The Periodical: 22nd April 2022

Cryptocurrencies and stockmarkets move tentatively from 40 day nominal lows, metals tantilise and US natural gas blows up a top

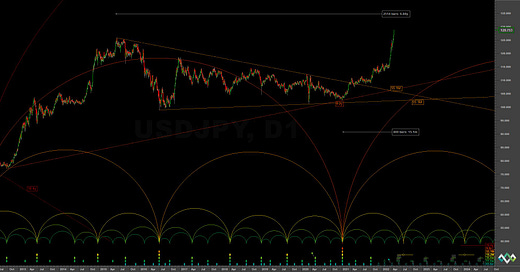

Chart of the Week: USDJPY

Round Up

Another exciting few weeks in the financial markets has seen equity indices attempt to establish what should be the 40 day nominal low in the last week or two. Moves from this low have been varied, with the DJIA leading the way for the US markets while the European equivalents have floundered somewhat. The lows made around the world in early March are now confirmed in the majority of cases as a low of at least 20 week magnitude.

The currency market has presented some excellent opportunities recently. AUDNZD has likely peaked from it’s current 80 day component iteration and is heading for a low in mid May. USDCAD has bounced from the 40 week nominal low and has already reached the 1.267 area. EURGBP has chopped around in an interesting manner during it’s long grind down for the last year or so - this should be culminating in a 40 week nominal low soon.

Precious metals have teased us with the prospect of a 40 week nominal low after peaking in early March this year and falling subsequently to targets around the 20 week FLD. A move from a low of 40 week magnitude should easily break the 18 month FLD upside resistance seen for many months. Price has failed to do so thus far, raising the prospect of the 40 week low infact being at the next 80 day iteration, in late May. To assist us in both silver and gold the 80 day component, phased at the lows, is exemplary. One to keep a close eye on and we will bring timely updates for that in due course to subscribers.

Cryptocurrency continues to move in commonality with stockmarkets, save for individual issue amplitude modulation. Both Bitcoin and Ethereum are at 40 day nominal lows and are attempting to build upward momentum, although in a tentative manner so far. A weak (bearish shaped) 40 day component here would likely prompt a shift in the phasing analysis.

Finally of note in the energy market is US natural gas which climbed incredibly over the last few weeks into what is very likely an 80 day magnitude peak and possibly a 20 week nominal peak. The peak was fairly overdue and price is now falling with the kind of amplitude that accompanied the rise, working it’s way through a classic bearish FLD cascade on the way.

Upcycled

Further reading and insight into the fascinating world of time series analysis and signal processing:

Twitter Highlight

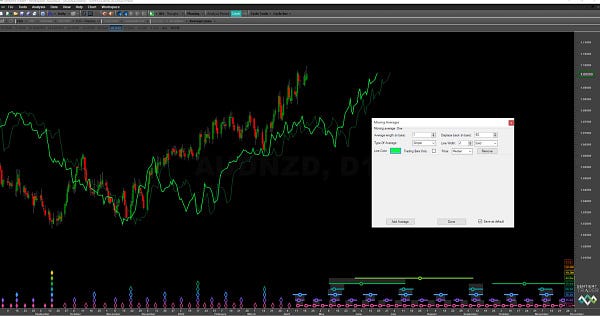

The use of a moving average as a low pass filter for financial time series is covered in depth over at the Hurst Cycles Toolset section. For users of Sentient Trader we discovered the ability to smooth an FLD in a similar manner this week. Check out this series of tweets to learn how:

Performance Reports

We track each trade we publish to subscribers and collate the results into quarterly performance reports, check them out below:

September 2021 - November 2021