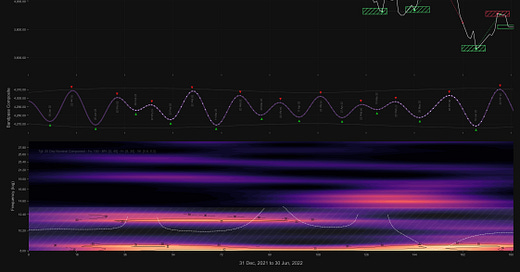

S&P 500: Hurst Cycles - 30th June 2022

Price begins to roll over after hitting target of 3900 from the 40 day nominal low 17th June. We look at the next moves in the S&P as we approach a crucial low in July.

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Analysis Summary

At the last report into the S&P 500, price was on the cusp of a move back up via a bear market rally and 40 day nominal low to targets around 3900. This was achieved on the 24th June:

From 21st June Report:

At the medium and short term the next 40 day nominal low in July is a crucial point, being as it is also a 20 week nominal low as phased. The 80 day component Hurstonian tools are helpful at this juncture. Both the 80 day FLD and VTL should act as resistance levels for price if the phasing is accurate. This translates to a level of 3800-3900 over the next week or two. The 40 day component is running at around 36 days, correlated in both the phasing analysis of Sentient Trader and the numerical approach of time frequency shown below.

Price is now at the position of moving into the first 20 day nominal low of the 40 day component and is currently around the 10 day FLD. Should the 40 day low on the 17th be correctly phased then we can expect price to find little support at the 20 day FLD and continue lower, matching or breaching 3636. Indeed the 10 day FLD cross target is established at 3718, implying a bearish FLD cascade is to occur, shown on short term chart below.