the cycle low and the price low. This does happen on occasion, we can use the principle of commonality in order to smooth the modulation somewhat. Watch out for updates on this sector next week on Sigma-l.

In the currency market there has been some excellent moves recently. AUDNZD moved down to our target of the 20 week FLD and has bounced from what is likely the final 80 day component of the current 40 week component iteration. USDCAD is primed for the 40 week nominal low very soon, price having come down the 18 month FLD. This instrument will be establishing the large low over the coming weeks, prior to an attempt at the target of 1.32 set by the 18 month FLD cross some time ago. EURGBP has continued it’s increased amplitude, moving to the 20 week FLD resistance recently and starting to form it’s 40 day nominal peak, expect an update on this fascinating analysis next week.

Energy markets have continued to display incredible amplitude over the last couple of weeks, crude oil in particular clarifying the phasing uncertainty displayed from the period prior to the war in Ukraine. The sudden increase in the 40 day component amplitude is a stark demonstration of amplitude modulation in financial markets. The move from the 80 day (at least) nominal peak recently giving rise to some excellent trading opportunities. US natural gas has climbed into it’s own 80 day nominal peak, imminent now. The current phasing suggests another opportunity for bulls mid April, so look out for that.

Precious metals continued their decline from what is likely the 40 week nominal peak, made in early March 2022. Phasing analysis suggests a low of at least 20 week magnitude is to come over the next couple of weeks - this will be instructive as to the path for Gold and Silver longer term. Note that Gold has not yet reached our target in the last report but Silver has done so. Price is currently at the 80 day FLD support in both of these and within the nest of lows for the 20 week component trough. Hurstonians should pay close attention!

Twitter Highlight

Many thanks to David Hickson, creator of the excellent Sentient Trader software (charts you see on this site), for the video detailed below: