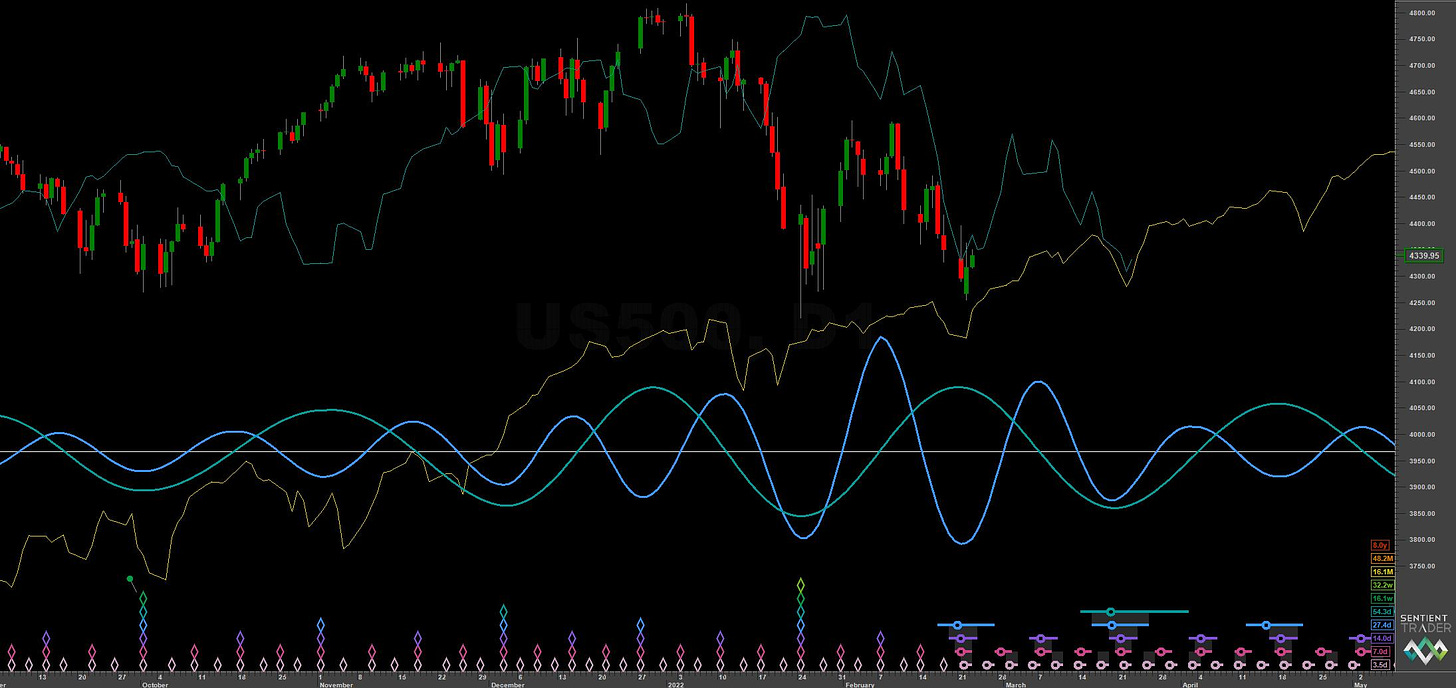

S&P 500: Hurst Cycles - 23rd Feb 2022

Standard & Poor's 500 Index | Phasing Analysis Update, Outlook & Trading Strategy

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Phasing Analysis

Long Term

Components greater than and including the 18 month nominal cycle

Medium Term

Components less than and including the 18 month nominal cycle

Short Term

Components around the 80 day nominal cycle

Summary

A fascinating picture is emerging in global stockmarkets as we attempt to nail down the low of at least 40 week magnitude expected in this period. Sentient Trader has decided that the 40 week component has occurred on the 24th January but caution should be noted here due to commonality with other instruments, namely the FTSE and Russell 2000. In our last report on the S&P 500 we also raised this point:

Traders should be mindful of the phasing in the FTSE and Russell 2000 which suggests the next 80 day low in late March will be a low of at least 20 week magnitude and possibly the 40 week. Any weakness in the S&P around this 20 day cycle should be watched carefully for signs of a final collapse. The 18 month FLD supporting price will be crucial.