ΣL November 2023 Results & December Preview

The Sigma-L portfolio saw a nominal gain of 53.83% (normalised -19.57%) in November 2023, across 42 trades. In this report we examine the results and look forward to a packed December schedule

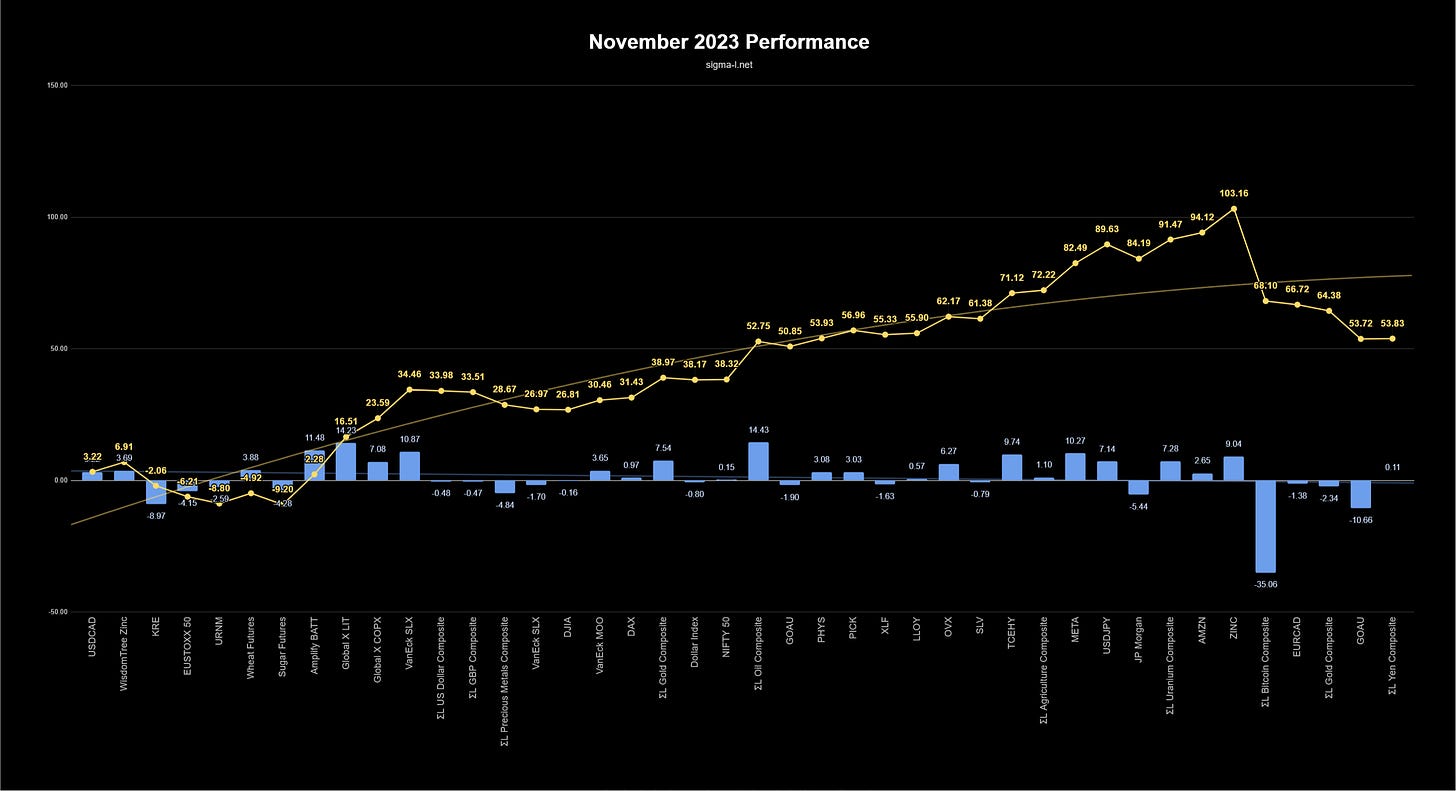

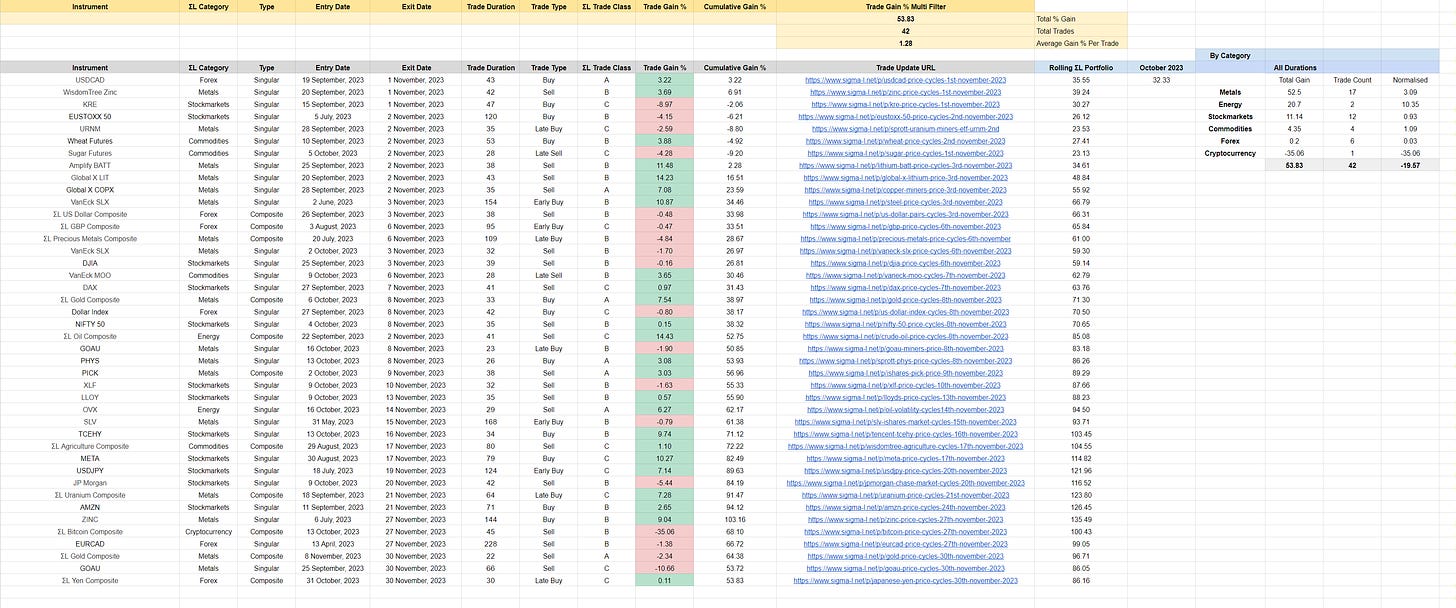

ΣL November 2023 Performance

Covering trade reports posted in November 2023 on Sigma-L.

View the full trade list and details in Google Sheets

Headline Numbers

Sigma-L Nominal vs Benchmarks - November 2023

S&P 500 (7.65%): 46.18%

Gold (2.69%): 51.14%

WTI Crude Oil (-7.19%): 61.02%

Bitcoin (6.82%): 47.01%

Monthly Breakdown

Total Nominal Gain: 53.83%

Total Normalised Gain: -19.57%

Total Trades: 42

Win:Loss Ratio: 1.3:1 (24:18)

Average Gain Per Trade: 1.28%

Win Percentage: 57%

Average Win: 5.89% / Average Loss: -4.87%

Average Duration: 61 Days

Breakdown by Direction & ΣL Category

Sell Side (Nominal)

Total Gain: 3.52% / Trade Count: 22 / Win:Loss Ratio: 1.2:1 (12:10)

Average Gain Per Trade: 0.16%

Win Percentage: 55%

Average Win: 5.55% / Average Loss: -6.31%

Average Duration: 57 Days

Biggest Win: 14.43% → Sell - ΣL Oil Composite 8th November 2023

Biggest Loss: -35.06% → Sell - ΣL Bitcoin Composite 27th November 2023

Buy Side (Nominal)

Total Gain: 50.31% / Trade Count: 20 / Win:Loss Ratio: 1.5:1 (12:8)

Average Gain Per Trade: 2.52%

Win Percentage: 60%

Average Win: 6.23% / Average Loss: -3.06%

Average Duration: 75 Days

Biggest Win: 10.87% → Early Buy - VanEck SLX 3rd November 2023

Biggest Loss: -8.97% → Buy - KRE 1st November 2023Nominal / Normalised Gain By ΣL Category (Trade Count)

Metals: 52.5% / 3.09% (17)

Energy: 20.7% / 10.35% (2)

Stock Markets: 11.14% / 0.93% (12)

Commodities: 4.35% / 1.09% (4)

Forex: 0.2% / 0.03% (6)

Cryptocurrency: -35.06% / -35.06% (1)

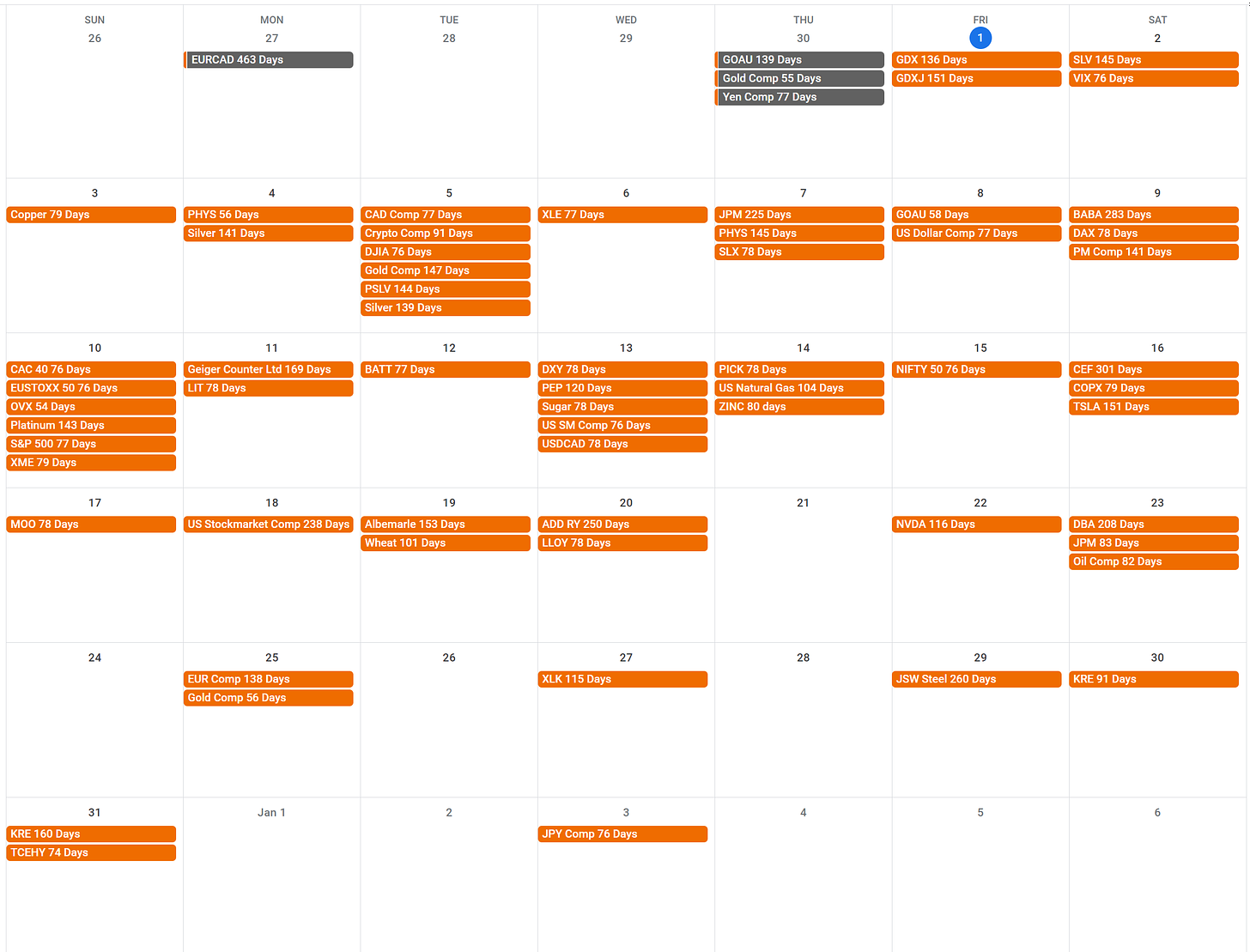

Dates for your Diary - December 2023

November 2023 Recap

November was steady on Sigma-L, notable for the performance of utility metals over several reports. Skewing the data was a large loss in cryptocurrency, the amplitude of which is generally much higher, outweighing significantly when only a single trade is reported. The timing of the prominent wave in Bitcoin is still very valid with minimal frequency modulation, only amplitude was unexpected in the reported trade. Stock markets were steady as was energy, the 80 day nominal wave in WTI Crude a particular highlight.

We have a busy December coming up and we will be working up until Christmas Day to bring you results, updated time-frequency reports and comment as per the schedule above.

Over the UK winter period I will be working on a new app, hopefully for use by subscribers by mid 2024. This will be browser based and include many signal processing tools, bespoke configured for financial markets and building on knowledge gained in development of current and previous tools. I look forward to sharing the progress of this unique approach with you.

Finally I would like to wish you all a very happy Christmas and a wonderful 2024 to come!

David

Don’t Miss..

Today - VIX 76 Days

Due for an update today (as it is scheduled for tomorrow, a Saturday), the VIX has caused a stir on fintwit over the last few months amongst those who have not identified the excellent periodicity. It has collapsed after the peak in late October and a trough is now imminent.

Sunday 3rd December - Copper (HG) 79 Days

We can’t not mention this excellent wave in Copper, troughing back in late October and approaching a peak early December. This needs no introduction as an excellent periodic feature.

Friday 8th December - ΣL US Dollar Composite 77 Days

The dollar has weakened against major currencies since late October, this component being the most prominent driver of price. In this update we will examine the incoming peak.

Sunday 10th December - S&P 500 77 Days

Throughout the early part of the month we will be reporting on the peak of this prominent wave in stock markets worldwide, that, of course, includes the S&P 500. Price has moved up in an extraordinary linear fashion from the low in late October. Also watch out for the US Stockmarket Composite, due on the 13th December, for a more smoothed rendition of the wave.

Thursday 14th December - Natural Gas 104 Days

Energy traders will want to keep a very close eye on Natural Gas futures in early to mid December. We have a trough of the prominent wave around 104 days which is still relatively attenuated. If we do get an increase in amplitude it could happen quickly.

Saturday 23 December - ΣL Oil Composite 82 Days

After moving serenely southward for the down leg of this wave through October and early November, price has made a relatively muted consolidation so far. The peak of the wave should arrive by mid late December and is possibly a good short if the generally sideways price action continues.

Thanks for sharing, David! Good stuff. Do you track corn? If yes, could you share it?