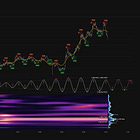

S&P 500 (SPY) - 1st April 2025 | @ 258 Days (~ 37 Weeks) | + 5.42%

Last trade: + 5.42% | 'A' class signal detected in the S&P 500 (via SPY). Running at an average wavelength of 258 days (~ 37 Weeks) over 16 iterations since February 2015. Currently troughing

ΣL Cycle Summary

The move down from the peak of the 40 week nominal wave in stock markets has been quite apparent this time around, helping to retain it’s status as one of the few stationary features of global equity measures at the longer term scale. In SPY, we are moving into the latest trough imminently, with a small margin of error, measured at around one 30 day cycle wavelength, to contend with. This was covered in more depth in the recent post on US stock market indices and the same 40 week nominal wave.

This wave is common across most global indices and should always be on your radar as a cycle trader. It’s historical performance well worth the ‘A’ rating on Sigma-L.

Trade Update

Summary of the most recent trade enacted with this signal and according to the time prediction detailed in the previous report for this instrument, linked below.

Type: Sell - S&P 500 (SPY) 14th November 2024

Entry: 14th November 2024 @ 593.35

Exit: 1st April 2025 @ 561.2

Gain: 5.42%