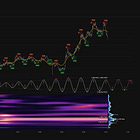

ΣL US Stock Market Composite - 13th March 2025 | @ 36 Weeks | + 6.45%

Last trade: + 6.45% | 'C' class signal detected in ΣL US Stock Market Composite (SPY, QQQ, IWM, DIA). Average wavelength of 36 weeks over 16 iterations since November 2014. Currently troughing.

ΣL Cycle Summary

It’s time once again to turn our attention to the one cycle in stock markets that has been relatively stationary for years (under ~ 500 days), the 40 week nominal wave. As mentioned in the last report, this wave was identified by JM Hurst some decades ago and it is fantastic to see it represented clearly in the spectra to this day. While other components of his nominal model have proved to be somewhat spurious, this cycle is evidently stable over time, at wavelengths under 500 days.

That said, we have still seen some attenuation of this wave over the last few years. The most stationary period in the sample since 2014 was an excellent series of peaks and troughs between 2016-2020. Subsequent to that power has diminished somewhat as the larger component (around 3.5 years wavelength) pushed price around, reducing the ability to detect periodicity, even with our sensitive tools. That longer cycle may well have peaked, see the report linked here.

We now approach the troughing zone for this cycle. I have included a phasing of the 40 day nominal wave, one of the clearer shorter terms components in US stock markets. It is likely that the 40 week nominal wave trough will co-incide with a trough of this shorter wave, either imminently or mid April. Both are well within the margin of error for the 40 week wave’s frequency modulation from the sample.

Within our composite IWM (Russell 2000) performed the best, yielding 10.5% over the trade period.

Trade Update

Summary of the most recent trade enacted with this signal and according to the time prediction detailed in the previous report for this instrument, linked below.

Type: Early Sell - ΣL US Stock Market Composite 14th October 2024

Entry: 14th October 2024

Exit: 13th March 2025

For a composite analysis, each constituent’s respective gain over the period is displayed, in descending order. The average of the constituent gain is also shown.

Constituent Gain:

IWM (10.50%)

QQQ (5.75%)

SPY (5.27%)

DIA (4.30%)

Composite Average Gain:

6.45%