The Periodical: 23rd September 2022

Stockmarkets and crypto continue decline toward an 18 month nominal low, the Dollar starts to peak from it's latest 80 day component and Gold sets up for a low of at least 20 week magnitude.

Chart Highlight: USDCAD

Round Up

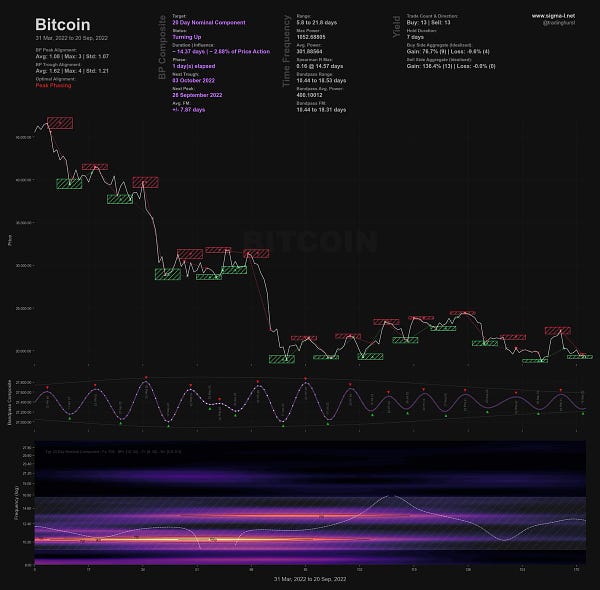

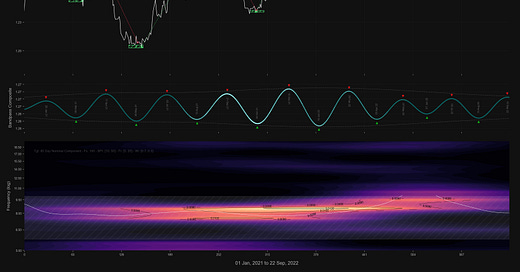

An interesting couple of weeks in the markets from a cyclical perspective. In both cryptocurrency and stockmarkets the anticipated 80 day nominal trough in early September produced a lacklustre rally. Price in both markets is now continuing the underlying decline in what is a typical move at the late stages of a larger, bearish component. Watch the next 40 day component low due at the start of October for a possible position for the larger low or, more likely, toward the end of October. This reflects a 40 day margin of error present in both markets currently. Crucially and most notably in crypto (check out Bitcoin) the 54 month FLD looms very close to price. This is an area of likely support for the proposed and forthcoming 18 month nominal low.

Gold and Silver have diverged somewhat at the latest 20 day component with Gold still displaying the exemplary signal at the 80 day component degree described previously. A low of at least 20 week magnitude is due. Uranium has likely peaked from it’s 40 week component and is now en-route to the large low due at the end of 2022 / early 2023. That is likely to be an excellent buying opportunity which we will cover it in detail here when the time is right.

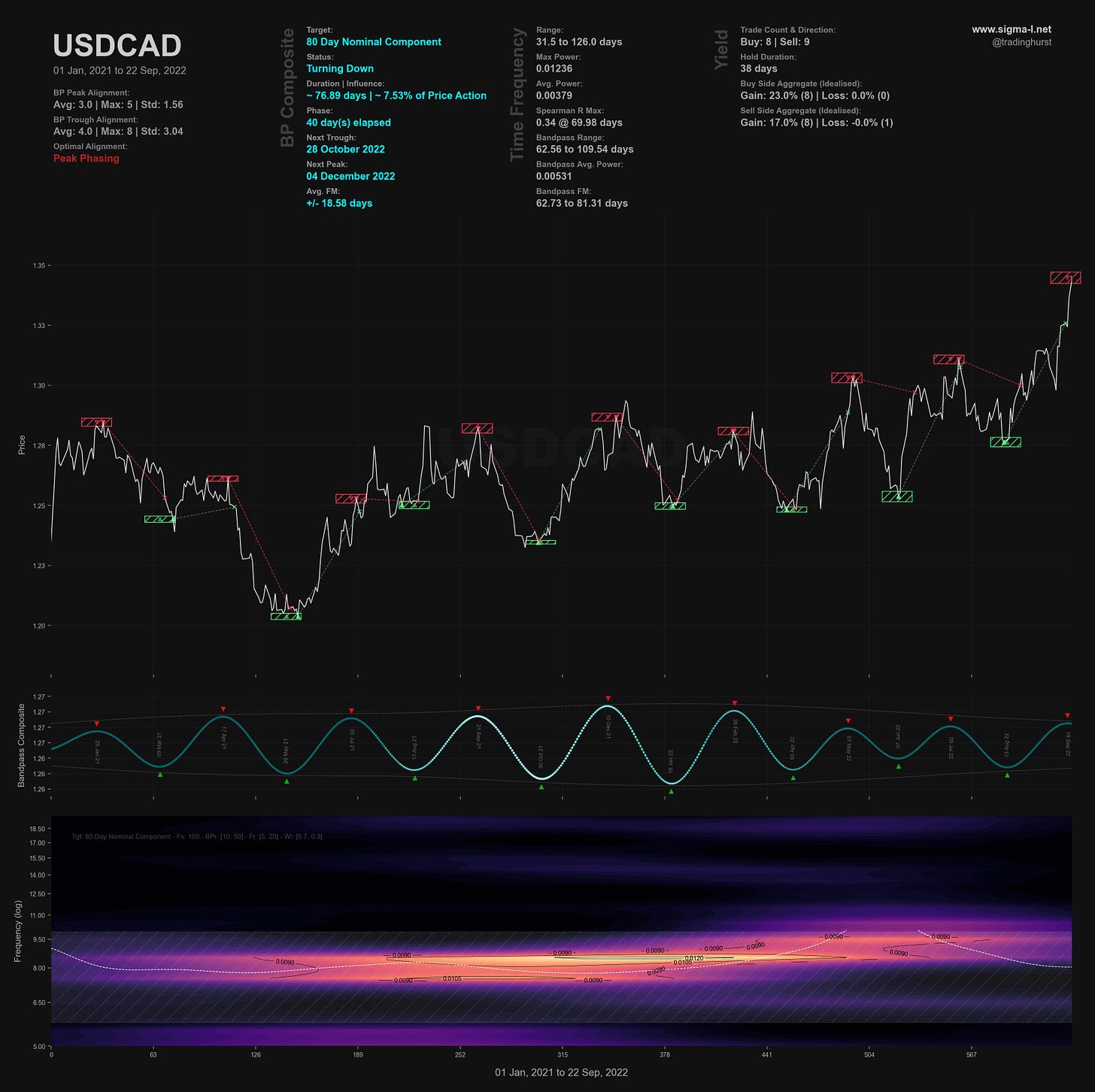

Currency markets have been dominated by the Dollar’s strength with the greenback now beginning a lengthy process of peaking and distributing via what will probably be a generally sideways consolidation, initially. Sterling, EURUSD and other USD crosses are approaching lows of 40 week magnitude. The mainstream media adding contrarian evidence with their clamouring to pen stories of £:$ parity soon. It will come, but not quite yet! USDCAD and USDJPY are making imminent 80 day component peaks, the former displayed above as our chart of the week.

The oil market is weak and is moving down from the 54 month component peak described and anticipated for months on Sigma-L. The move from the 20 week nominal low has failed to reach the 20 week FLD, which is not particularly surprising given underlying trend. Currently price is sitting at the 18 month FLD in what is probably the 40 day nominal low. Update coming on that one next week. Natural Gas has also surprised with a bearish move from what was anticipated to be a 40 week nominal low. Although price action initially hit our target of 9-9.5 (thanks to the robustness of Hurst Cycles!) the subsequent move back down was not befitting a 40 week nominal low. It is likely therefore that the 40 week trough has occurred early July -we will revisit this analysis in due course.

Twitter Highlight

When the net overall effect of larger degree summed components reaches a neutral point, smaller components within price action are more visually apparent. This is a key point and is typified by sideways movement or a ‘pause zone’ in which the underlying trend will usually continue subsequent to the pause. Below, in Bitcoin the 20 day nominal component comes to the fore.