Silver: Hurst Cycles - 21st November 2022

Silver continues to display varying amplitude but correlated frequency in it's periodic components vs gold. We look at the most recent lows and consider the case for an 18 month component trough

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Analysis Summary

Silver, although correlated very much with gold, has been markedly more volatile in each swing of the 80 day ‘nominal’ component recently (~ 54 days wavelength). The low in late September and built through October is possibly of 18 month magnitude.

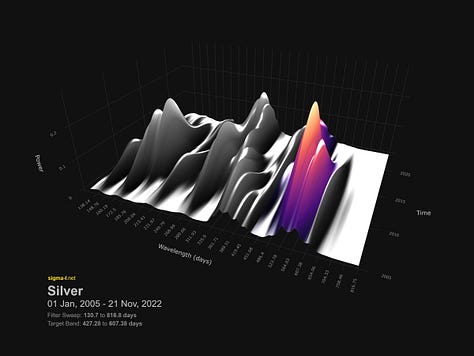

Utilising a time frequency analysis from 2005 to nowtime, in a similar manner to our recent Gold report, yields what is likely the 18 month nominal component, running at around 16.8 months over the sample. Indeed in Silver the increased amplitude, even at this longer component, is helpful in identifying the presence of this wave and can be used to assist commonality. We can confidently say that a component of between 14-17 months in duration is present in both gold and silver. This component can be notionally attributed to the ‘18 month nominal’ component for ease of reference, as per Hurst’s nominal model.

Price has breached both the 20 and 40 week FLDs, suggesting a low of at least 40 week magnitude has occurred but the next 80 day and 20 week component troughs should seal the deal. If the 18 month component has occurred, we should expect these troughs to form higher lows. These are expected mid December and late January / early February respectively, at current average wavelengths.

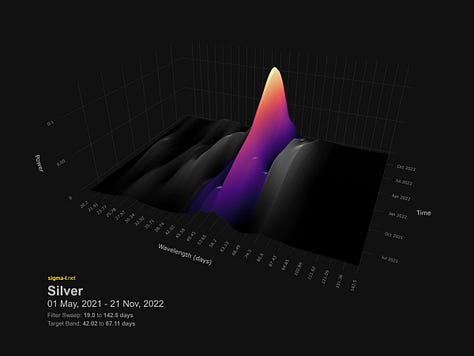

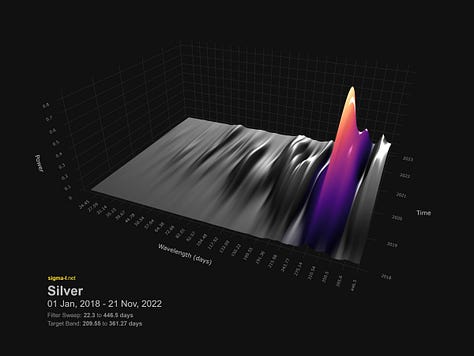

In a similar and not unexpected manner, the component running at around 54 days is exemplary in Silver and particularly well phased to the price peaks across the sample we show below - over 10 iterations in this case.

Phasing Analysis

Sentient Trader

Utilising a pattern recognition algorithm and Hurst’s diamond notation

Time Frequency Analysis

Wavelet convolution targeting 18 month, 40 week and 80 day components

Trading Strategy

Interaction Status

Interactions and price in the FLD Trading Strategy (Advanced). This looks at an idealised 40 week cycle and an array of 3 FLD signal cycles. We apply the instrument’s phasing to the model and arrive at an overall summary for the interactions with the 20 day FLD, current and forthcoming.

Sigma-L recommendation: Neutral / No Trade

Entry: n/a

Stop: n/a

Target: n/a

Reference 20 Day FLD Interaction: n/a

Underlying 40 Day FLD Status: n/a

Underlying 80 Day FLD Status: n/a

Risk on traders could well attempt a short at this point with the excellent 80 day nominal component seemingly peaking. However, as we are awaiting clarity on the larger components it may well be wise to sideline entries until at least the next 80 day nominal trough is established. This is expected in mid December, according to the time frequency analysis.

The outlier analysis at this stage is that the 18 month component low is still to come, likely at the next 20 week nominal low late January / early February.

FLD Settings

If you do not have the use of Sentient Trader use these settings to plot common FLDs in your trading software (daily scale) to more easily follow trading signals and strategy from Sigma-L.

Make sure to account for non-trading days if your broker omits them in the data feed (weekends, for example). The below offsets are given with no added calculation for non-trading days.

80 day nominal: 71.8 days | 36 day FLD offset

40 day nominal: 34.7 days | 17 day FLD offset

20 day nominal: 16.8 days | 8 day FLD offset

10 day nominal: 8.6 days | 4 day FLD offset

Correlated Exposure

A non exhaustive list of correlated instruments for consideration

iShares Silver Trust SLV 0.00%↑

Aberdeen Standard Physical Silver Shares ETF SIVR 0.00%↑

ProShares Ultra Silver ETF AGQ 0.00%↑

Invesco DB Silver Fund DBS 0.00%↑

Global X Silver Miners ETF SIL 0.00%↑

ETFMG Prime Junior Silver ETF SILJ 0.00%↑

iShares MSCI Global Silver Miners ETF SLVP 0.00%↑