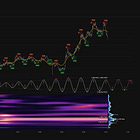

JP Morgan Chase & Co (JPM) - 20th March 2025 | @ 81 Days | + 13.55%

Last trade: + 13.55% | 'A' class signal detected in JPMorgan Chase & Co (JPM). Running at an average wavelength of 81 days over 16 iterations since December 2021. Currently troughing.

ΣL Cycle Summary

This excellent signal, an example of the Hurst 80 day nominal wave, really increased in amplitude over the last couple of iterations. This is seen most clearly in the high pass filtered price below where a smooth rise in the amplitude envelope is clearly evident. Fortunately as the frequency modulation is minimal and therefore the signal relatively stationary, we can take advantage of good timing. The most recent peak a profitable example. This signal is also perhaps a good barometer for the wider market and the 80 day nominal wave; for it is almost entirely without power in the wider US stock market indices over the last year or two.

Trade Update

Summary of the most recent trade enacted with this signal and according to the time prediction detailed in the previous report for this instrument, linked below.

Type: Sell - JP Morgan & Chase 14th February 2025

Entry: 14th February 2025 @ 276.59

Exit: 19th March 2025 @ 239.11

Gain: 13.55%