ΣL Uranium Composite - 30th July 2024 | @ 153 Days | + 14.03%

Last trade: + 14.03% | 'B' class signal detected in in Sigma-L Uranium Composite (NXE/DNN/UEC/CCJ/UUUU). Average of 153 days over 9 iterations since June 2020. Currently troughing

ΣL Cycle Summary

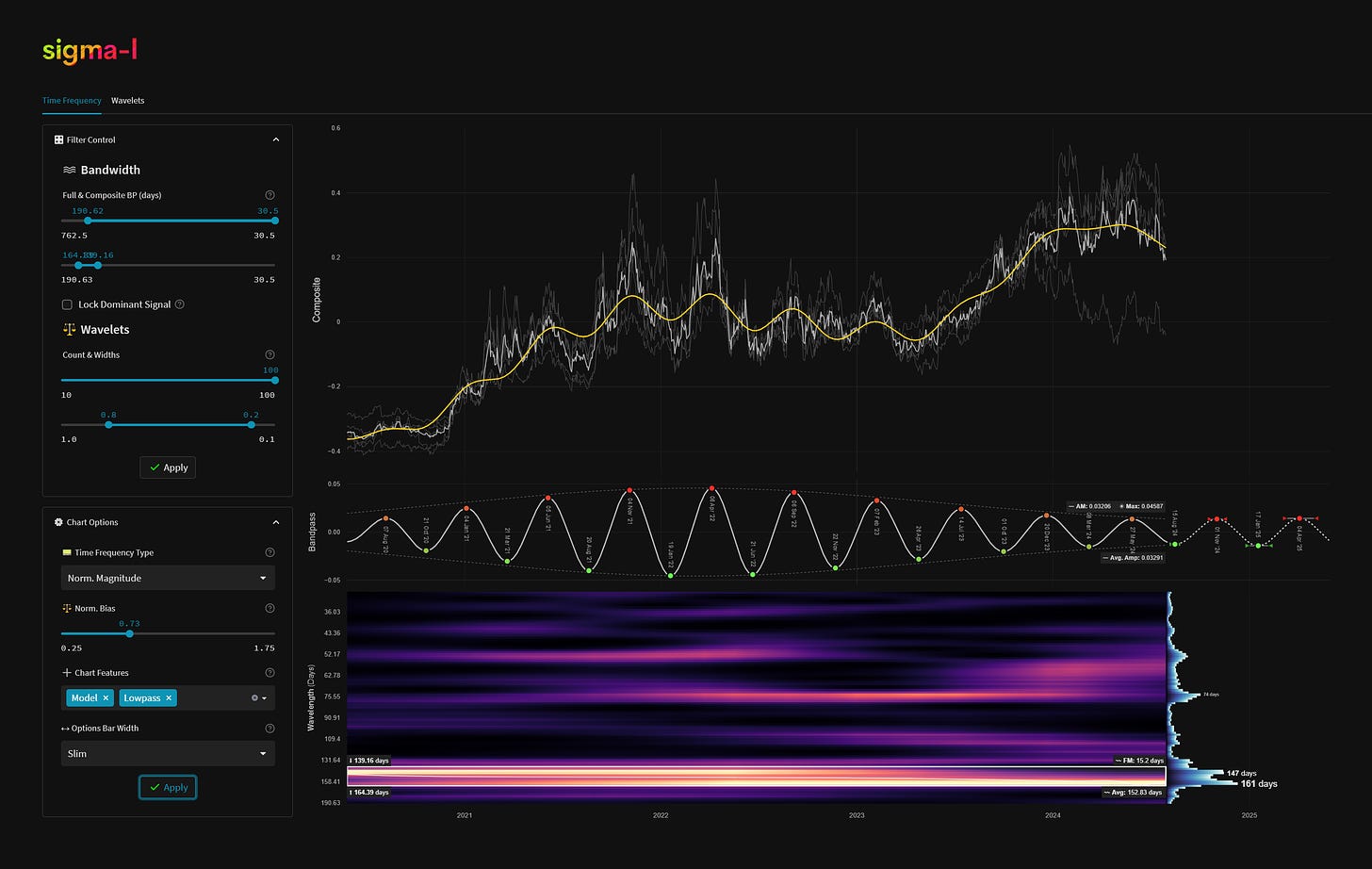

The shorter wave in Uranium, around 75 days average wavelength, has been suppressed by this cycle recently. Indeed this is naturally so as financial markets in general, Uranium being no exception, follow a power law distribution in the frequency domain. That is to say longer wavelength cycles, in general, exhibit more power to influence price action. Only when larger waves are exhibiting neutral power do the smaller waves tend to dominate and are readily picked up in a spectral analysis of a time series. This happens, visually, in a consolidation phase of the longer wave where price action moves sideways. More commonly the larger wave dominates in a trending market and we can also retain some power from the smaller wave, as has been the case in Uranium for a few years, yielding some excellent results. Price is most certainly fractal, some might say. A trough of the component around 150 days is now near and this report is somewhat early to it - but well within the zone of error from the frequency modulation in our last report. Bulls will need to see the highs of May breached in order to assume continued upward momentum from even larger cycles that are at play.

Trade Update

Summary of the most recent trade enacted with this signal and according to the time prediction detailed in the previous report for this instrument, linked below.

Type: Late Sell - ΣL Uranium Composite 19th June 2024

Entry: 19th June, 2024

Exit: 29th July, 2024

For a composite analysis, each constituent’s respective gain over the period is displayed, in descending order. The average of the constituent gain is also shown.

Constituent Gain:

CCJ (16.27%)

DNN (15.42%)

UUUU (13.16%)

UEC (13.02%)

NXE (12.26%)

Composite Average Gain:

14.03 %

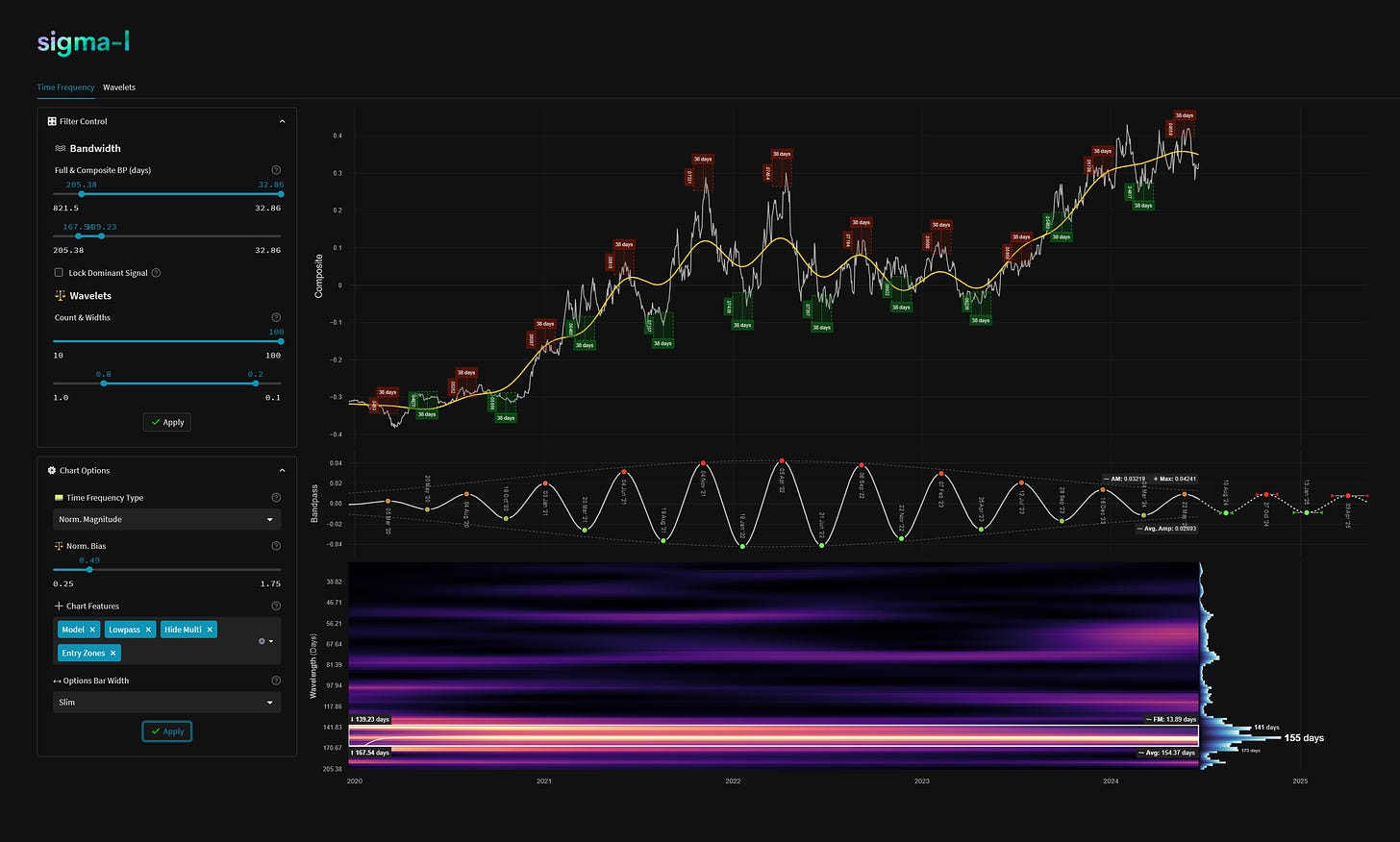

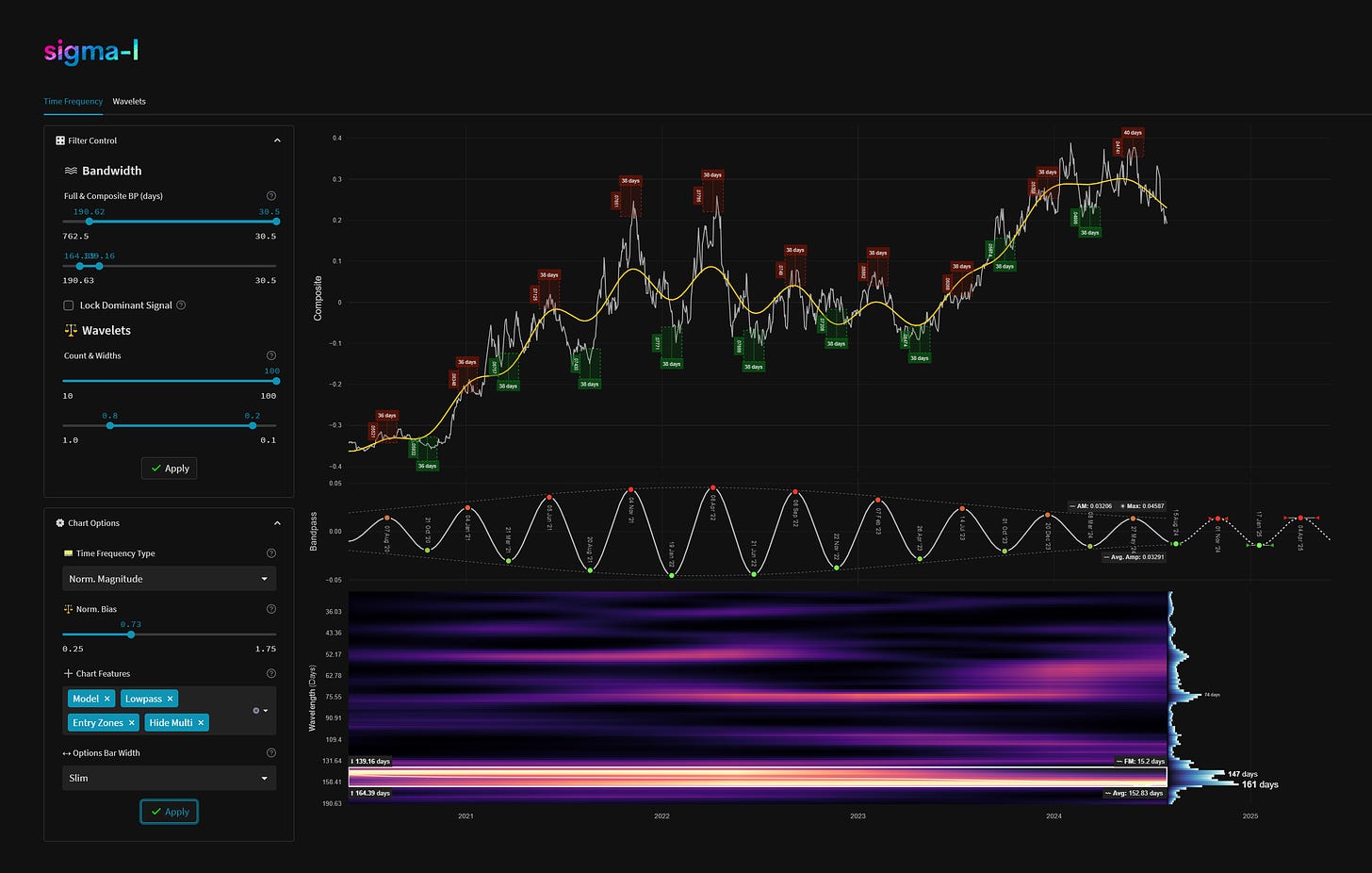

Time Frequency Analysis

Time frequency charts (learn more) below will typically show the cycle of interest against price, the bandpass output alone and the bandwidth of the component in the time frequency heatmap, framed in white.

Before and After

Signal comparison between our last report and the current time, in chart format.

Current Signal Detail & Targets

Here we give more detail on the signal relative to speculative price, given the detected attributes of the component. In most cases the time target to hold a trade for is more important, given we focus on cycles in financial markets. Forthcoming trough and peak ranges are based upon the frequency modulation in the sample (learn more).

Detected Signal Class: B - learn more

Average Wavelength: 152.83 Days

Completed Iterations: 9

Phase: Troughing

FM: +- 15 Days

Next Trough Range: 7th - 23 August, 2024

Next Peak Range: 24th October - 9th November, 2024

Sigma-L Recommendation: Early Buy

Time Target: ~ 1st November, 2024

Current Signal Phase

This is ‘how far along’ the cycle is in it’s period at now time and is related to the predicted price action direction.

Current Signal Frequency Modulation (FM)

This is how much, on average, the signal detected varies in frequency (or wavelength) over the whole sample. A lower variance is better and implies better profitability for the component. Frequency usually modulates relatively slowly and over several iterations.

Current Signal Amplitude Modulation (AM)

This is how much the component gains or loses power (price influence) across the sample, on average. Amplitude modulation can happen quite quickly and certainly is more evident than frequency modulation in financial markets. The more stable the modulation the better.

Hi David, does it look like uranium has seen a major peak or is there a larger cycle which shows it can see another big run ( perhaps to new price highs)? Thanks for your thoughts.