Welcome to Sigma-L!

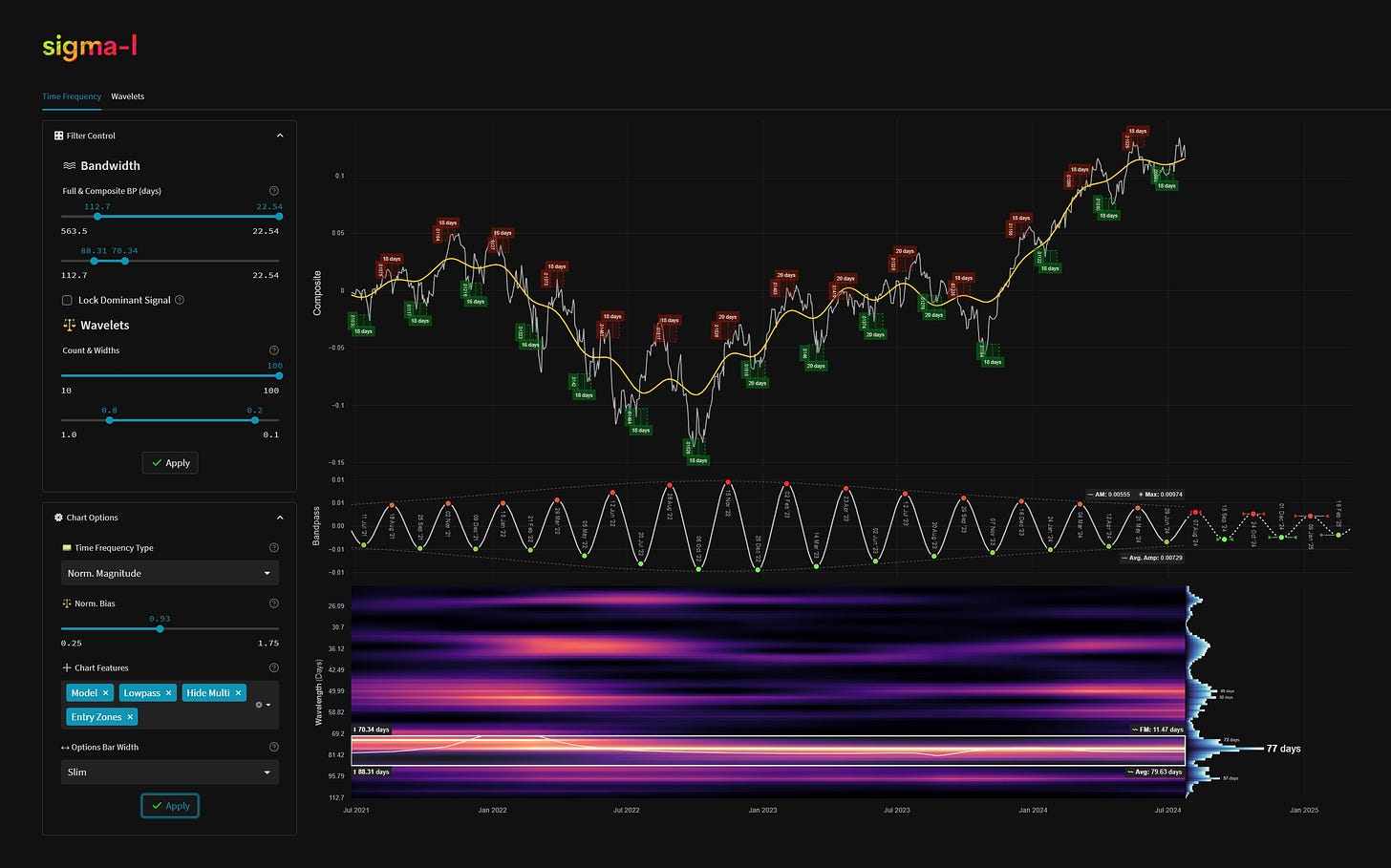

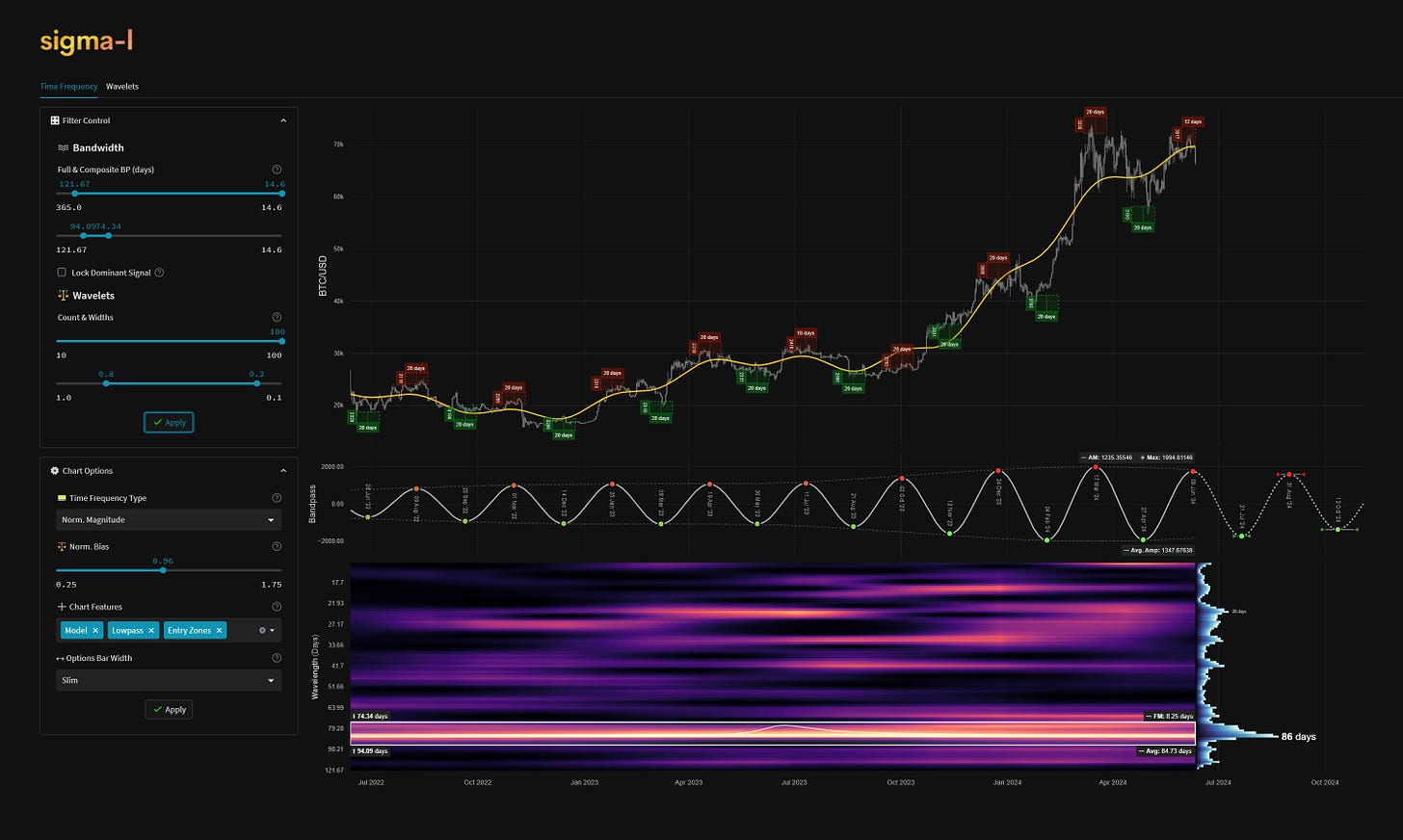

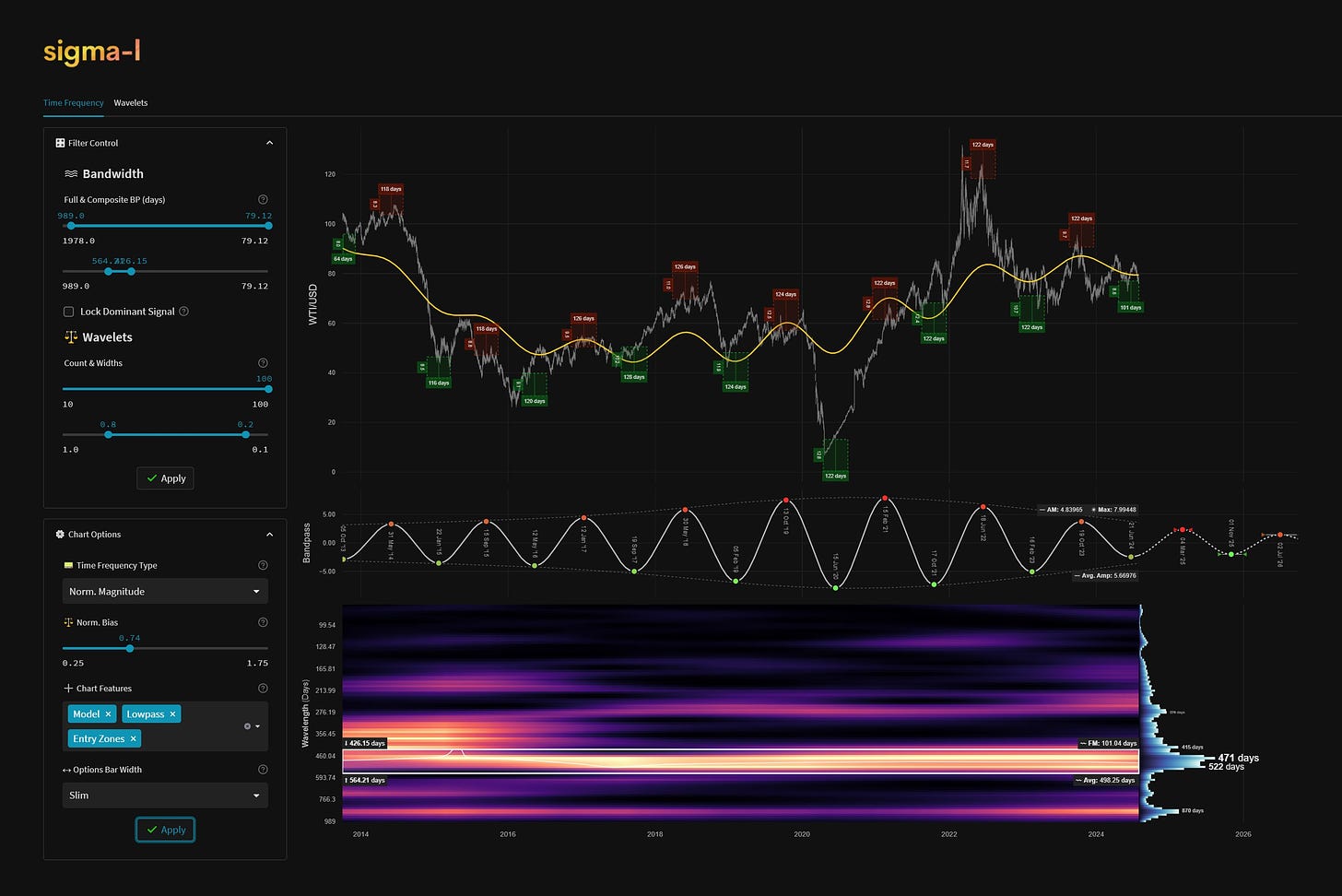

Our unique approach builds on the pioneering work of engineer JM Hurst. We add modern signal processing techniques to identify crucial turning points in all financial markets

Sigma-L provides interested subscribers with the opportunity to learn, employ and enjoy a market analysis technique often steeped in mystery, misunderstanding and trepidation. That technique is broadly entitled cycle analysis and calls for rigorous measurement tools in order to avoid being fooled by randomness.

Every week subscribers can look forward to a robust synopsis of many financial markets using a technical analysis method grounded in the signal processing of time series. Whilst Hurst was one of the first to employ numerical analysis of time series, we now have a much more powerful set of tools to extract any and all periodicity present, thanks in part to modern computing. Most notably we use wavelet convolution, a relatively new approach that allows us to glimpse not only any strong cycles but also how they modulate in time. This is commonly referred to as a time frequency analysis.

The initial concepts, established in the 1970’s by engineer JM Hurst in the seminal work ‘Profit Magic for Stock Transaction Timing’ and in further work, have stood the test of time. Indeed we often identify cycles he originally pinpointed with our modern techniques, such as the 80 day nominal wave.

We are proud to continue this work and hope you will join us to see for yourself the insights a time based analysis can bring.

David