Natural Gas: Hurst Cycles - 19th August 2022

NG moves higher than expected from the 80 day nominal low in June, tracking the 20 week FLD. With a price peak of the 80 day component now overdue and the 40 week low to come, we look at the next move

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Analysis Summary

Natural Gas has been remarkably bullish from the 80 day nominal low in June. We anticipated the 40 day nominal peak to form within a week or so of the last report in July before falling back to the 40 day FLD support (dark blue on short term chart below). The peak came on the 26th of July, significantly higher than expected and testing the previous peaks of the 40 week component before falling to around 7.6 and the 40 day nominal low.

The fact price has tested the 40 week nominal peak so late in this cycle demonstrates there is a lot of bullish pressure and volatility amongst the smaller components in this instrument. Both of these create excellent trading conditions for the Hurstonian trader!

Price is likely now starting to fall into the next 80 day component low, due early September and, according to the longer term phasing, a 40 week nominal low. Of note is the somewhat right translated price peak relative to the 80 day FLD trough (shown in light blue on the short term chart). This will dictate a more conservative target for the short in prospect, likely to around the 8 area initially. That said, the amplitude of the 80 day component has exploded in recent months so a test of the 40 week FLD support at around 6.5 is possible.

At the medium to long term the move from the incoming 40 week nominal low will likely spark a ‘blow off’ top of the 54 month component, which troughed in mid 2020. Looks like a tough winter ahead.

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

Short Term

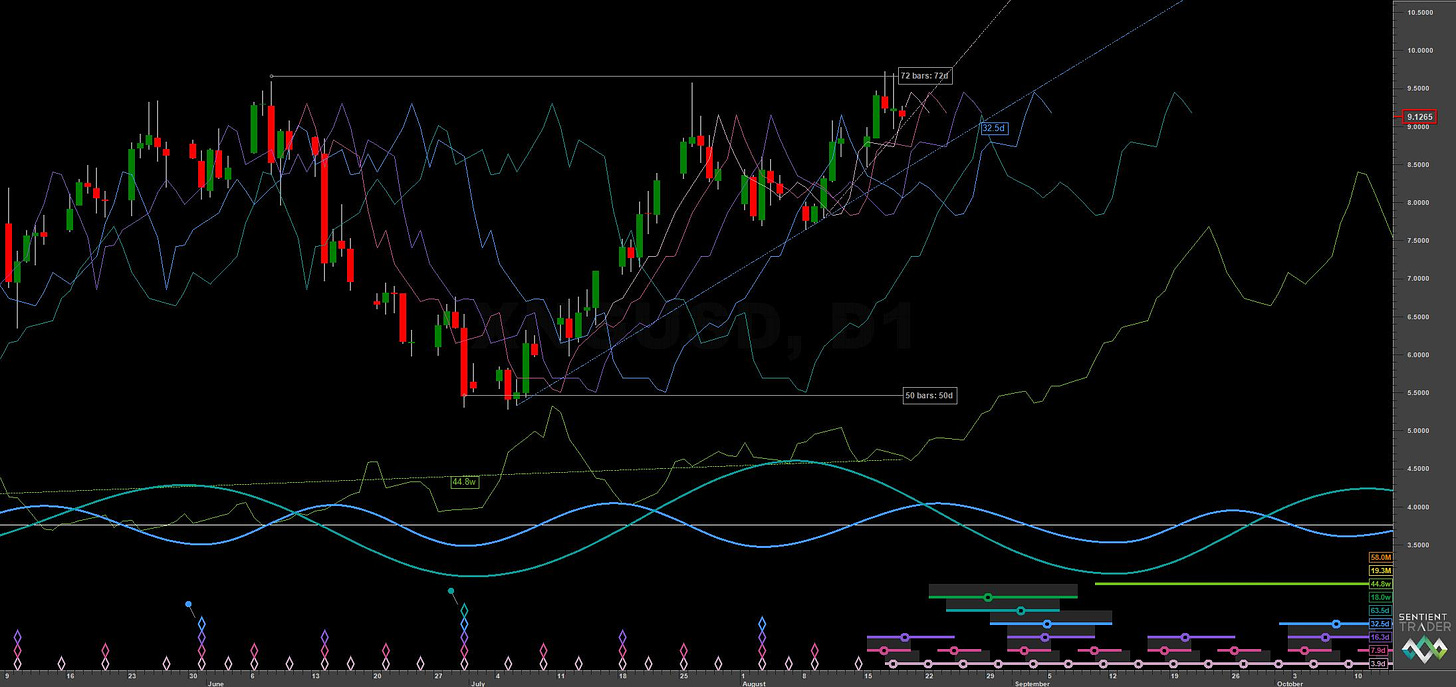

Components around the 80 day nominal cycle

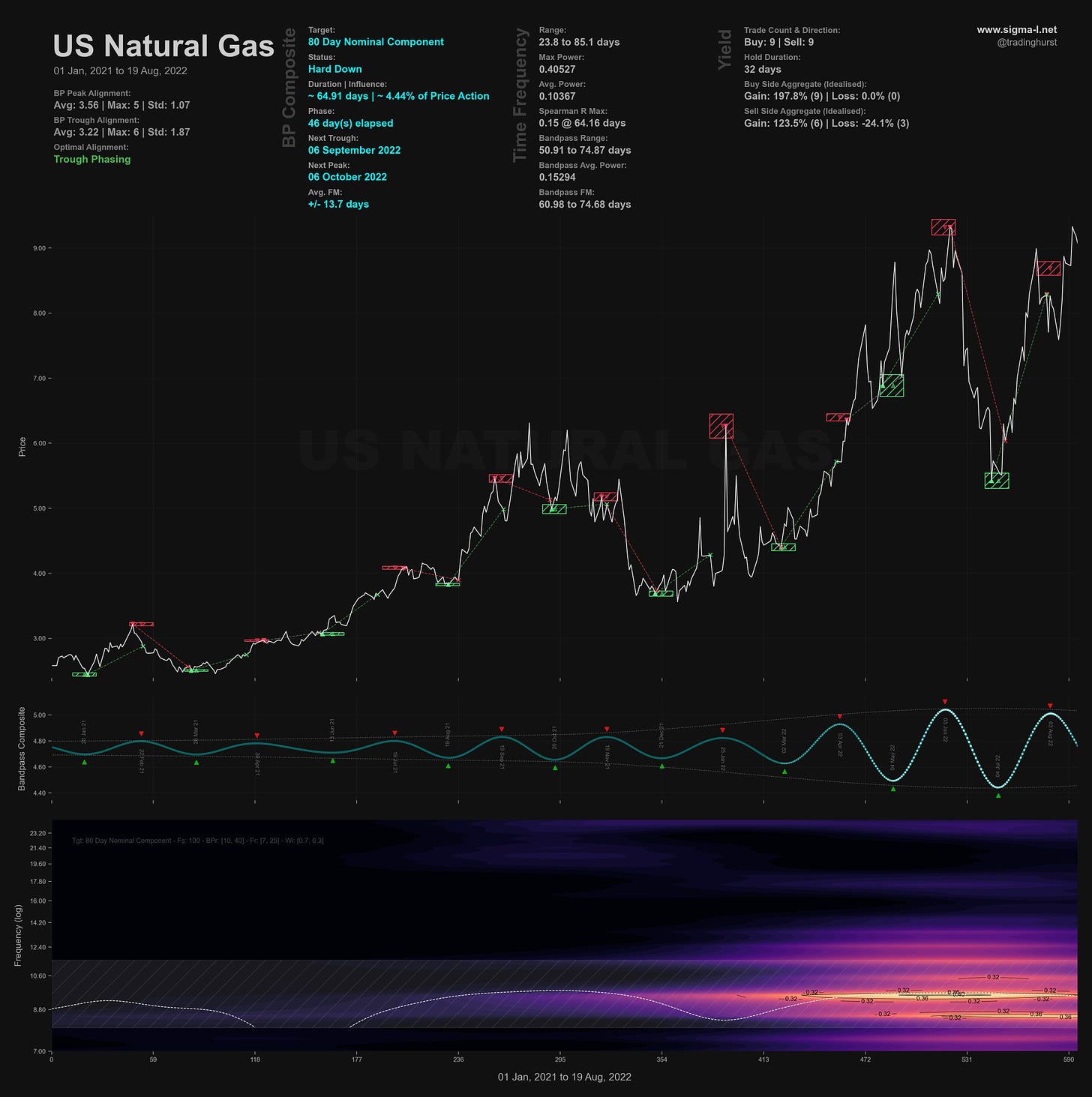

Time Frequency

Wavelet convolution output targeting 80 day nominal component

Trading Strategy

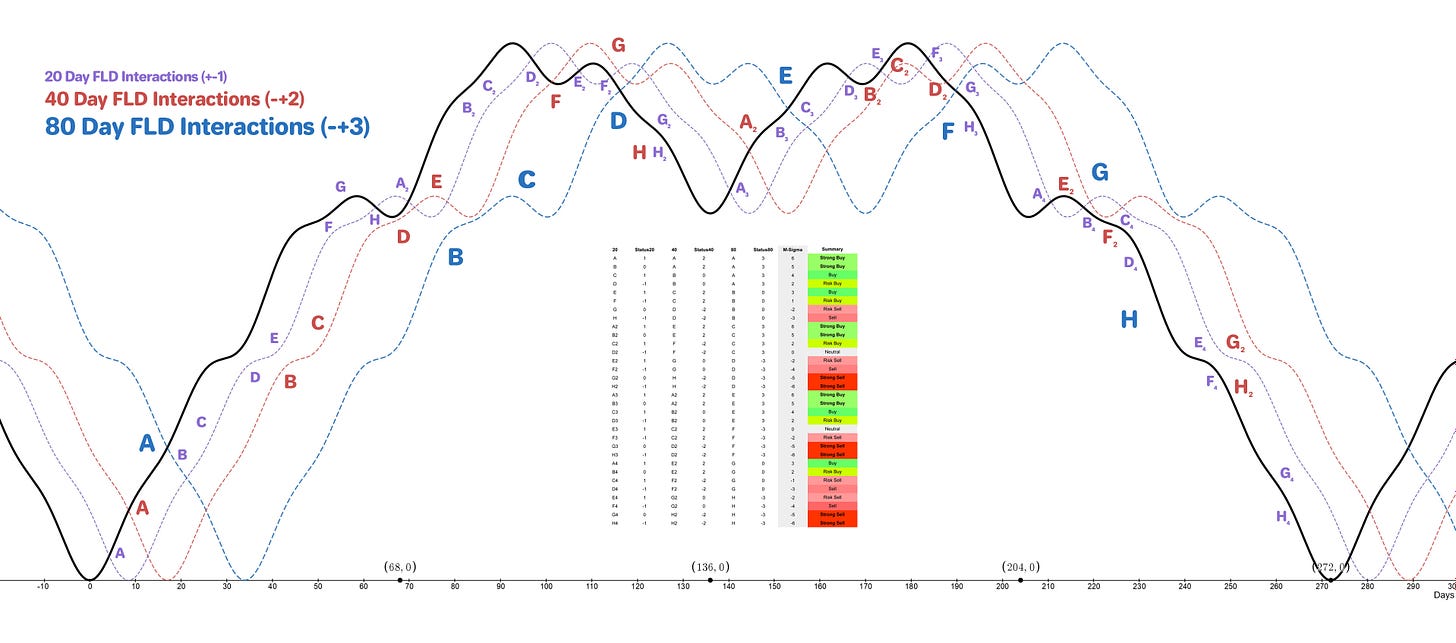

Interaction Status

Interactions and price in the FLD Trading Strategy (Advanced). This looks at an idealised 40 week cycle and an array of 3 FLD signal cycles. We apply the instrument’s phasing to the model and arrive at an overall summary for the interactions with the 20 day FLD, current and forthcoming.

Sigma-L recommendation: Sell

Entry: 5 day FLD / VTL / 10 Day FLD

Stop: Above forming 40 day nominal peak

Target: Initially 8 (40/80 day FLD support), possibly lower to the 40 week FLD around 6.5.

Reference 20 Day FLD Interaction: F4

Underlying 40 Day FLD Status: H2

Underlying 80 Day FLD Status: H

Whilst at this stage in a 40 week component trading cycle (as described above) this short would be a strong sell, the underlying trend here has dictated a downgrade to a ‘sell’.

A 5 day upward VTL is the highest risk:reward short entry on offer with initial price targets at around 8. Should price reach the 40 day FLD support again in short order (within next week or so) then we may expect price to fall further prior to the 80 day and 40 week nominal low in early September.

A generally sideways move that settles around the 8 area may well suggest the 40 week nominal low occurred in late June but this would represent a significant frequency modulation of the 40 week component, currently running at around 44 weeks from 7 iterations in the sample. 34.7 weeks have elapsed so far. Worth bearing this outlier scenario in mind, although it does not change the expected time for the next 80 day nominal component trough.

FLD Settings

If you do not have the use of Sentient Trader use these settings to plot FLDs in your trading software (daily scale) to more easily follow trading signals and strategy from Sigma-L.

Make sure to account for non-trading days if your broker omits them in the data feed (weekends, for example). The below offsets are given with no added calculation for non-trading days.

80 day nominal: 63.5 days | 32 day FLD offset

40 day nominal: 32.5 days | 16 day FLD offset

20 day nominal: 16.3 days | 8 day FLD offset

10 day nominal: 7.9 days | 4 day FLD offset

Correlated Exposure Options

A non exhaustive list of correlated instruments for consideration

United States Natural Gas Fund LP UNG -0.34%↓

ProShares Ultra Bloomberg Natural Gas BOIL -0.83%↓

United States 12 Month Natural Gas Fund LP UNL -0.77%↓

iPath Series B Bloomberg Natural Gas Subindex Total Return ETN GAZ -3.19%↓

ProShares UltraShort Bloomberg Natural Gas KOLD 1.04%↑