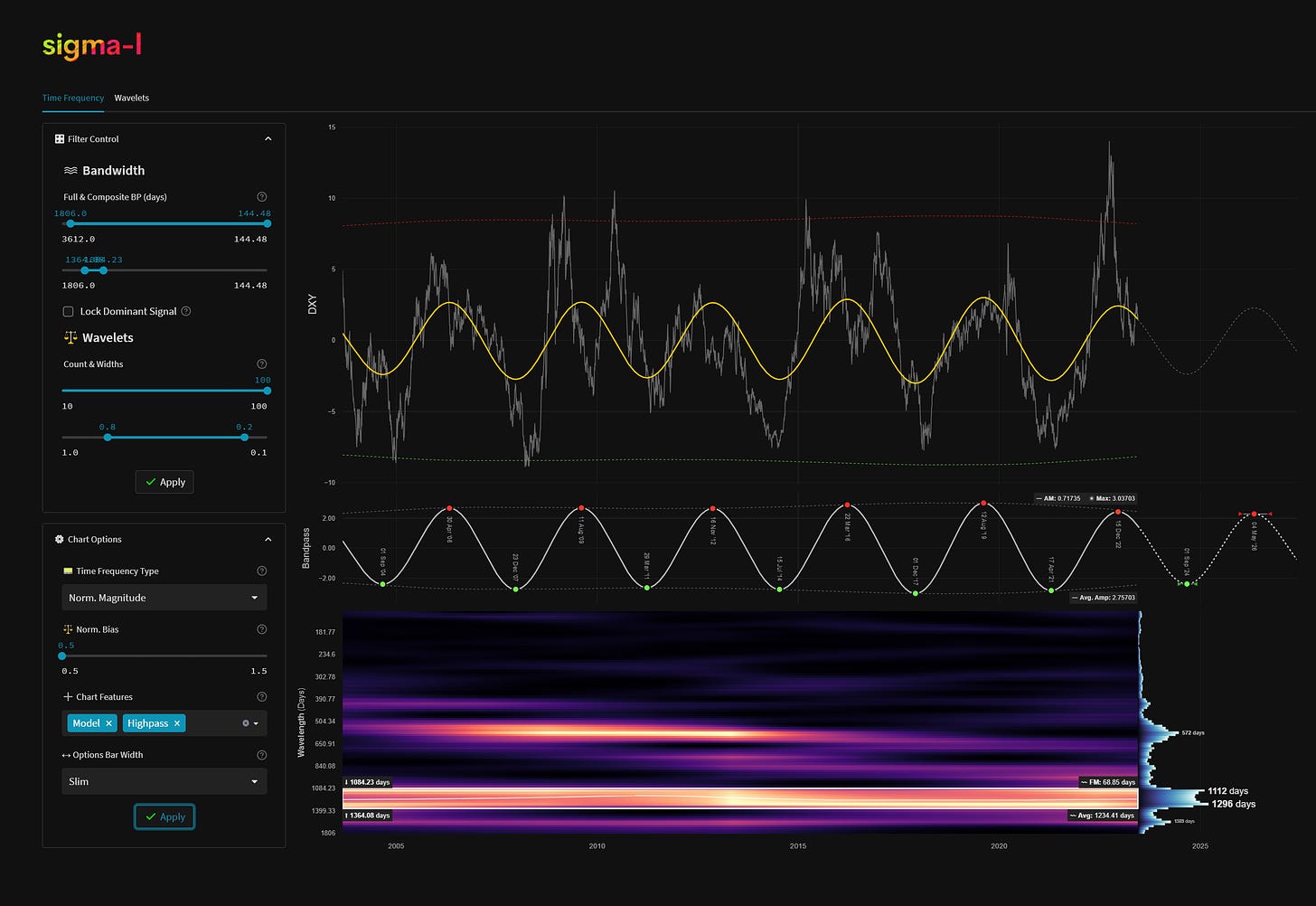

US Dollar Index - 13th June 2023 | @ 1234 Days

'A' class signal detected in US Dollar Basket / Index. Average wavelength of 1234 days (3.38 years) over 6 iterations since October 2003. Currently moving down.

Current Signal Status

Defining characteristics of the component detected over the sample period.

Detected Signal Class: A - learn more

Average Wavelength: 1234.41 Days (3.38 years, 40.58 Months)

Completed Iterations: 6

Time Frequency Analysis

Time frequency charts (learn more) below will typically show the cycle of interest against price, the bandpass output alone and the bandwidth of the component in the time frequency heatmap, framed in white. If a second chart is displayed it will usually show highpassed price with the extracted signal overlaid for visual clarity.

Current Signal Detail & Targets

Here we give more detail on the signal relative to speculative price, given the detected attributes of the component. In most cases the time target to hold a trade for is more important, given we focus on cycles in financial markets. Forthcoming trough and peak ranges are based upon the frequency modulation in the sample (learn more).

Phase: Hard Down

FM: 69 Days

AM: 0.71735

Next Trough Range: June 24th - November 9th, 2024

Next Peak Range: February 24th - July 12th, 2026

Sigma-L Recommendation: Late Sell

Time Target: ~ 1st September, 2024

Current Signal Phase

This is ‘how far along’ the cycle is in it’s period at now time and is related to the predicted price action direction.

Current Signal Frequency Modulation (FM)

This is how much, on average, the signal detected varies in frequency (or wavelength) over the whole sample. A lower variance is better and implies better profitability for the component. Frequency usually modulates relatively slowly and over several iterations.

Current Signal Amplitude Modulation (AM)

This is how much the component gains or loses power (price influence) across the sample, on average. Amplitude modulation can happen quite quickly and certainly is more evident than frequency modulation in financial markets. The more stable the modulation the better.