Market Cycles 2025: Our Top 10 To Watch

In this article we take a look at some of the best periodic signals to track in 2025. Presented in no particular order and derived using our bespoke time frequency analysis!

Uranium: ~ 150 Day Cycle

Since 2000 Uranium has been on our radar as a highly periodic sector, exhibiting power at both wavelengths around 75 and 150 days in our samples across multiple instruments. Whilst the smaller wave has lost power recently, the larger cycle (~ 150 days) is crucial in punctuating the underlying trend. The most recent move up from the low in August 2024 was the highest amplitude move in 4 years. Price is currently very close to forming the next trough of this component.

More on this Cycle: Uranium Cycles Composite 28th October 2024

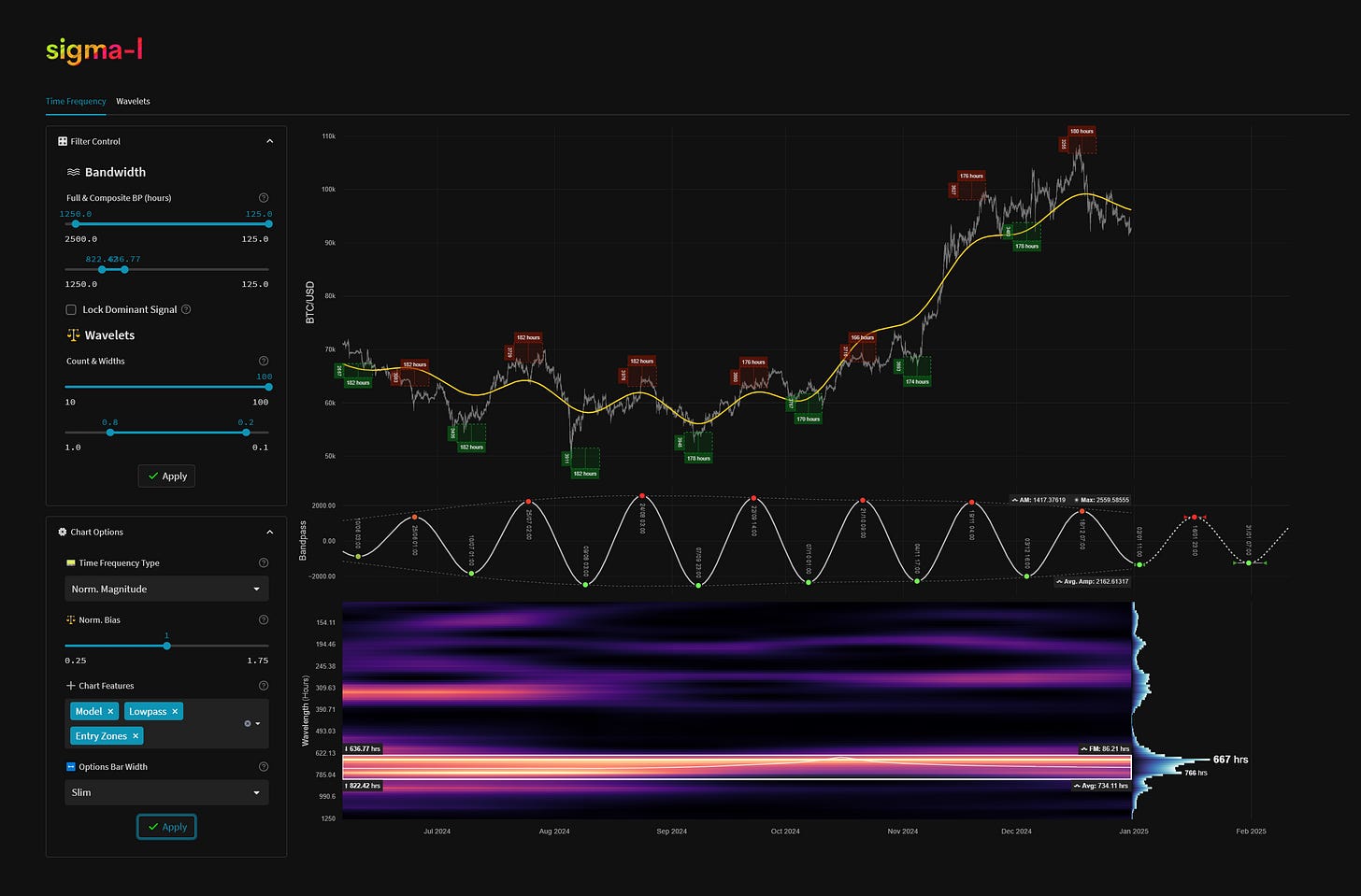

Bitcoin: ~ 700 Hour (~ 30 Day) Cycle

There is a lot of spurious discussion on cycles in cryptocurrency, a lot of it being a case of being fooled by randomness or misinterpretation. Whilst the wider spectra in Bitcoin is fairly noisy relative to other financial markets, there is currently a gem at wavelengths below 50 days, that of the 700 hour (or ~ 30 day) cycle. This is one to keep an eye on over the next few months.

More on this Cycle: Bitcoin Cycles 16th December 2024

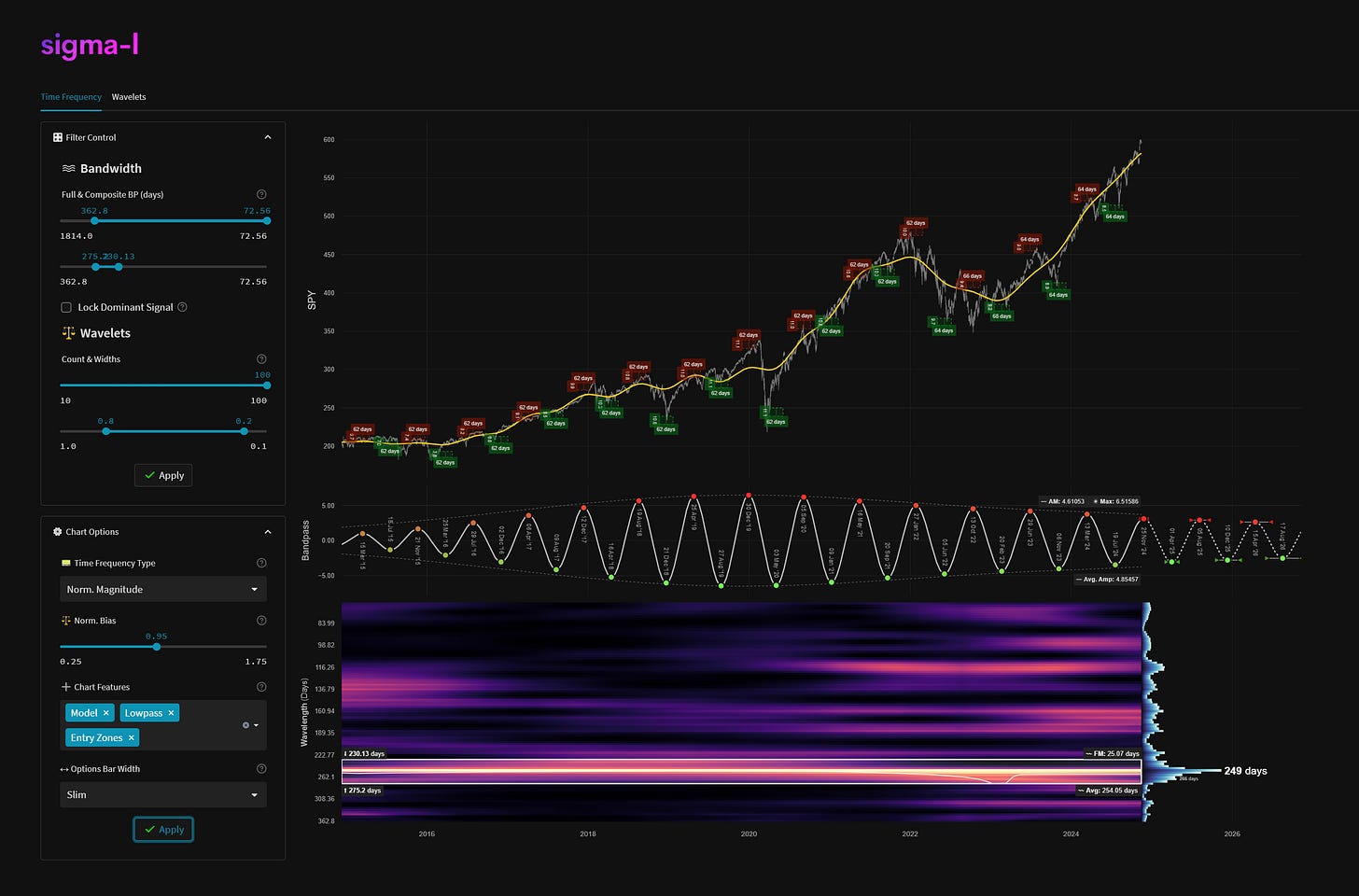

S&P 500: ~ 40 Week Cycle

Hurst’s nominal model stands the test of time with this component. Notionally the 40 week nominal wave described by his nominal model, it stands out like a beacon for most global stock markets and notably in all US stock markets. A sample since 2015 demonstrates the outstanding stability in frequency over the last decade. This is one of the more dominant, longer term cycles in equity measures.

More on this Cycle: S&P 500 Cycles (SPY) 14th November 2024

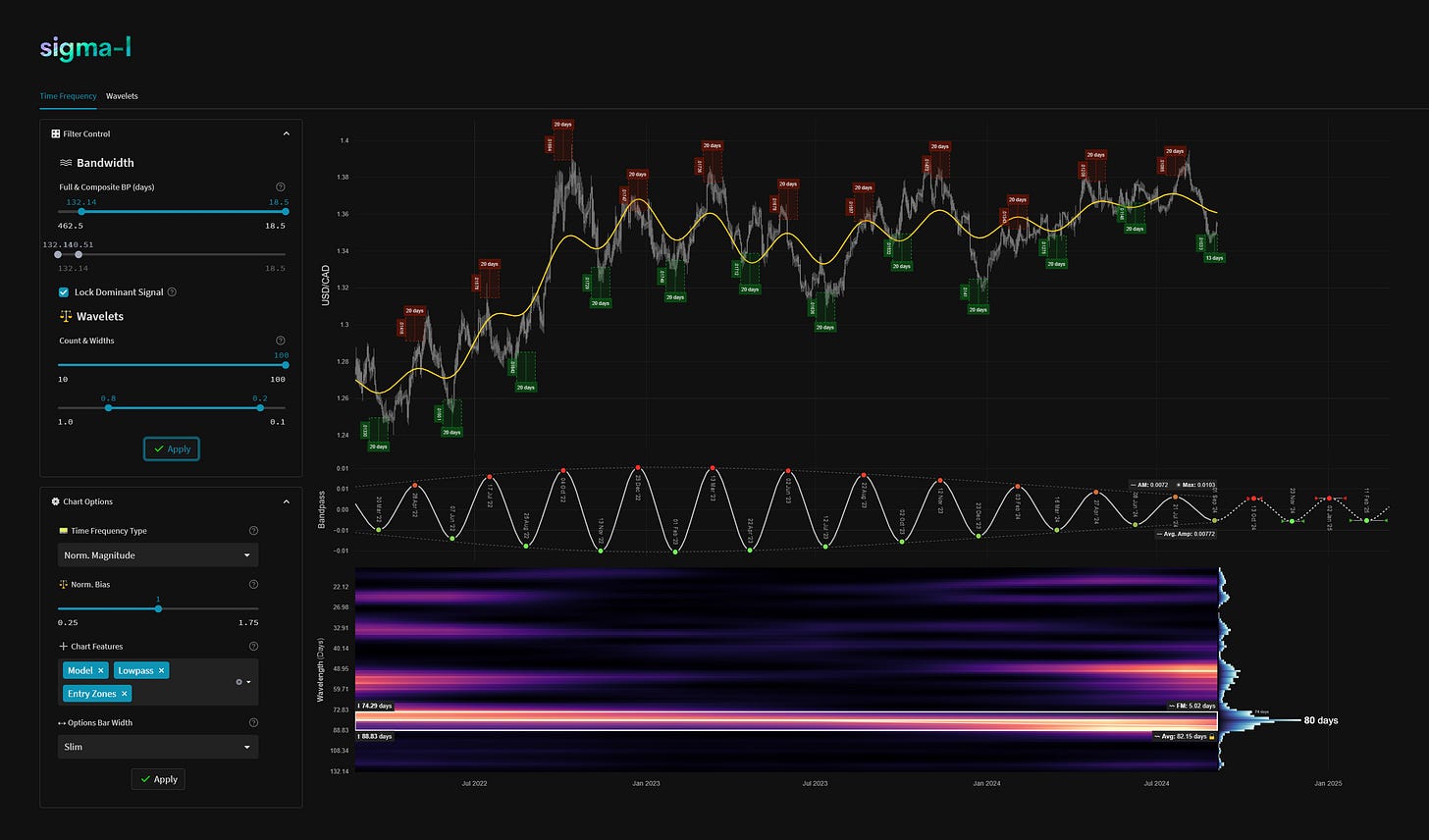

USDCAD: ~ 80 Day Cycle

This sublime feature in the Loonie has been beating away for years and is heavily featured on Sigma-L. Indeed one could have simply traded this instrument at the peaks and troughs of this component and been profitable on every trade over the last 3 years, such is the stationarity. Always keep this one in your pocket.

More on this Cycle: USDCAD Cycles 4th September 2024

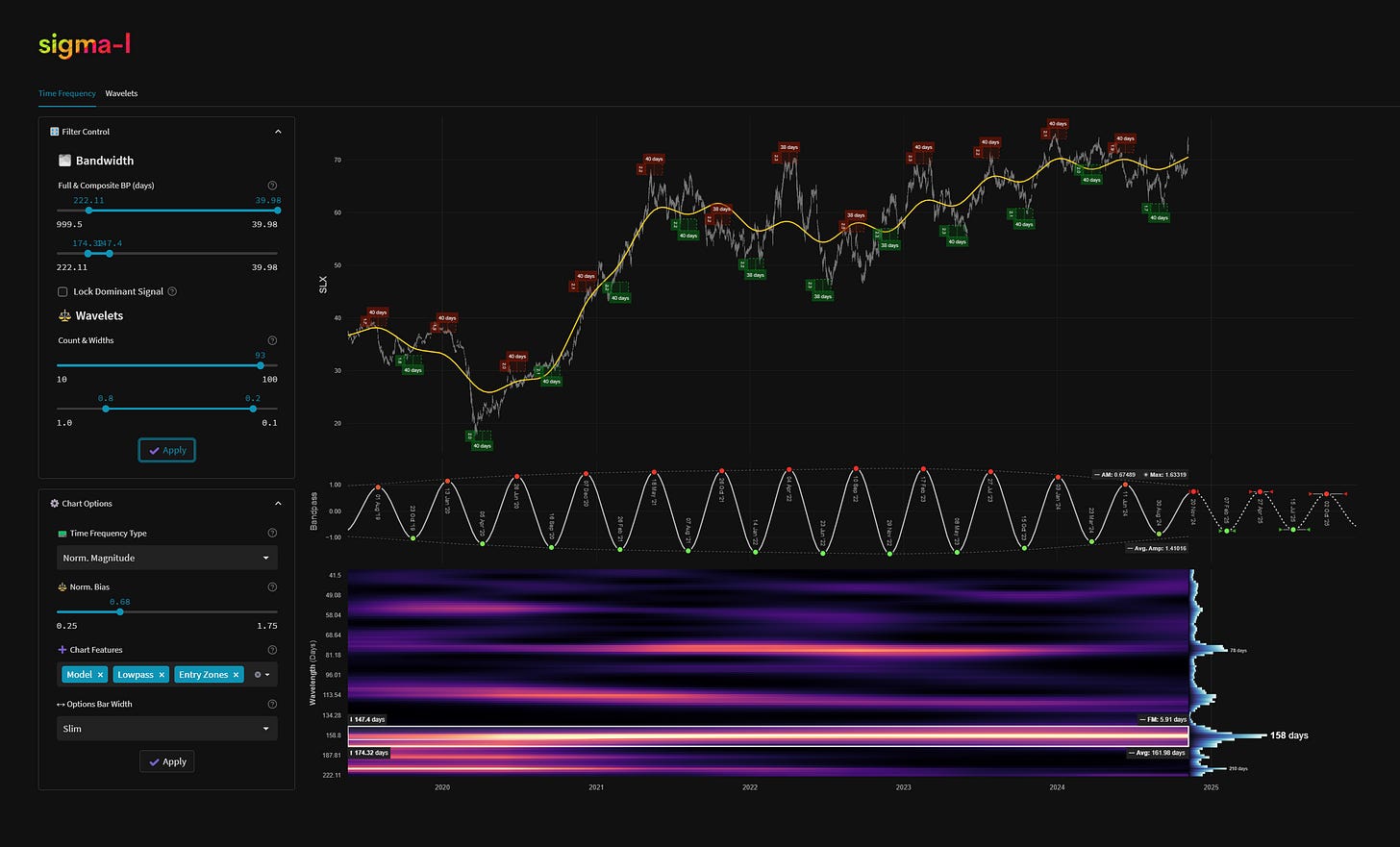

SLX (Steel ETF): ~ 160 Day Cycle

This component is very similar to the aforementioned wave in Uranium and also shares similarities with Copper at a similar wavelength, which is unsurprising. It is supremely periodic and stationary, recently moving down sharply from the latest peak iteration in November. A trough is due in the next few weeks.

More on this Cycle: VanEck Steel Cycles ETF (SLX) 11th November 2024

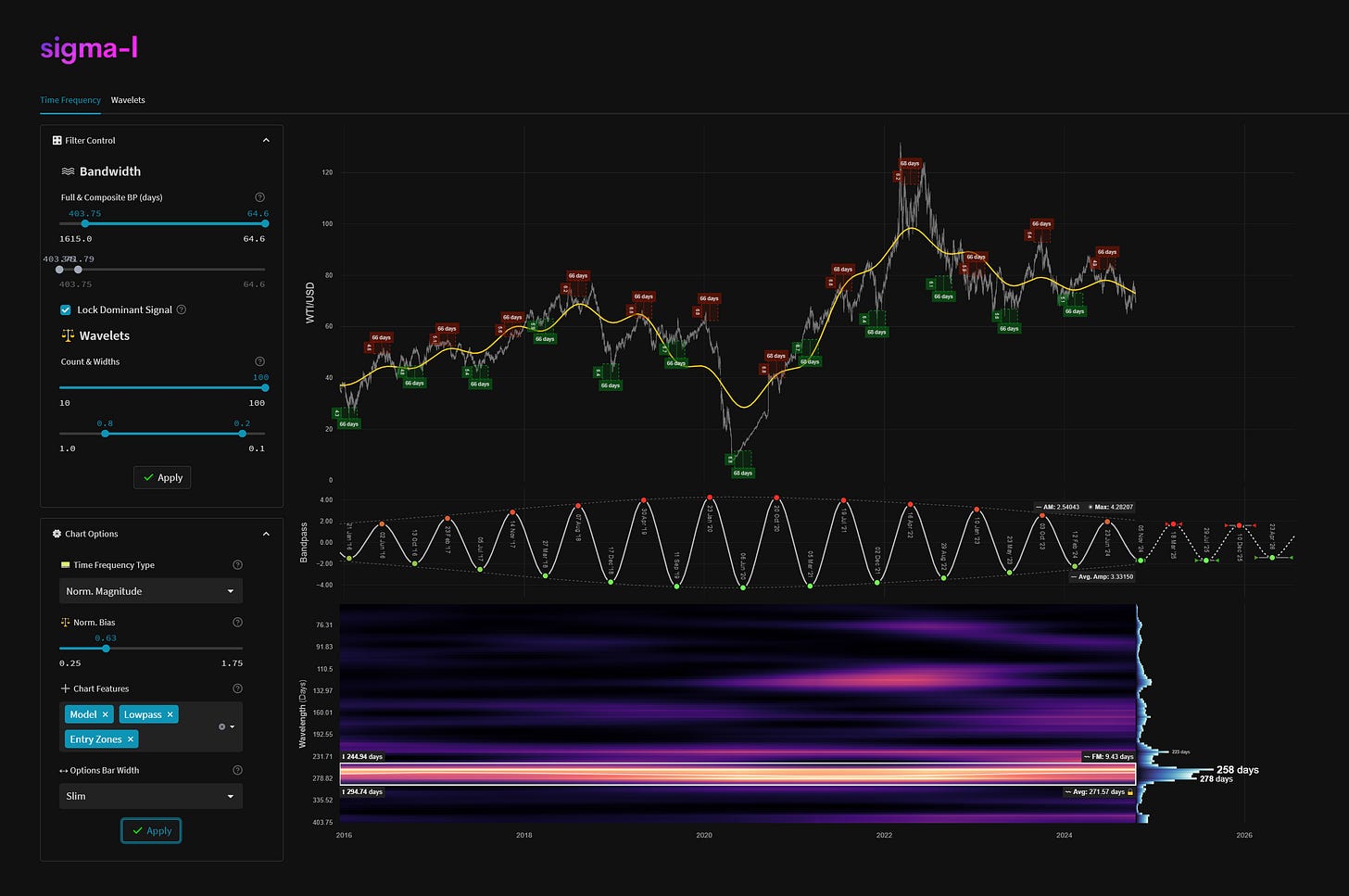

WTI Crude Oil: ~ 40 Week Cycle

Although the most recent trough of this component, which formed in November 2024, has seen turgid price action to the upside so far, we are seeing signs of a late push in recent weeks. Clearly an important cyclical feature of price in our sample since 2015, it should be on the radar of all commodity analysts.

More on this Cycle: WTI Crude Oil 16th October 2024

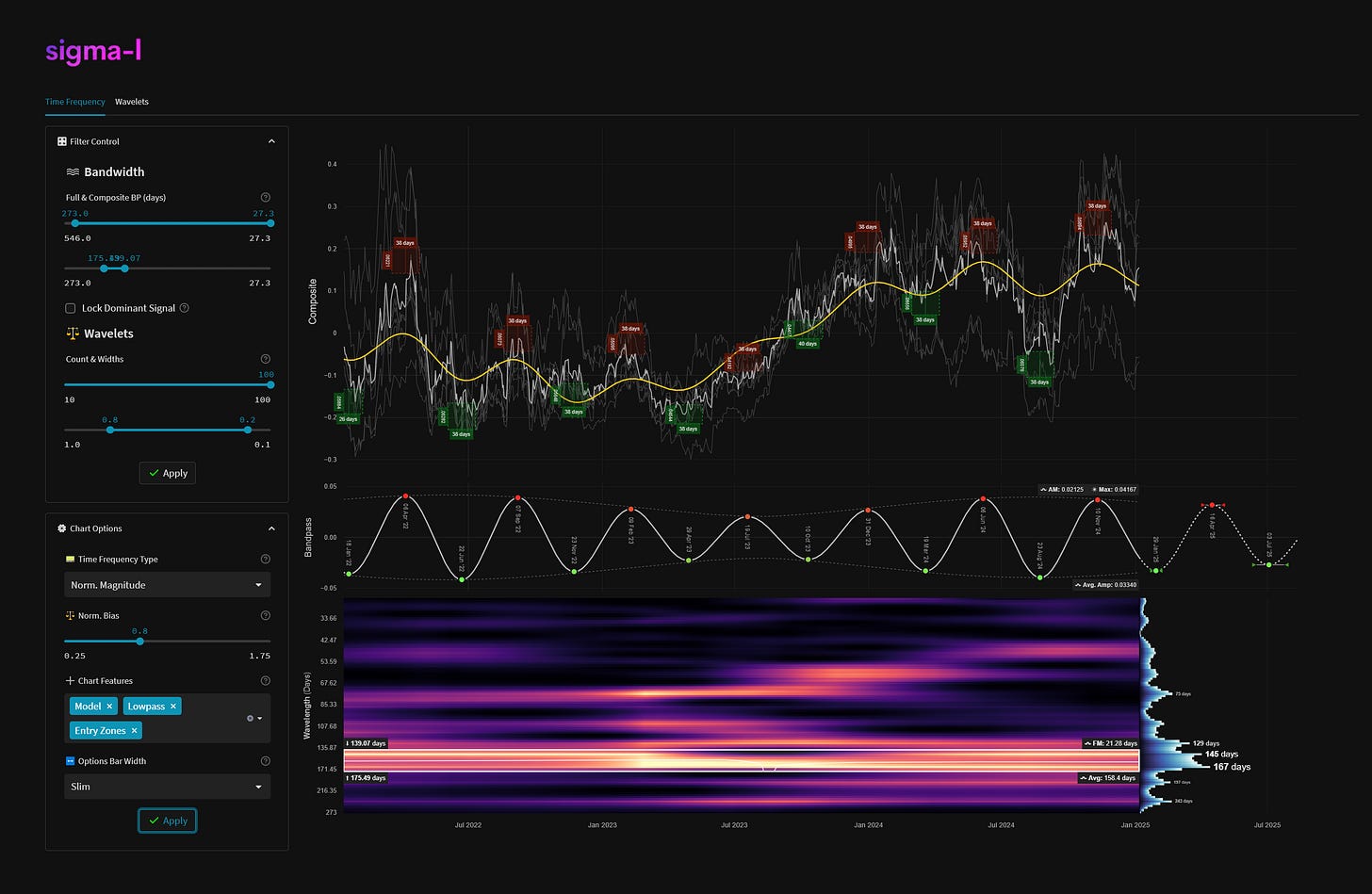

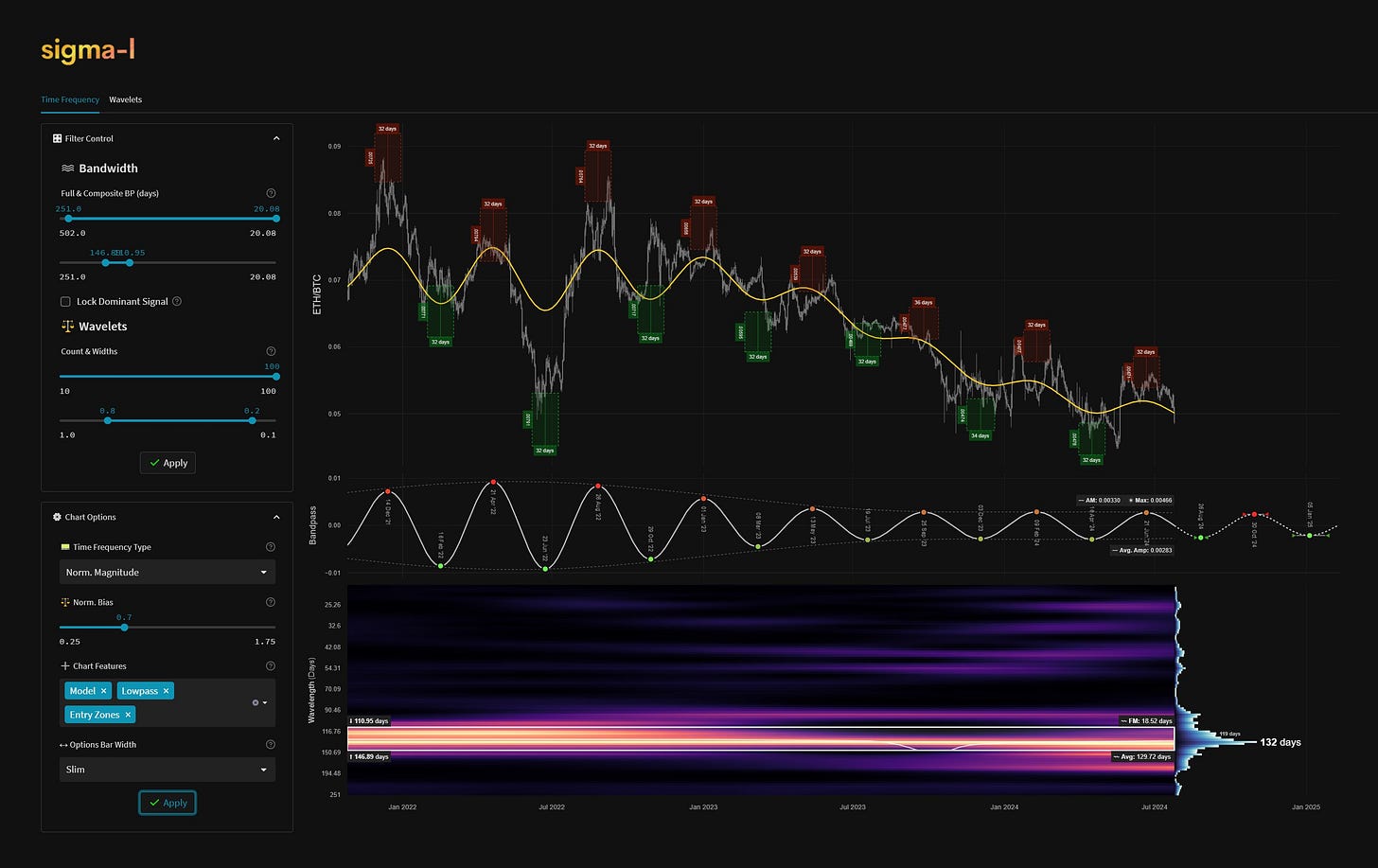

ETH/BTC: ~ 130 Day Cycle

This excellent cycle, which perhaps defines ‘alt-season’ in crypto land, is highly stationary and has punctuated the larger downtrend within our sample since 2022. Although ETH has had a hard time against the og cryptocurrency Bitcoin, it has, on occasion, hit back. In this case very periodically!

More on this Cycle: ETH/BTC Cycles 6th January 2024

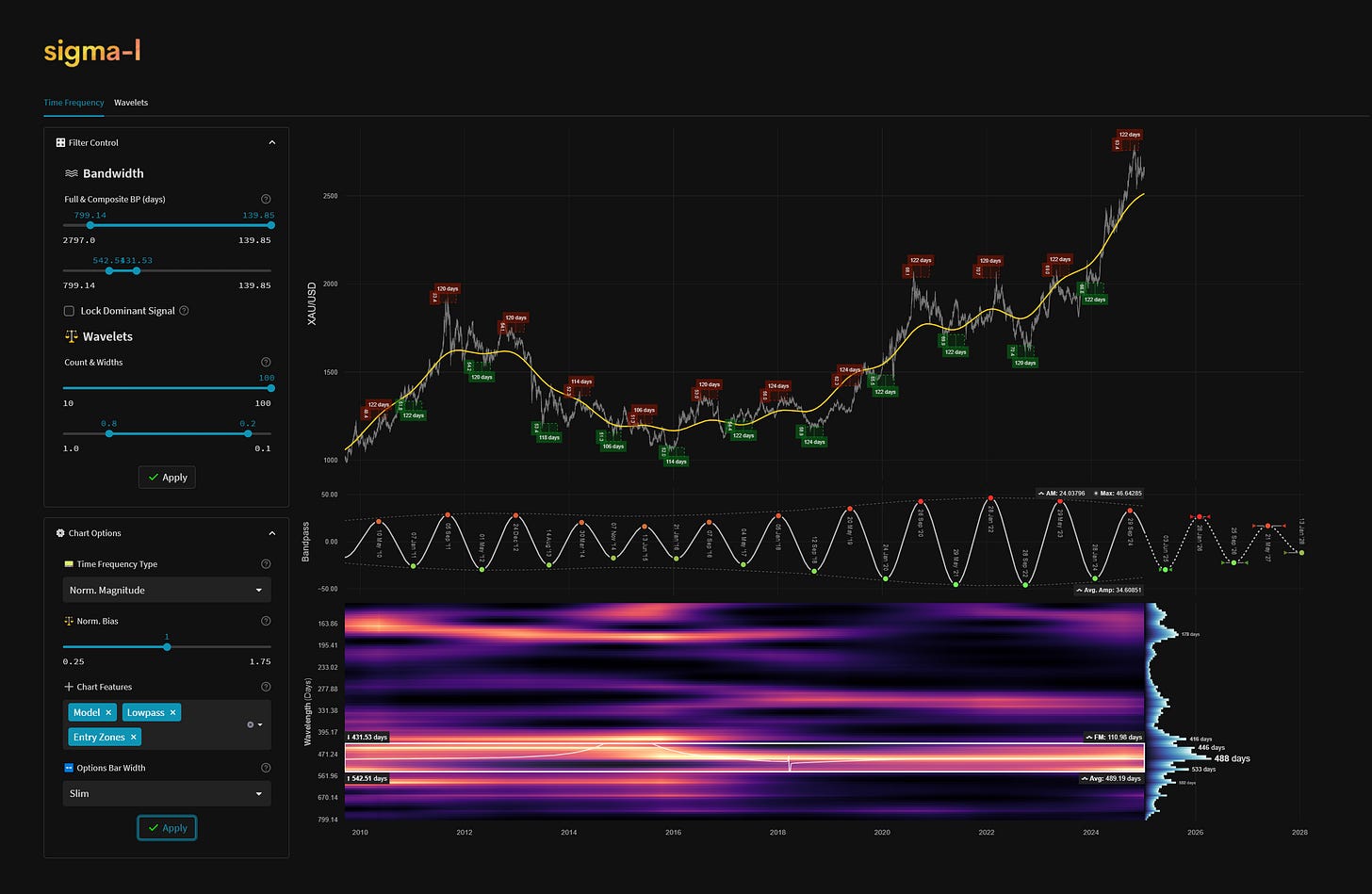

Gold: ~ 500 Day Cycle

A strong contender for one of the better long term cycles in any market is this beauty in Gold. Although not as crisply defined as some via our sample above since 2009, the stability shown since late 2018 has reinforced it’s signal quality. Troughing mid 2025 according to the current phasing analysis.

More on this Cycle: Gold Cycles 19th November 2024

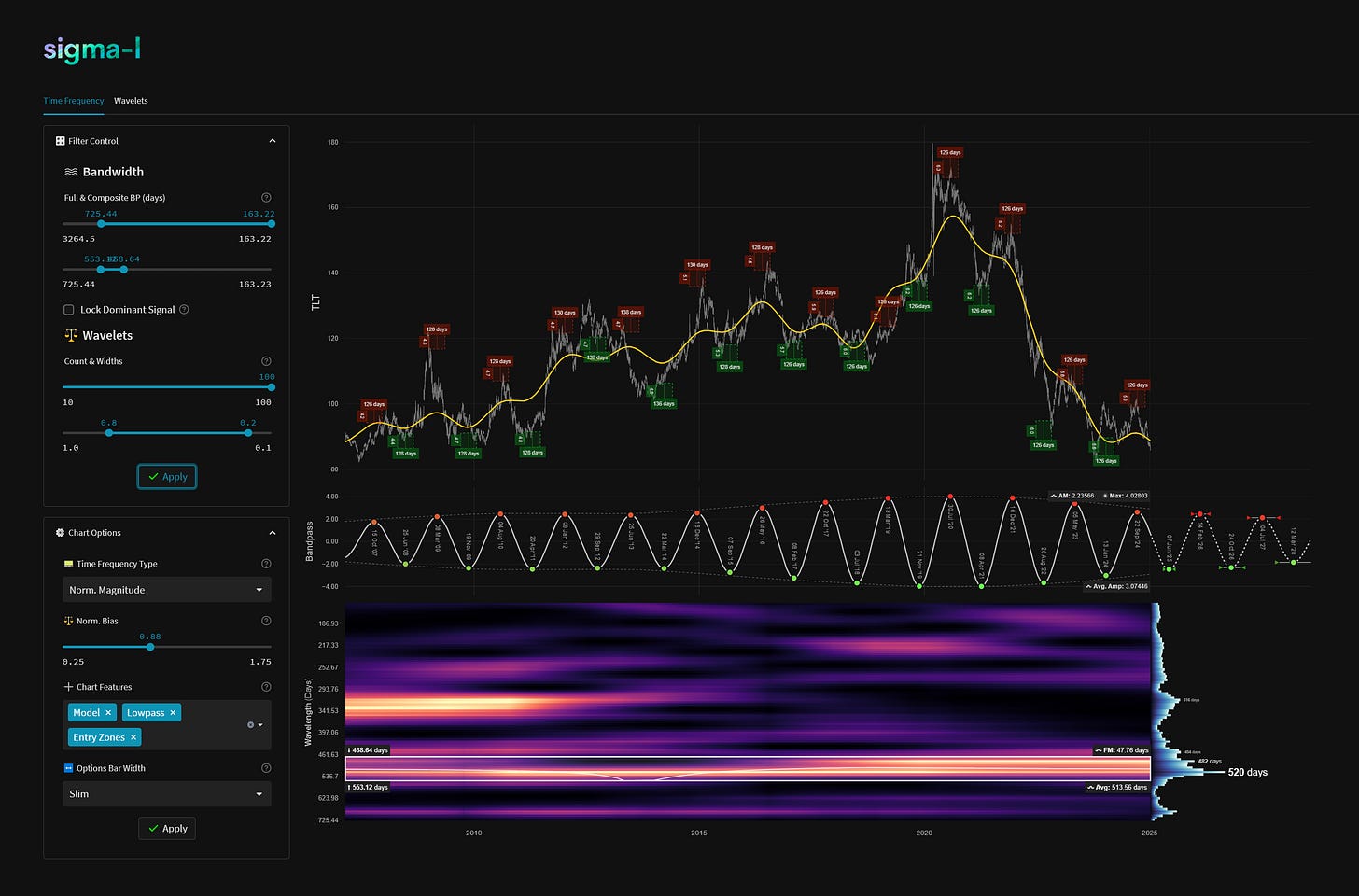

TLT US 20 Yr Bond: ~ 500 Day Cycle

This very nice wave in TLT, which is the iShares US 20 Year Treasury Bond ETF, has dominated the undulations in this market within our sample for nearly 20 years now. The most recent trough, back in early 2024 produced a less than enthusiastic move back up, suggesting another low is coming before a huge bottom mid 2025.

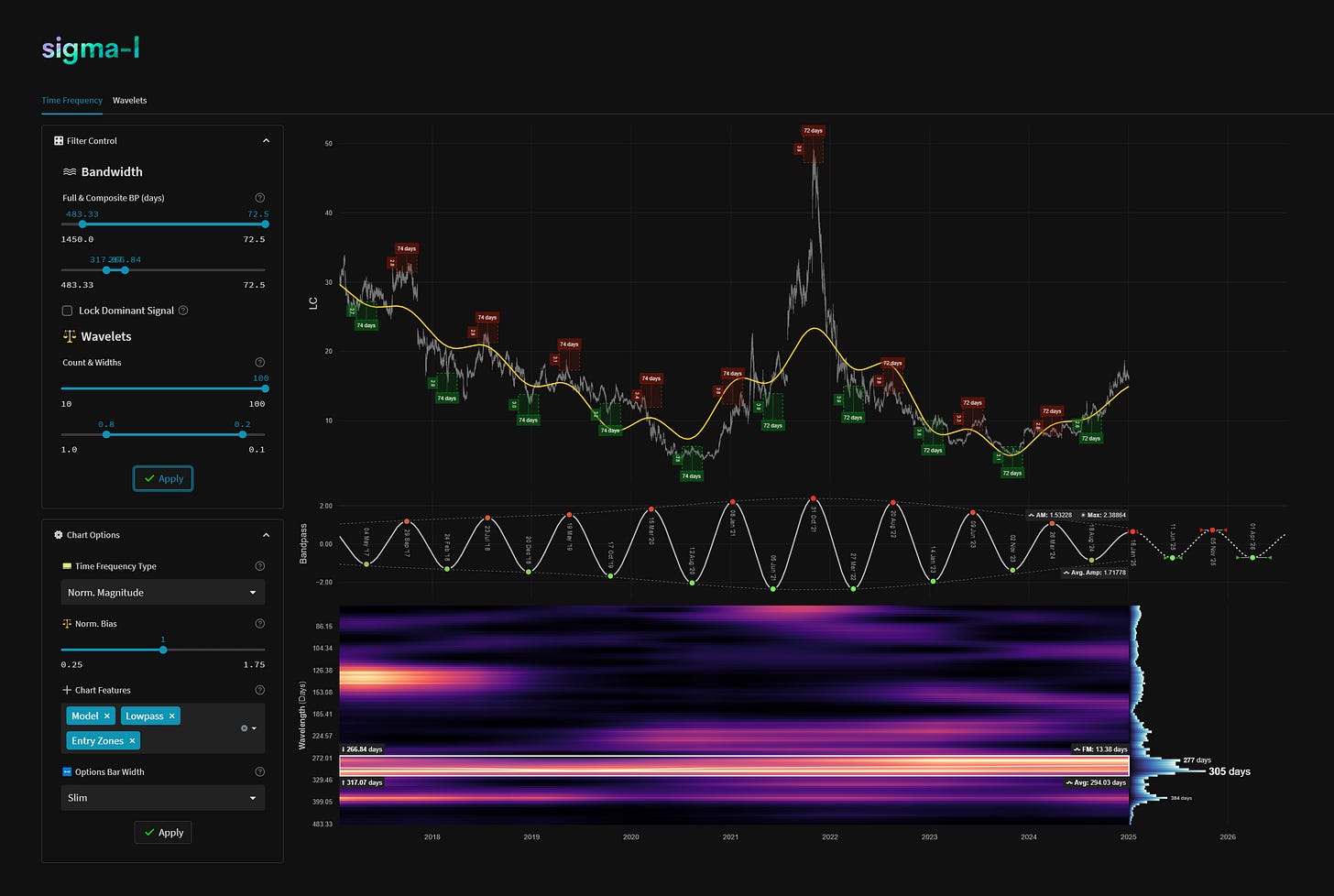

Lithium (LC): ~ 300 Day Cycle

Another commodity/metal on the menu for 2025 is the excellent Lithium futures contract (LC) and a stationary cycle around 300 days wavelength. Peaking at the time of writing with potentially a lucrative low coming in around early June this year. Bulls will be hoping for similar amplitude from that low as was seen from the trough in August 2020, for a couple of years.

More on this Cycle: Lithium Futures Cycles 3rd January 2024

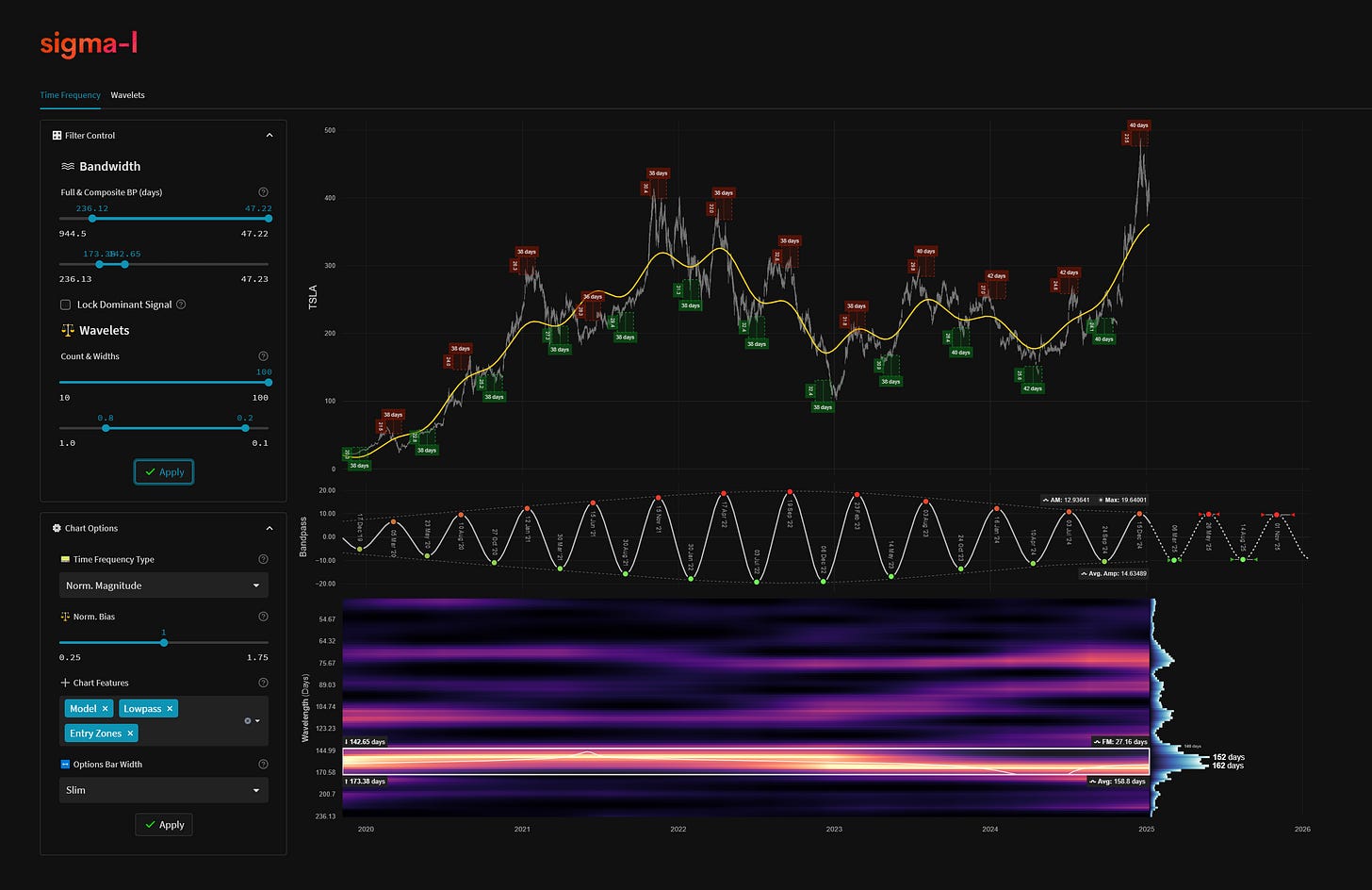

Bonus: TSLA: ~ 160 Day Cycle

It was very hard to choose a bonus cycle to feature as there as so many currently available. However, as Elon Musk is flavour of the month across the world on X I thought the superb cycle around 160 days wavelength in Tesla apt. This really is a ‘beacon-esque’ signal with a huge increase in amplitude towards the most recent peak. The next trough is due around the start of March, 2025 according to the current phasing.

This was by no means an exhaustive list of cycles in all financial markets (indeed there are some really good signals in forex we left out) but it hopefully gives a hint of the better phasings we are working with this year. Some shorter term, as in Bitcoin and some longer waves as in Gold and the stock market.

Feel free to join us here on Sigma-L in 2025 or leave me a message on X for cycle analysis you would like to see, all using our bespoke techniques.

Best of luck for this year to all,

David