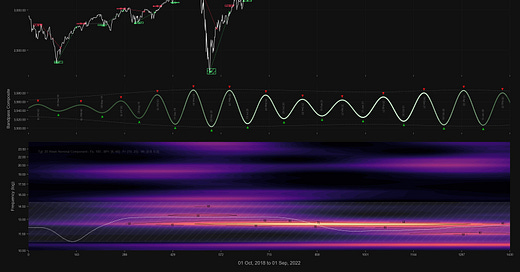

S&P 500: Hurst Cycles - 1st September 2022

The S&P 500 falls from the 20 week nominal cycle peak and approaches targets around 3800. We look at what is next for this market as price approaches the 80 day nominal low in the coming days

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Analysis Summary

The S&P moved somewhat more sharply from the low of at least 20 week magnitude back in early/mid July, a handsome bear market rally which was only stopped by the 40 week FLD in most global equity markets. This is shown at the medium and short term charts below and has been accompanied by some frenzied selling over the last few days. We speculated as to the position of the 20 week nominal low, with candidates being the 17th of June or the 14th of July, in our last report:

From July 29th Report

Price is tracking the 20 week FLD upwards at the time of writing and will likely continue to do so in the move to the next 40 day low, due mid August. If the 20 week nominal low occurred on the 17th June (rather than the 14th July) that low will also be an 80 day nominal low, the lower probability scenario at this point.