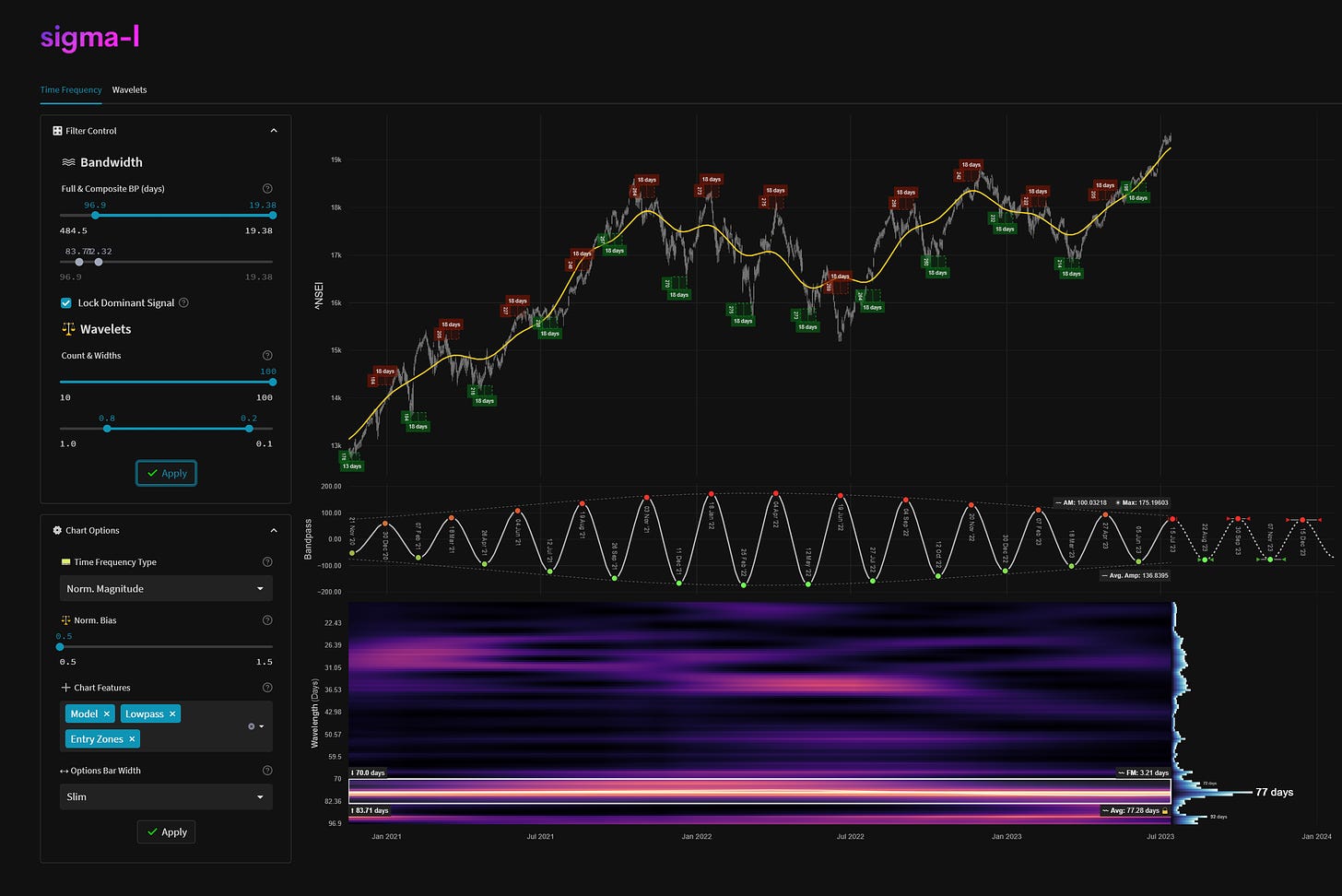

Nifty 50 - 14th July 2023 | @ 77 Days

'B' class signal detected in India's Nifty 50. Running at an average wavelength of 77 days over 13 iterations since November 2020. Currently peaking.

Instrument Summary

The Nifty 50 index consists of prominent blue-chip stocks from India. Notable stocks include Reliance Industries, a leading energy and retail company; HDFC Bank, a renowned private sector bank; Infosys, a global IT services firm; Tata Consultancy Services, a major IT company; and Hindustan Unilever, a leading consumer goods manufacturer. These stocks represent established sectors of India's economy known for their stability and consistent performance.

Current Signal Status

Defining characteristics of the component detected over the sample period.

Detected Signal Class: B - learn more

Average Wavelength: 77.28 Days

Completed Iterations: 13

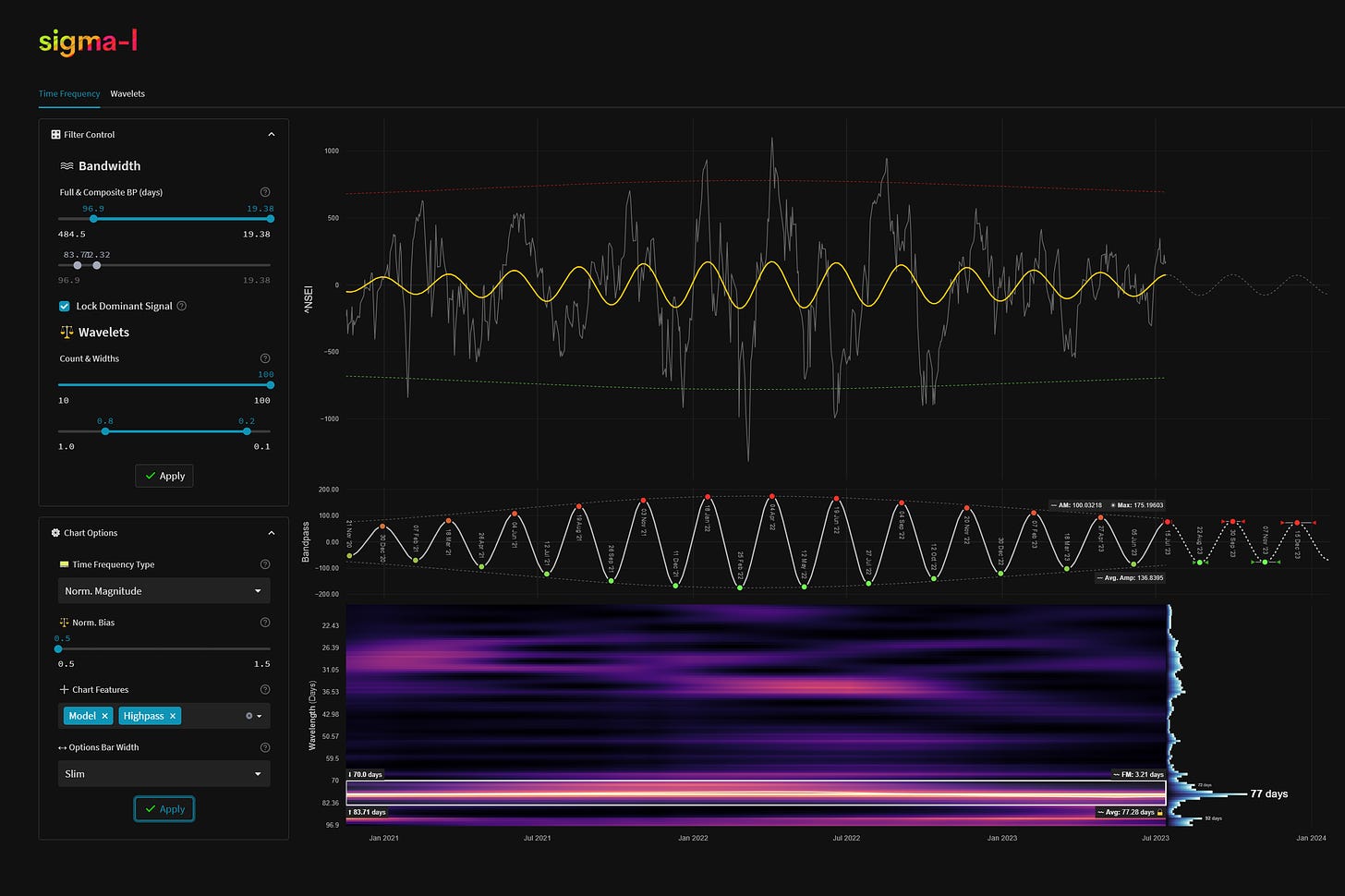

Time Frequency Analysis

Time frequency charts (learn more) below will typically show the cycle of interest against price, the bandpass output alone and the bandwidth of the component in the time frequency heatmap, framed in white. If a second chart is displayed it will usually show highpassed price with the extracted signal overlaid for visual clarity.

Current Signal Detail & Targets

Here we give more detail on the signal relative to speculative price, given the detected attributes of the component. In most cases the time target to hold a trade for is more important, given we focus on cycles in financial markets. Forthcoming trough and peak ranges are based upon the frequency modulation in the sample (learn more).

Phase: Peaking / Peaked

FM: +- 3 Days

AM: 100.03218

Next Trough Range: 19th August - 25th August, 2023

Next Peak Range: 27th September - 3rd October, 2023

Sigma-L Recommendation: Sell

Time Target: ~ 22nd August, 2023

Current Signal Phase

This is ‘how far along’ the cycle is in it’s period at now time and is related to the predicted price action direction.

Current Signal Frequency Modulation (FM)

This is how much, on average, the signal detected varies in frequency (or wavelength) over the whole sample. A lower variance is better and implies better profitability for the component. Frequency usually modulates relatively slowly and over several iterations.

Current Signal Amplitude Modulation (AM)

This is how much the component gains or loses power (price influence) across the sample, on average. Amplitude modulation can happen quite quickly and certainly is more evident than frequency modulation in financial markets. The more stable the modulation the better.