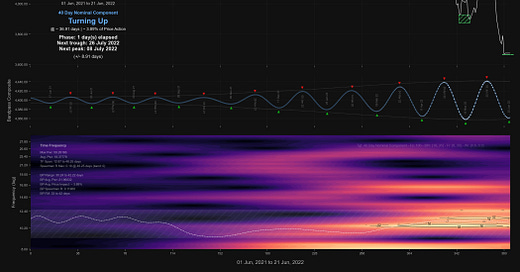

S&P 500: Hurst Cycles - 21st June 2022

Crisp resistance at the 80 day FLD precedes a collapse in price to the 40 day nominal low. We look at the crucial price action to come over the next month

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Analysis Summary

Our last report into the S&P 500 noted the 80 day component low was imminent around the 10th of May and was expected to move up until the end of May, forming the 40 day nominal peak:

The 40 week and 18 month FLD should now be considered as resistance to price until the large low later in the year. Any move to near the area of these FLDs should be examined for a shorting opportunity. The current 80 day nominal low we are imminently expecting will likely form it’s 40 day nominal peak at the end of the month.

Price moved generally upward for a couple of weeks, the 80 day nominal cycle low forming around the 12th May.