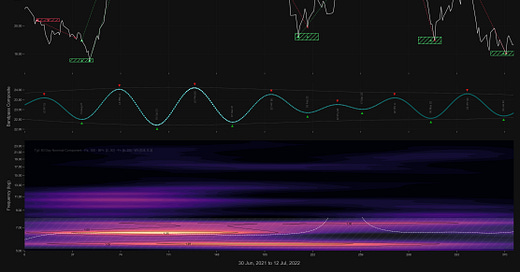

Uranium: Hurst Cycles - 12th July 2022

In this report we return to the fascinating and potentially long term bullish market of Uranium. We examine the most recent price action and look to the coming months via the Global X ETF URA

Tools required: Nominal Model | FLD | FLD Trading Strategy | FLD Trading Strategy (Advanced) | Principle of Nominality | Underlying Trend

Analysis Summary

It has been quite some time since we examined the Uranium market, infact since the last report price has been in a volatile range, attempting to make the 40 week nominal low alluded to in January of this year. The placement of that low is the main subject of the following analysis as we look forward to the end of the year and an 18 month component low (long term chart, below). Since the last report price is actually at a very similar price area, around the 18-19 level, having moved up and down in a neutral shaped 20 week component most recently.